Land Bank of the Philippines (LANDBANK) is launching its new GoBayani savings account designed to financially empower OFWs and overseas Filipinos with secure and reliable banking services.

LANDBANK GoBayani is a digital deposit account that provides Filipinos abroad access to the Bank’s digital banking services and conveniently perform their transactions online, such as sending money to their families via fund transfer. Accountholders can also perform e-commerce transactions and receive remittance via Visa Direct through Visa partners abroad.

GoBayani users can also digitally pay bills and other dues, which will soon include monthly contributions to Pag-Ibig Fund, Social Security System (SSS), and PhilHealth.

“We are cheering on our kababayans abroad to save and grow their money through LANDBANK GoBayani. We want to support every step of their journey towards financial independence for them and their families back home,” said LANDBANK President and CEO Lynette V. Ortiz.

LANDBANK is set to visit overseas Filipinos in United Arab Emirates, Japan, Hong Kong and Taiwan in June to promote LANDBANK GoBayani and other digital banking services.

Open a GoBayani account via the LANDBANK app

Overseas Filipinos can fully open a LANDBANK GoBayani savings account with no initial deposit and maintaining balance via their smartphones within minutes, through the new straight-through account opening feature of the LANDBANK Mobile Banking App (MBA).

“Investing in our digital infrastructure forms part of our response to the increasing demand for convenient digital solutions. We are continuously enhancing our digital offerings to deliver a seamless banking experience to our customers and expand financial access to all,” said LANDBANK President and CEO Ortiz.

Aside from GoBayani, customers can also open a LANDBANK PISO Plus basic deposit account and a regular LANDBANK Visa debit account through the MBA to help build their savings and start their financial journey.

The LANDBANK MBA is a free application that offers seamless and convenient online fund transfers, bills payment, balance inquiry, and salary loan services. Using the MBA, LANDBANK customers also enjoy free fund transfers to other banks via InstaPay and PESONet for the first three transactions in a day worth P1,000 and below.

To open a LANDBANK account, interested clients need only their smartphones downloaded with the latest version of the LANDBANK MBA, a secure Internet connection, and any of the following valid identification cards: Philippine Passport, Driver’s License, SSS, UMID, PRC ID, or PhilSys ID.

ABOUT LANDBANK

LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation and sustainable development to benefit Filipinos. The Bank is present in all 82 provinces in the country, committed to providing accessible and affordable financial support to key players and industries as part of its broader thrust of serving the nation.

LANDBANK branch rises in Burauen, Leyte

(front) LANDBANK President and CEO Lynette V. Ortiz (center) and Burauen Mayor Juanito E. Renomeron (rightmost) lead the opening of the LANDBANK Burauen Branch on 18 July 2024, alongside Julita Mayor Atty. Percival S. Cana (2nd from left), Burauen’s Association of Barangay Captains President Fe S. Renomeron (4th from left), and LANDBANK Executive Vice President Liduvino S. Geron (leftmost). BURAUEN, Leyte – As part of its continuing commitment to bringing banking services closer to local communities, Land Bank of the Philippines (LANDBANK) has officially inaugurated a branch in Burauen, and its eighth in the Province of Leyte. LANDBANK President and CEO Lynette V. Ortiz and Burauen Mayor Juanito E. Renomeron led the inauguration rites for the branch on 18 July 2024. They were joined by Julita Mayor Atty. Percival S. Cana, Burauen’s Association of Barangay Captains President Fe S. Renomeron, LANDBANK Executive Vice President Liduvino S. Geron, and other local government officials. Located in Brgy. Poblacion District 8, the LANDBANK Burauen Branch will cater to the banking needs of residents from the 77 barangays of the town. This eliminates the need to travel to the Tacloban City branches, saving clients two (2) hours of travel time and approximately P200 in round-trip expenses. The branch’s strategic location also allows it to reach the 142 combined barangays of the municipalities of Dagami, Julita, Tabontabon, and La Paz, servicing over 11,000 farmers and fishers, 16,700 beneficiaries of the Conditional and Unconditional Cash Transfer (CCT/UCT) programs of the Department of Social Welfare and Development (DSWD), government employees, and private depositors. “Our mission is clear – to drive transformative progress from countryside to countrywide by delivering secure and reliable financial services up to the farthest corners of the archipelago. With the new LANDBANK Burauen Branch, we aim to enhance the accessibility of banking services for local residents,” said LANDBANK President and CEO Ortiz. She also committed to supporting the Province’s entire agricultural value chain by continuously extending loans to local farmers, fishers, and other players from the sector, as well as local government units for the development of essential infrastructure. The LANDBANK Burauen Branch is equipped with two automated teller machines (ATM) and features a Digital Corner where clients can open a deposit account in 15 minutes or less using the LANDBANK Digital Onboarding System (DOBS). “All of this means only one thing and that is more opportunities for us, Burawanons, in terms of financial inclusion, financial growth, and financial development. As an agricultural municipality, this would mean a lot to our farmers and to our business sector who would no longer need to travel just to inquire and avail the services of this financial institution. Truly, LANDBANK in Burauen is a blessing for us,” said Burauen Mayor Renomeron. The new branch complements the operations of seven other LANDBANK branches in Leyte located in the cities of Baybay, Ormoc and Tacloban, and the municipalities of Carigara and Hilongos. For fast, safe, and convenient cash withdrawals and transactions, LANDBANK has 61 automated teller machines (ATMs), six cash deposit machines (CDMs), and a LANDBANKasama Agent Banking Partner strategically located across the Province. Customers can also enjoy free cash withdrawals at 43 ATMs in 7-Eleven convenience stores, as part of the Bank’s partnership with Pito Axm Platform, Inc. (PAPI). As of end-June 2024, LANDBANK operates 607 branches and branch-lite units, along with 60 lending centers nationwide. This extensive network is complemented by 3,112 ATMs and 232 CDMs, 3,399 7-Eleven ATMs, and 1,101 LANDBANKasama Partners operating 1,859 point-of-sale (POS) terminals. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion and digital transformation to advance national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive services to empower Filipinos towards a better future of inclusive and sustainable development from countryside to countrywide.

LEARN MORE

A-FLOW signs P2.4-billion Tranche 1 Loan of a P10.8-billion 10-Year Facility with LANDBANK

In the photo from left are Ayala Land, Inc. (ALI) Vice President and Treasurer Jose Eduardo A. Quimpo II, ALI Senior Vice President, Chief Finance Officer and Chief Compliance Officer Augusto D. Bengzon, ALI President and Chief Executive Officer (CEO) and AyalaLand Logistics Holdings Corp. (ALLHC) Chairman Anna Ma. Margarita B. Dy, FLOW Digital Infrastructure CEO and A-FLOW Properties I Corp. (A-FLOW) President Amandine Wang, ALI Senior Vice President, ALLHC President and CEO and A-FLOW Chairman Robert S. Lao, Land Bank of the Philippines (LANDBANK) President and CEO Lynette V. Ortiz, LANDBANK Executive Vice President and National Development Lending Sector Head Ma. Celeste A. Burgos, LANDBANK Vice President Lucila E. Tesorero and LANDBANK Vice President and Corporate Banking Department 1 Head Jell B. Ong. Makati City, Philippines – A-FLOW Properties I Corp. (A-FLOW), a joint venture between Ayala Land, Inc. (ALI) subsidiary AyalaLand Logistics Holdings Corp. (ALLHC) and FLOW Digital Infrastructure, and Land Bank of the Philippines (LANDBANK) announced the signing of a P2.4 billion loan agreement representing Tranche 1 of a P10.8 billion 10-year loan. The signing of the loan facility agreement underscores the mutual commitment to advancing the nation’s digital infrastructure and supporting the Philippines’ transition towards a more digitally integrated economy. The loan facility is intended for the development of the initial phase of the first A-FLOW data center campus located in Biñan, Laguna. Currently under construction, the 6MW-IT capacity Phase 1A of the three-building data center campus project is targeted to be ready-for-service by the end of the year. A-FLOW President Amandine Wang said, “This agreement marks a significant step forward in our shared commitment to develop the largest carrier-neutral data center campus in the Philippines. We are excited to build an ecosystem to attract a combination of international hyperscale customers and local enterprise customers.” LANDBANK President and CEO Lynette V. Ortiz emphasized the importance of collaborating with key stakeholders, “We recognize that partnering with key players like A-FLOW is essential for advancing national development. And in this era of rapid digitalization, we are likewise ready to drive investments into the local data center market, along with other sectors contributing to our nation’s technological progress,” she said. Ortiz further commented, “This is the first data center project financed by LANDBANK, and with this new partnership, we are confident that this project will yield significant economic benefits.” For ALI President and CEO and ALLHC Chairman Anna Ma. Margarita B. Dy, digital transformation, cloud computing, and the rise of artificial intelligence are technologies that require robust and scalable data center solutions. “Ayala Land is proud to be participating in this new opportunity leveraging our land and our capabilities to contribute to the country’s move towards a digital economy,” Dy said. “Like any other infrastructure project, capital is key. So, we thank LANDBANK for the P10.8 billion loan facility to A-FLOW, a critical enabler for this project,” she added. A-FLOW’s partnership with LANDBANK enables both companies to capitalize on each other’s strengths, marking a shared vision of fostering innovation and sustainable growth. This milestone collaboration underscores the importance of public-private partnerships in serving the country and achieving the nation’s development goals. About A-FLOW A-FLOW is a joint venture between FLOW Digital Infrastructure (“FLOW”), an investor, developer, and operator of digital infrastructure in Asia Pacific, and AyalaLand Logistics Holdings Corp. (“ALLHC”), the largest developer of industrial parks and real estate logistics facilities in the Philippines. A-FLOW’s first data center is strategically located in Laguna, accommodating a total of 36MW IT load capacity. With the launch of A-FLOW, the partnership supports the digital growth and expansion of businesses in the Philippines, leveraging FLOW's deep data center expertise and ALLHC's established record in industrial real estate development. About LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion and digital transformation to advance national development. Present in all 82 provinces in the country, the Bank is committed to provide accessible and responsive services to empower Filipinos towards a better future of inclusive and sustainable development from countryside to countrywide.

LEARN MORE

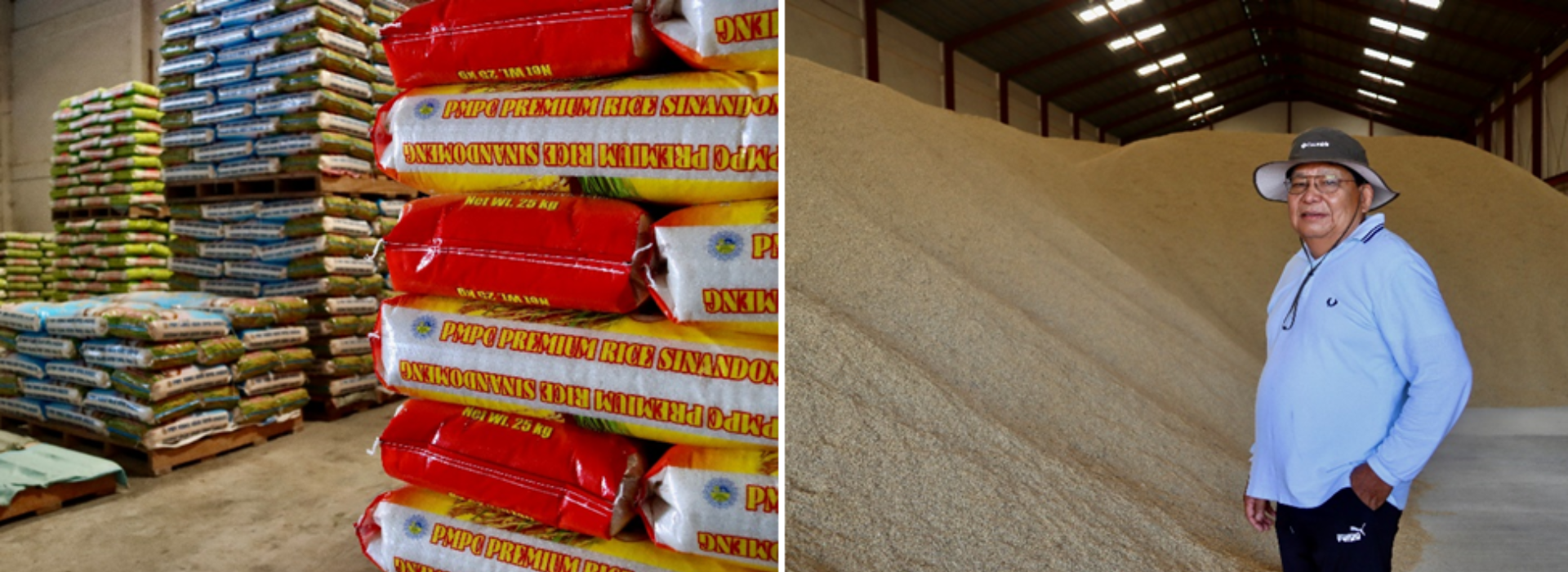

LANDBANK-backed co-op empowers rice, onion farmers in Nueva Ecija

TALAVERA, Nueva Ecija – For the longest time—despite working long, hard days in the field—rice farmer Ricardo Buenaventura struggled to improve his farm’s productivity and profitability due to lack of capital. Ricardo could not pursue opportunities that would help expand his operations, such as acquiring a bigger farmland or investing in farm mechanization, with income that was just enough to sustain his family’s daily needs. Determined to provide a better life for his family, Ricardo called on his fellow farmers facing similar challenges to work together to boost their production and income. They officially formed the Nagkakaisang Magsasaka Agricultural Primary Multi-Purpose Cooperative (PMPC) in 1992 with 16 members, and Ricardo as their Chairman. As a newly-established cooperative, seeking credit assistance to support their operations proved to be a hurdle seemingly too difficult to overcome. Lenders often turned them away or offered hefty interest rates they could not afford at the time. They found the boost they needed when Land Bank of the Philippines (LANDBANK) granted the co-op their very first loan amounting to P120,000.00 to fund their working capital. “Nagtiwala sa amin ang LANDBANK kahit nagsisimula pa lamang ang aming kooperatiba. Binigyan nila kami ng pagkakataon para palakasin ang aming koop at pagbutihin ang aming kabuhayan,” said Buenaventura. Growing with LANDBANK The co-op invested in farm machinery and equipment such as hauling trucks and mechanical dryers, and was able to improve its production to around 70,000 - 100,000 sacks of rice per cropping season. That initial partnership has come a long way. LANDBANK has since increased its total loan to Nagkakaisang Magsasaka Agricultural PMPC to P1 billion to fund its expanded operations, which now include relending to finance the production of its members, rice and agri-inputs trading, diesel retailing, rice milling, onion cold storage rental and trading, and importation of milled rice and fertilizers produced by the co-op. LANDBANK has also financed the construction of warehouses and an onion cold storage, as well as the purchase of farm machinery and equipment to improve agricultural productivity. From having only 16 members, Nagkakaisang Magsasaka Agricultural PMPC’s membership base has grown to 1,500 consisting of farmers producing rice, onion and other high-value crops, backyard poultry and livestock raisers, and micro, small and medium enterprises (MSMEs) such as sari-sari store owners. "By empowering agricultural cooperatives, we are also enhancing small farmers’ access to credit, technology and other critical resources for growth. We look forward to partnering with more agri co-ops towards increasing productivity and ensuring food security in the country,” said LANDBANK President and CEO Lynette V. Ortiz. Uplifting lives of Nueva Ecija farmers With their fully-integrated services, the Nagkakaisang Magsasaka Agricultural PMPC is now able to support the growth requirements of its members throughout the entire rice production process, from planting to marketing and distribution. Aside from financing the purchase of their members’ farm inputs, the co-op also serves as a ready market for their produce, buying wet palay at a fair price. The co-op produces around 70,000 to 100,000 sacks of rice per cropping season under its own rice brand and distributes rice to consumers in Metro Manila, Quezon City, Marikina, Taguig, Parañaque, Bohol, Pampanga, and Tarlac. The co-op is also diversifying its operations to provide more assistance to its onion farmer-members and strengthen the local onion value chain. Of their P1-billion LANDBANK loan, P112 million was allocated for the construction of an onion cold storage which has allowed their members to reduce agricultural losses and improve their income. The co-op’s cold storage has a capacity of 60,000 bags of onions, allowing farmers to reduce agricultural losses and improve their income. “Sa tulong ng LANDBANK, marami na ang naipundar ng aming kooperatiba at naitulong sa palay farmers. Ngayon, nakakatulong na din kami sa onion farmers dito sa Nueva Ecija na palakasin ang kanilang produksyon,” said Ricardo. Fully operational since April 2024, the co-op’s cold storage can accommodate up to 60,000 bags of onions and is expected to benefit onion growers from the municipalities of Bongabon, Guimba, Gabaldon, Llanera and Talavera. The co-op also extends credit support to finance onion production and buys members’ produce at a more lucrative price compared to other markets in the Province in support of the local onion industry. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country serving the growth requirements of the local agriculture sector and the entire agri-value chain. Present in all 82 provinces in the country, the Bank is committed to providing accessible and affordable financial support towards boosting food security and advancing inclusive and sustainable development from countryside to countrywide.

LEARN MORE