Be in the know of the latest news and updates about LANDBANK.

LANDBANK delivers RCEF-RFFA aid to Iloilo farmers

LANDBANK Miag-ao Branch distributes cash cards loaded with P5,000.00-worth of cash assistance to 2,206 farmer beneficiaries in Tigbauan, Iloilo under the RCEF-RFFA Program. In stride with advancing agricultural development, the Land Bank of the Philippines (LANDBANK) recently distributed cash cards to farmer beneficiaries under the Rice Competitiveness Enhancement Fund-Rice Farmers Financial Assistance (RCEF-RFFA) Program in Tigbauan, Iloilo. In partnership with the Department of Agriculture (DA), the LANDBANK Miag-ao Branch distributed Intervention Monitoring Cards (IMCs) loaded with P5,000.00-worth of cash assistance to 2,206 farmer-beneficiaries. As of June 2023, the Bank has already distributed LANDBANK IMCs to a total of 235,145 beneficiaries nationwide, with the rest of eligible beneficiaries set to receive their financial assistance until the end of August this year. "LANDBANK remains at the forefront of providing timely support to small farmers all over the country. Together with the DA, we will continue to ramp-up the distribution of cash cards to help increase agricultural production and income," said LANDBANK President and CEO Lynette V. Ortiz. The RCEF-RFFA Program aims to offer vital support to smallholder rice farmers registered under the Registry System for Basic Sectors in Agriculture (RSBSA), who are cultivating rice lands measuring two hectares and below. LANDBANK serves as the disbursing arm of the RCEF-RFFA Program, wherein eligible farmers receive cash assistance of P5,000.00 as part of the implementation of the Rice Tariffication Law (RTL).

LEARN MORE

LANDBANK doubles daily amount limit of fund transfers

In line with providing accessible and convenient digital services, the Land Bank of the Philippines (LANDBANK) has doubled the daily aggregate amount limit of fund transfers via InstaPay from P50,000.00 to P100,000.00, effective 14 July 2023. LANDBANK clients can transfer up to P50,000.00 per transaction via Instapay, and now as much as P100,000.00 in total per day. The state-run Bank recently reduced its transaction rate for fund transfer via InstaPay from P25 to P15 starting from 15 June 2023. “We continue to extend the limits of our digital banking solutions to meet the growing needs of our diverse client base. LANDBANK is driven to promote greater digital adoption to help accelerate financial inclusion in the country and build a cashless society,” said LANDBANK President and CEO Lynette V. Ortiz. The Bank also removed the daily transaction limit for both fund transfer and bills payment, allowing customers to perform an unlimited number of transactions per day. The previous daily aggregate amount limit of P50,000.00 for bills payment facilitated through the LANDBANK iAccess has likewise been removed. LANDBANK is currently working on providing depositors the ability to set their own fund transfer and bills payment limits for added flexibility and convenience. Meanwhile, inter-bank fund transfers using LANDBANK and Overseas Filipino Bank (OFBank) accounts remain free of charge. The new fund transfer and bills payment policies apply to transactions facilitated via LANDBANK’s retail digital banking channels, the LANDBANK Mobile Banking App (MBA) and iAccess. For the first five months of 2023, the two digital platforms have facilitated a combined 66.7 million transactions with value of P123.4 billion

LEARN MORE

LANDBANK, General Trias ink partnership for digital payments

(standing) General Trias City Mayor Luis A. Ferrer IV (4th from right), Vice Mayor Jonas Glyn P. Labuguen (5th from right), and LANDBANK Cavite City Branch Assistant Vice President Edgar Deligero (3rd from right), together with other local officials and LANDBANK representatives, celebrate the new partnership for the use of the LANDBANK Link.BizPortal at the General Trias City Hall. GENERAL TRIAS, Cavite – The City Government of General Trias has partnered with the Land Bank of the Philippines (LANDBANK) for the safe, fast, and convenient collection of local fees for business permits and real estate taxes through the Bank’s web-based payment channel. Through the LANDBANK Link.BizPortal, residents can now settle fees, dues, and charges to the local government unit (LGU) online at their convenience with just a few clicks on their computers or mobile devices. “Our collaboration with the City of Government of General Trias allows for convenient and hassle-free payments. LANDBANK will continue to support local government partners in delivering innovative and responsive public service,” said LANDBANK President and CEO Lynette V. Ortiz. General Trias City Mayor Luis A. Ferrer IV, Vice Mayor Jonas Glyn P. Labuguen, and LANDBANK Cavite City Branch Assistant Vice President Edgar Deligero, led the signing of a Memorandum of Agreement for the use of the LANDBANK Link.BizPortal, together with other local officials and LANDBANK representatives at the General Trias City Hall. “Being an advocate of Ease of Doing Business and efficient delivery of government services, this program with LANDBANK will enable the city to offer quality service to its constituents,” said General Trias Mayor Ferrer. The LANDBANK Link.BizPortal is a digital facility that allows clients to pay for products and services via the internet from both government and private institutions. For the first three months of the year, the LANDBANK Link.BizPortal has already facilitated 2.18 million transactions amounting to P3 billion in value.

LEARN MORE

LANDBANK ensures success of new law writing off P57.74-B agrarian debt

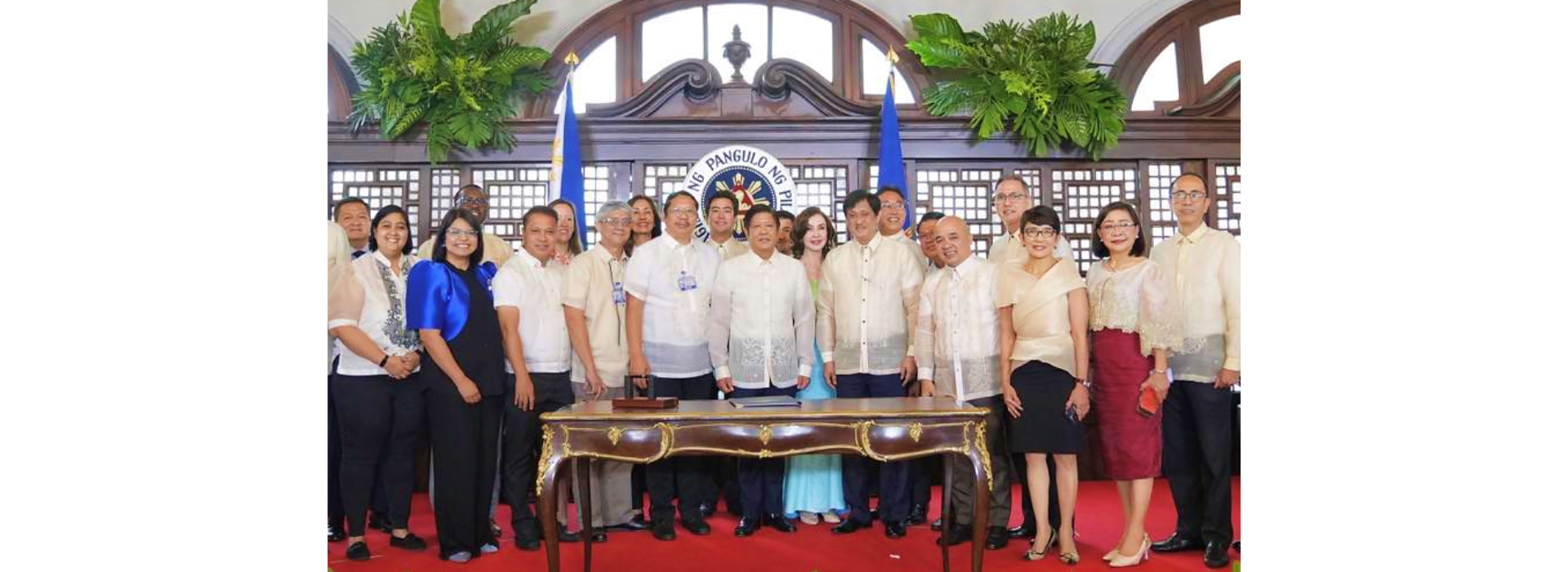

President Ferdinand R. Marcos, Jr. (center) signs into law the New Agrarian Emancipation Act on July 7, 2023, with Agrarian Reform Secretary and LANDBANK Board Member Conrado M. Estrella III (8th from right) and other DAR officials, together with LANDBANK President and CEO Lynette V. Ortiz (3rd from right), Executive Vice President Alex A. Lorayes (4th from right), and Vice President Atty. Marife Lynn O. Pascua (2nd from right) witnessing the event. (photo courtesy of DAR). The Land Bank of the Philippines (LANDBANK) ensures that it will be working closely with government partners for the seamless and immediate implementation of the new law that frees agrarian reform beneficiaries (ARBs) nationwide from agrarian debts, in line with efforts to boost and modernize the agriculture sector. The National Government is writing-off land amortizations managed by LANDBANK amounting to P57.74 billion as of 30 June 2023—effectively relieving over 649,000 ARBs tilling 1.17 million hectares of land debt. The condonation is part of the landmark Republic Act No. 11953 or the New Agrarian Emancipation Act signed by Philippine President Ferdinand R. Marcos, Jr. on 7 July 2023. Of the P57.74 billion, the National Government will condone outright P14.56 billion in principal loans of over 263,000 ARBs upon the effectivity of the law. The Department of Agrarian Reform (DAR), in coordination with LANDBANK, will also expedite the processing of the remaining P43.17 billion principal loans of over 385,000 ARBs. “We are proud to be part of this landmark initiative of the Marcos Administration to free farmers from debt and help them start anew. LANDBANK will likewise continue to pour investments and extend support initiatives for farmers nationwide to boost their productivity and income,” said LANDBANK President and CEO Lynette V. Ortiz. The New Agrarian Emancipation Act condones all loans, including interests, penalties, and surcharges incurred by ARBs from land awarded to them under Presidential Decree 27 (Tenant Emancipation Decree issued in 1972), Republic Act No. 6657 (Comprehensive Agrarian Reform Law of 1988), and Republic Act No. 9700 (An Act strengthening the CARP and extending the acquisition and distribution of agricultural lands, issued in 2009). The DAR will issue the implementing rules and regulations of the new law, in coordination with the Presidential Agrarian Reform Council Executive Committee (PARC ExCom) and with the technical expertise of LANDBANK, within 60 days from the issuance of the Act. For his part, Agrarian Reform Secretary and LANDBANK Board Member Conrado M. Estrella III lauded Congress for the immediate passage of the law, and expressed gratitude to LANDBANK for its consistent support to ARBs over the years. “Nagpapasalamat din po kami sa mga taga-LANDBANK sapagkat sila po ay very active na nagbibigay po ng credit assistance sa ating mga ARBs,” he said. LANDBANK has extended P2.7 billion in loans to 2,356 individual ARBs and 469 ARB cooperatives and farmers’ associations nationwide. Apart from credit assistance, LANDBANK also provides financial literacy and capability-building seminars to make sure borrowers are equipped with basic financial knowledge to manage their finances and boost their income.

LEARN MORE

LANDBANK, BDO lead P5-B syndicated facility to empower underserved women

ASA President and CEO Kamrul H. Tarafder (4th from left), LANDBANK President and CEO Lynette V. Ortiz (5th from left), and BDO Capital President Eduardo V. Francisco (rightmost), alongside other local bank leaders, lead the ceremonial signing for ASA’s P5-billion syndicated corporate notes facility on 05 July 2023 in Pasig City. The Land Bank of the Philippines (LANDBANK) has joined hands with the BDO Capital & Investment Corporation (BDO Capital) in arranging a P5-billion syndicated corporate notes facility with other domestic banks, to support ASA Philippines Foundation, Inc.’s (ASA) credit expansion for underserved women. The state-run Bank has a significant participation in the syndicated transaction, the proceeds of which will be used for ASA’s working capital to reach and empower more women in the country through the provision of accessible financing. “We, at LANDBANK, welcome this timely opportunity to advance gender equality and women empowerment. Through our collective efforts and joint resources, we can foster an equal playing field for all – regardless of gender – to further boost economic productivity and growth,” said LANDBANK President and CEO Lynette V. Ortiz. ASA’s five-year corporate notes issuance was classified as the first-ever Gender Bonds in the country, as certified by social bond second-party opinion provider DNV and registered with the Securities and Exchange Commission (SEC). The issuance of the first-of-its-kind bonds was launched on 05 July 2023 in Pasig City, following a ceremonial signing between ASA President and CEO Kamrul H. Tarafder, LANDBANK President and CEO Ortiz, BDO Capital President Eduardo V. Francisco, and other industry leaders for ASA’s notes facility. Joining them were Bangko Sentral ng Pilipinas (BSP) Deputy Governor Bernadette Romulo-Puyat, ASA Board Member Eric L. Gotuaco, and other development partners. LANDBANK Investment Banking Group and BDO Capital jointly arranged the syndicated transaction, with RCBC Trust and Investment Group serving as the Security Trustee and Notes Facility Agent. Other lenders to the transaction include the BDO Unibank, Inc., Philippine National Bank, Bank of the Philippines Islands, and Security Bank. LANDBANK has been supporting ASA’s expansion since 2014, as part of its steadfast support to microfinance organizations in the country. The new partnership likewise complements the state-run Bank’s efforts to provide ample opportunities for women entrepreneurs.

LEARN MORE

LANDBANK grants P700-M loan for Davao del Sur’s dev’t projects

(front) Davao del Sur Governor Yvonne Roña Cagas (4th from right) and LANDBANK Senior Vice President Charlotte I. Conde (5th from right) lead the signing of a P700-million loan agreement to fund various development projects in the Province of Davao del Sur. (Photo courtesy of Davao del Sur PIO) DAVAO DEL SUR – The Land Bank of the Philippines (LANDBANK) is extending a P700-million loan to the Provincial Government of Davao del Sur to finance the province’s development projects in health, tourism, infrastructure, and digitalization. The Provincial Government and LANDBANK recently signed a loan agreement to formalize the partnership. It was led by Governor Yvonne Roña Cagas and LANDBANK Senior Vice President Charlotte I. Conde, and witnessed by other local and Bank officials. “LANDBANK is working closely with Davao del Sur and other local government partners nationwide for the rollout of meaningful projects to promote economic activities. Our support to local communities will further drive our broader thrust of serving the nation in support of the National Government’s inclusive development agenda,” said LANDBANK President and CEO Lynette V. Ortiz. Of the total loan amount, P215 million will be allocated to upgrade the Davao del Sur Provincial Hospital (DSPH), including the acquisition of various medical, dental and hospital laboratory equipment for enhanced delivery of healthcare services. The planned expansion and improvements will effectively upgrade the DSPH from a Level II to a Level III Tertiary hospital, with an increased bed capacity of 200 and a three-story building dedicated as a birthing facility. Complementing the Provincial Government’s bid for enhanced healthcare services is the establishment of a Bio-Medical Waste Management System to be funded through P40 million from the approved loan. The system will be designed to comply with the strictest environmental and bacteriological reduction standards. Meanwhile, some P220 million will also finance the completion of the Gov. Douglas Ra. Cagas Sports Complex and Business Center in Digos City. The project includes the construction of a rubberized track and field oval, basketball, volleyball, and badminton courts, and improvement of the existing grandstand, among others. Another P125 million will be allocated to purchase brand-new heavy equipment and service vehicles, to be used in the maintenance and rehabilitation of roads, bridges and other infrastructure projects across the province for improved mobility of people and agricultural produce. The remaining P100 million will be dedicated to the establishment of the Revenue Administration and Management System with Integrated Financial Management Information System, aimed to automate the Provincial Government’s transactions and services. The system is also expected to further advance the local government’s efforts in the delivery of efficient public service while promoting transparency and accountability. LANDBANK continues to extend necessary credit assistance to local government units (LGUs) to spur inclusive and sustainable economic development. As of end-April 2023, the state-run Bank’s outstanding loans to LGUs nationwide hit P95.12 billion.

LEARN MORE

New LANDBANK ATMs drive financial inclusion in Guimaras

Residents from the remote towns of Sibunag and San Lorenzo now enjoy easy access to their cash needs with the newly-installed LANDBANK ATMs in Sibunag Municipal Hall in Brgy. Dasal (right photo) and San Lorenzo Municipal Compound in Brgy. Cabano (left photo). GUIMARAS – In line with its commitment of bringing convenient and reliable banking services closer to more Filipinos, the Land Bank of the Philippines (LANDBANK) has ramped up expansion efforts in this island province with the installation of two new automated teller machines (ATMs) in the far-flung towns of Sibunag and San Lorenzo. The new LANDBANK touchpoints are strategically located at the Sibunag Municipal Hall in Brgy. Dasal and San Lorenzo Municipal Compound in Brgy. Cabano to primarily service residents from 25 combined barangays, which includes farmers, fishers, local government employees, teachers, and other depositors. Over 7,600 beneficiaries of the Conditional and Unconditional Cash Transfer (UCT) programs of the Department of Social Welfare and Development (DSWD) will also benefit from faster and more efficient payout services through the new ATMs. “Our continued expansion in remote and underserved areas advances our continuing thrust towards financial inclusion. LANDBANK will remain focused on reaching and serving all our customers nationwide, as we firm up our support in pushing the National Government’s inclusive development agenda,” said LANDBANK President and CEO Lynette V. Ortiz. Jenefer Salmorin, a Pantawid Pamilyang Pilipino Program (4Ps) beneficiary from Sibunag, said that the availability of a LANDBANK ATM in their town makes claiming of financial assistance from the National Government more convenient and accessible. This helps DSWD beneficiaries like her, along with other residents, to save time and money from traveling at least 25 minutes to the Municipality of Jordan and spending P50.00 for a special ride just to withdraw their financial assistance. For Sibunag Mayor Annabelle V. Samaniego, the installation of the new LANDBANK ATM in the town also provides improved access to formal financial services and promotes financial literacy among residents. “This has lessened our consumed time, money, and effort just to withdraw cash we needed. On behalf of the people of the Municipality of Sibunag, I am expressing my sincerest gratitude and appreciation to LANDBANK as our genuine partner for the development of the municipality,” said Mayor Samaniego. LANDBANK is the only bank present in all five municipalities of the Province of Guimaras, servicing the banking requirements of residents through the Guimaras Branch in Brgy. San Miguel in Jordan, with 10 ATMs, one cash deposit machine (CDM), and seven Agent Banking Partners (ABPs) located throughout the province. In support of the province’s digitalization efforts, the Bank has also successfully onboarded the provincial government and all municipal governments in its Link.BizPortal facility, which allows residents to pay for local dues online without the need to physically visit the LGU offices. As of end-April 2023, LANDBANK has 606 branches and branch-lite units, 58 lending centers, 2,920 ATMs, 224 CDMs, and 1,743 ABP POS cash-out terminals, which are spread strategically across all 82 provinces of the country.

LEARN MORE

LANDBANK, Malasiqui partner to advance digital payments in Pangasinan

(front row) Malasiqui Mayor Noel Anthony M. Geslani (center) with LANDBANK Senior Vice President Ma. Belma T. Turla (2nd from right) and Assistant Vice President Emelyn M. Justiniano (leftmost), among other Bank officials and local partners, launch Malasiqui’s upgraded online services on June 8, 2023, which will allow residents and local business owners to process and pay for their real property taxes and business permits anytime and anywhere. MALASIQUI, Pangasinan – Residents and business owners from this 1st class municipality can now settle their payments for real property taxes and business permits faster and more conveniently through the online payment facility of the Land Bank of the Philippines (LANDBANK). The Municipal Government of Malasiqui has partnered with the state-owned Bank for the integration of the LANDBANK Link.BizPortal to its website, where constituents can now access the local government’s online services. Through the Link.BizPortal, customers can complete payments for local transactions safer and easier online without having to physically visit the municipal hall. Malasiqui Mayor Noel Anthony M. Geslani alongside LANDBANK Senior Vice President Ma. Belma T. Turla and Assistant Vice President Emelyn M. Justiniano led the launch of Malasiqui’s new online services on 8 June 2023 at the town’s Municipal Hall. They were joined by Malasiqui Vice Mayor Alfe M. Soriano, Department of Trade and Industry (DTI) Pangasinan Provincial Director Natalia B. Dalaten, and LANDBANK San Carlos (Pangasinan) Branch Head Menchie C. Mencias. “LANDBANK continues to collaborate with local government units and other government partners to provide customers with safe and secure online payment options. This forms part of our push for greater financial inclusion, while promoting transparency and efficiency in the delivery of meaningful and responsive public service,” said LANDBANK President and CEO Lynette V. Ortiz. LANDBANK has now onboarded a total of 22 local government units (LGUs) in Pangasinan to the Link.BizPortal, to provide efficient and convenient digital payment services for Pangasinenses. These LGUs include the Provincial Government of Pangasinan and the City Governments of Alaminos, Dagupan, San Carlos and Urdaneta. “Itong launching po natin ngayon ay napakahalaga dahil kahit saan, kahit anong oras ay pwede ng makapagbayad ng fees,” said Mayor Geslani, adding that the newly launched online services will help promote ease of doing business in Malasaqui, while helping generate more income for the municipal government. The Link.BizPortal is LANDBANK’s web-based payment channel that allows clients to pay for products and services online to over 1,250 government and private partner merchants nationwide. As of April 2023, LANDBANK has recorded nearly 2.8 million transactions amounting to P4.2 billion through the Link.BizPortal. LANDBANK’s offering of digital banking solutions advances the National Government’s digital and financial inclusion agenda in line with its expanded mandate of serving the nation.

LEARN MORE

Capiz developer taps LANDBANK for growth, expansion

The 670-hectare township development of Pueblo de Panay, Inc. (PDPI) in Roxas City, Capiz steers local economic activities and generates employment opportunities for almost 10,000 locals. The construction and improvement of various projects within the property are supported by LANDBANK, which has been PDPI’s development partner since 2017. (Photo courtesy of PDPI) ROXAS CITY, Capiz – Nestled amid the lush greenery of a tranquil rural landscape is a 670-hectare mixed-used township development of the Pueblo De Panay, Inc. (PDPI) that has been a contributing pillar to Roxas City’s bid for inclusive development. Home to various commercial establishments, agro-industrial zones, and endearing tourist attractions—with a residential component that integrates Capiznons’ traditional lifestyle with contemporary living—the PDPI mega township development steers local economic activities and generates average foot traffic of 60,000 alongside employment opportunities for almost 10,000 locals. Before becoming one of the largest real estate developers in the region, the journey of PDPI started with Ong Family’s humble beginnings in 2001 having only P1.7 million in capital. Today, the family-led PDPI has grown into a developer of several successful horizontal and vertical residential and commercial projects, providing housing and business opportunities to all market segments in Roxas City. Recently, PDPI ramped up improvements in its property to accommodate key locators, including business process outsourcing (BPO) companies, restaurants, hotels, banks, government offices, and other firms that provide local employment. As with any business expansion, the PDPI needed financial backing for its plans and projects to fruitfully materialize. They turned to the Land Bank of the Philippines (LANDBANK) in 2017, and secured funding for the construction of a seven-story BPO building and fish processing plant in the township. The six-story BPO building (left) and fish processing plant (right) in Pueblo de Panay are among the first developments financed by LANDBANK in support of PDPI’s expansion plan. LANDBANK likewise extended financing support for site development of a 7.4-hectare IT Park that can host up to 10 BPO buildings; construction of a five-story building to be occupied by a private educational institution; and concreting of roads across the development, which include drainage works and electrical and water lines. “LANDBANK and PDPI share the same vision of promoting countryside development and inclusive growth. It’s about connectivity: We understand them, and they understand us. We are lucky to have LANDBANK as our reliable partner,” said PDPI Chief Operations Officer Lex Lavin. Pueblo de Panay has transformed a once undeveloped parcel of land into a master-planned township and viable investment destination designed by the Singaporean firm Surbana Jurong. The township has become a bustling business hub where people can live, work, relax, and have fun, embodying the company’s advocacy of “Life. Work. Balance.” With this success, the PDPI has proven that a countryside-based and homegrown brand could have world-class aspirations and be a catalyst of local growth. The firm is committed to pursue this undertaking by stepping up further developments within the township. Responding to the call of the National Government to alleviate the housing backlog of the country, PDPI is developing additional residential projects in the next five years to provide almost 2,000 housing units for middle-income households, including an affordable housing project to cater to government workers and Overseas Filipino Workers (OFWs). With the help of LANDBANK, the Capiz-based developer is also planning to expand in other key cities and towns and offer PDPI’s brand of excellence all over the country. “We understand that LANDBANK is always there to support and guide us in our quest to provide the same development in other key cities, as well as underserved communities. We want to be there to give them the quality of life they deserve as Filipinos. That’s what we want. It’s not only about the profit we earn, but about the number of people benefitting from our projects,” Lavin said. Alongside its focus on supporting the agriculture sector, LANDBANK has been servicing emerging sectors and industries in line with fulfilling its expanded mandate of driving countryside and national development.

LEARN MORE

InstaPAY fee reduced from P25 to P15

In line with advancing financial inclusion, the Land Bank of the Philippines (LANDBANK) will be significantly reducing transaction rates for fund transfer via InstaPay effective 15 June 2023. All fund transfer transactions, regardless of the amount, will now be subject to a fixed transaction fee of P15, down from the previous rate of P25. "By lowering fund transfer rate, more customers will benefit from the convenience and efficiency of our products. This is part of our commitment to provide accessible and affordable digital banking solutions, and to help expand financial inclusion," said LANDBANK President and CEO Lynette V. Ortiz. Digital fund transfer is facilitated by the LANDBANK Mobile Banking App (MBA) and iAccess for retail clients, and weAccess for Corporate Accounts. For the first three months of 2023, the three digital platforms have facilitated transactions amounting to a total of P265.7 billion. In full support of the National Government’s financial inclusion agenda, the reduction of transaction rates underscores LANDBANK's steadfast commitment to meeting the evolving needs of customers, in line with its expanded mandate of serving the nation.

LEARN MORE

LANDBANK delivers cash cards to remote Caluya islands

LANDBANK Culasi Branch personnel took a 4-hour boat ride to distribute LANDBANK cash cards to social protection beneficiaries from the remote islands of the Municipality of Caluya, Antique. CALUYA, Antique – The Land Bank of the Philippines (LANDBANK) recently completed the distribution of cash cards to a total of 2,357 beneficiaries of the Department of Social Welfare and Development (DSWD) from the remote islands within the Municipality of Caluya—situated in the northernmost tip of the province of Antique in Western Visayas. Among the recipients are beneficiaries of the Listahanan and Social Pensioners programs residing in the islands of Caluya, Sibato, Sibolo, Liwagao, Panagatan, Sibay, and Semirara, reachable via a 4-hour boat ride from the mainland of Libertad, Antique. Beneficiaries can use the LANDBANK cash cards to conveniently withdraw their cash aid from the Jerique Grocery Store—a LANDBANK Agent Banking Partner (ABP) situated in the island of Caluya. The store’s mobile Point-of Sale (POS) terminal will also be deployed among the islands in the municipality during scheduled payouts. The LANDBANK cash cards can also receive funds from other LANDBANK accounts through fund transfers via the iAccess, the LANDBANK Remittance System (LBRS) for overseas remittances, ATMs, and from other bank accounts via InstaPay and ATM fund transfers. Beneficiaries may likewise use the cash cards for cashless transactions in groceries, pharmacies, convenience stores, and other accepting merchants via POS terminals. LANDBANK is the main distribution arm of financial assistance of the National Government, servicing the beneficiaries of the Conditional Cash Transfer (CCT) and Unconditional Cash Transfer (UCT) programs of the DSWD nationwide.

LEARN MORE

LANDBANK welcomes Fitch outlook upgrade

The Land Bank of the Philippines (LANDBANK) welcomes the latest report of global credit ratings agency Fitch Ratings, Inc., which upgraded its outlook on the Bank to “stable,” alongside improved confidence in the country’s return to strong medium-term growth following the Covid-19 pandemic. The report published on 30 May 2023, which also affirmed the Bank’s Long-Term Issuer Default Ratings (IDRs) at 'BBB' and Government Support Rating (GSR) at 'bbb', considered LANDBANK’s “strategic and growing policy roles, 100% state ownership as well as its systemic importance as the largest state-owned bank in the country, with market share of about 14% of system assets.” The ratings agency likewise gave consideration to the “state’s improving ability to support the bank, in times of need, as reflected in the revision of the sovereign rating Outlook to stable,” which was detailed in a separate report the agency published on 22 May 2023. “The improved outlook from Fitch is a welcome vote of confidence for the Bank’s robust financial stability and resilience to withstand external and domestic economic headwinds. With solid state backing, we will intensify our support to the country’s priority programs and initiatives, towards expediting our complete resurgence from the global pandemic,” said LANDBANK President and CEO Lynette V. Ortiz. Led by solid governance and leadership, the Bank has continued to build its strong financial muscle to support key development sectors. It ranks second in the industry in terms of assets at P3.1 trillion and deposits at P2.8 trillion as of the first quarter of 2023, with financial ratios maintained at healthy levels. It recorded net income of P10.8 billion in the same period. The Bank’s capital likewise expanded year-on-year by 3.2% to P225.3 billion, as the Bank expressed confidence that it will reach its projected growth targets by yearend. LANDBANK is the only State-run Bank that has continued to ramp-up its digitalization drive geared towards providing safe, accessible and convenient banking service to meet the growing needs of customers, with a 30% growth in value of transactions amounting to P735.95 billion for its major digital banking platforms in the first quarter of 2023 alone. The Bank has maintained its dominance as the biggest development partner of the Local Government Units (LGU) sector towards local development, with all 1,717 LGUs nationwide maintaining deposit accounts with the state-run Bank. It is the only bank present in all 82 provinces of the country, providing accessible products and services, including to underserved and remote communities. LANDBANK remains as the country’s biggest Government-Owned and Controlled Corporation (GOCC) and the largest credit provider to the agriculture sector, among other key economic sectors, with the financial capacity and resources to fully support the National Government’s sustainable and inclusive development agenda.

LEARN MORE