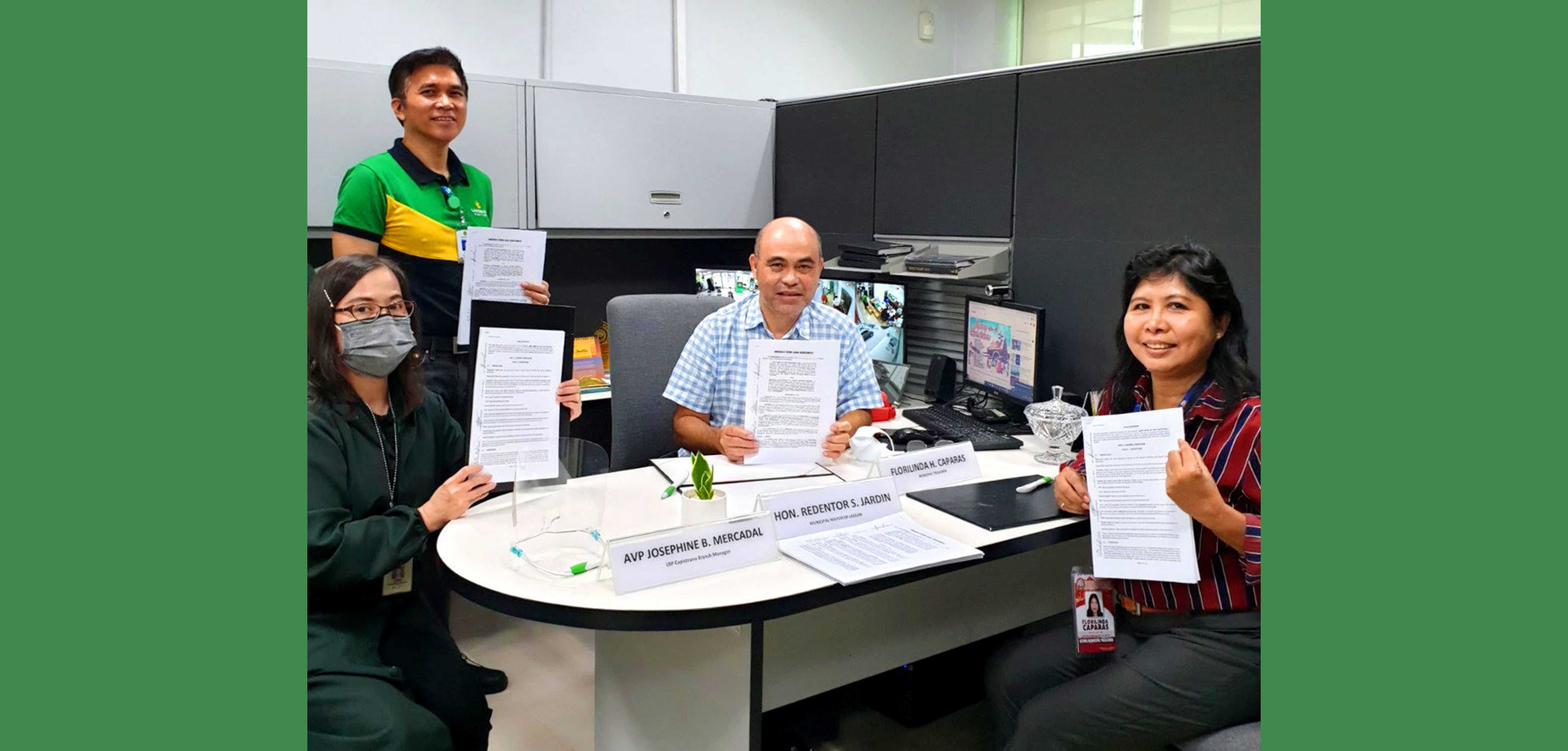

Jasaan Mayor Redentor S. Jardin (center) and Acting Municipal Treasurer Florilinda H. Caparas (right), sign two (2) loan agreements with LANDBANK Capistrano Branch Head Assistant Vice President Josephine B. Mercadal (left) and LANDBANK Cagayan de Oro Lending Center Account Officer Ramil C. Lumayag (standing, left) to finance the upgrading of water system facilities and the construction of a sanitary landfill and slaughterhouse in the municipality.

JASAAN, Misamis Oriental – The Land Bank of the Philippines (LANDBANK) and the Municipal Government of Jasaan, Misamis Oriental recently entered into two (2) loan agreements totaling P300 million for the expansion of the municipality’s water system and the construction of a sanitary landfill and slaughterhouse facilities.

Mayor Redentor S. Jardin and LANDBANK Capistrano Branch Head Assistant Vice President Josephine B. Mercadal led the loan signing together with Acting Municipal Treasurer Florilinda H. Caparas and LANDBANK Cagayan de Oro Lending Center Account Officer Ramil C. Lumayag on October 28, 2020.

LANDBANK granted the local government unit (LGU) a P150 million term loan to upgrade Jasaan’s water system facilities and address the municipality’s dwindling water supply. The expansion project aims to benefit around 7,723 households from six (6) barangays with efficient and uninterrupted potable water supply.

The loan will finance the construction of a Level-3 water system to connect secondary pipelines to Level-3 household connections. This will complete the series of upgrades implemented by the Jasaan LGU under its Potable Water Supply System Project.

LANDBANK also granted the LGU another P150 million term loan for the construction of a Category-1 Sanitary Landfill which will ensure the proper disposal of residual and hazardous wastes from the community. The project will involve the excavation of two (2) hectares of land, including the construction of drainage, gas ventilation, leachate, septic, hazardous waste and electrical systems, an administration building and a perimeter fence. The LGU is also looking to expand the landfill by 10 more hectares. In addition, a portion of the loan will be used to purchase several equipment for daily landfill operations.

The loan will also finance the construction of a class “AA” slaughterhouse that will upgrade Jasaan’s existing 100-square meter facility from accommodating up to 20 heads to 100 heads of hogs and cattle per day. Soon, farmers and raisers in the municipality will no longer travel far to accredited slaughterhouses in Cagayan de Oro City and Manolo Fortich for their needs.

“Even in the past, LANDBANK has been very accommodating and has supported our vision for Jasaan. With their assistance, we were able to establish our new municipal hall building and SIDARC water supply projects that continues to serve the citizens of Jasaan. Now, with the approval of our new loans, we are looking forward to bringing uninterrupted water services to the people and provide basic services for our constituents,” said Mayor Jardin.

LANDBANK has been a trusted partner of Jasaan LGU since 1993. In 2007, LANDBANK provided the LGU a P22.7-million term loan for the construction of the municipal hall building and a P29.71-million term loan for the establishment of its SIDARC water system.

“Working together is not something new to LANDBANK and LGUs. We recognize that LGUs are catalysts for positive change by bringing sustainable development in their respective localities,” said LANDBANK President and CEO Cecilia C. Borromeo.

Supporting local development

Through its financial services, LANDBANK supports LGUs in delivering local programs and projects geared towards accelerating inclusive and sustainable countryside development.

As of October 31, 2020, LANDBANK has extended P51.59 billion in outstanding loans to LGUs nationwide. This includes P17.18 billion for agri-aqua projects and P2.37 billion for utility projects of LGUs.

For more updates, please Follow, Like and Share the official LANDBANK Facebook, Instagram and YouTube accounts (@landbankofficial), Twitter (@LBP_Official), or visit the LANDBANK website (www.landbank.com).

Recto commends LANDBANK for declaring its single highest dividends in history to benefit Filipinos

Finance Secretary and Land Bank of the Philippines (LANDBANK) Chair Ralph G. Recto has praised the state bank for declaring PHP 33.5 billion in dividends––its single highest dividend yield in its history, with millions of Filipinos expected to benefit. The dividend remittance is in line with President Ferdinand R. Marcos, Jr.’s directive to uphold fiscal discipline, ensuring that the government maximizes non-tax revenues to fund priority programs without the need to impose new taxes on the people. “Ang halagang ito ay resulta ng kusang pagbubuti ng serbisyo ng LANDBANK. Ibig sabihin, mas maraming magsasaka ang nabigyan ng murang pautang, mas maraming mangingisda ang naabutan ng tulong, at mas masigla ang daloy ng kapital sa tinatawag nating countryside economy,” he said in his speech at the ceremonial turnover on June 9, 2025. “Kaya naman hindi lang po tseke ang inabot niyo ngayong araw, kundi pag-asa para sa milyon milyong Pilipinong makikinabang dito,” the LANDBANK Chair added. Under Republic Act No. 7656 or the Dividend Law, Government Owned and Controlled Corporations (GOCCs) are required to remit at least 50% of their net earnings during the preceding year as dividends to the national government. To maximize non-tax revenue, the Department of Finance (DOF) has requested GOCCs to increase this share to 75%. Secretary Recto thanked the DOF’s Corporate Sector and Strategic Infrastructure Group (CSSIG) for their impeccable work in helping oversee the country’s GOCCs, ensuring transparency, accountability, and genuine service for the Filipino people. “This dividend remittance to the National Treasury is living proof that when a government financial institution serves the people well, the nation reaps greater rewards,” he said. In 2024, LANDBANK remitted PHP32.12 billion in dividends — the highest among all GOCCs. With this year’s PHP33.53 billion declaration, LANDBANK maintains its standing as the top dividend contributor among GOCCs for the second consecutive year. “Our continued solid performance affirms LANDBANK’s role as a reliable partner of the National Government in its infrastructure push, its support to the agriculture, education and healthcare sectors. This is LANDBANK’s value to the Filipino people: clear in its impact and rooted in its mission,” said LANDBANK President and CEO Lynette V. Ortiz. Meanwhile, LANDBANK posted a solid PHP 13.29 billion net income for the first quarter of 2025, up 11% from PHP 11.98 billion year-on-year and 32% above its first quarter target. LANDBANK’s total assets also grew to PHP 3.43 trillion, up 5% year-on-year from PHP 3.27 trillion, driven by expansions in both loan and investment portfolios. Present during the turnover were DOF Chief of Staff and Undersecretary Maria Luwalhati Dorotan Tiuseco, CSSIG Undersecretary Rolando Tungpalan, and National Treasurer Sharon P. Almanza. (Press release courtesy of Department of Finance)

LEARN MORE

Resilience beyond the Shoal: Zambales fisher turns the tide by casting new net of hope

Paolo E. Quitaneg, a fisher from Zambales, secured a loan from LANDBANK to finance the construction of fish aggregating devices or “payaos,” which allow his family to continue earning a living even without entering the disputed waters of Scarborough Shoal in the West Philippine Sea. IBA, Zambales — Thirty-five-year-old fisher Paolo E. Quitaneg comes from a family that casts their nets and hopes into the sea. From an early age, he witnessed how the bountiful waters of Scarborough Shoal in the West Philippine Sea — locally known as Bajo de Masinloc or Panatag Shoal — sustained their livelihood and nourished countless generations before him. But in 2012, the tides suddenly turned. Due to escalating geopolitical tensions in the area, access to this traditional fishing ground, which Paolo described as a “true paradise,” was restricted. For small fishers like him, the loss of Scarborough Shoal meant not just a lost catch, but the unraveling of an entire way of life. Despite the risks, Paolo and fellow fishers tried to continue fishing in the area, But the rising presence of large foreign vessels made each trip more dangerous, as local fishers were intercepted, and faced threats and harassment at sea, with warning signals often blaring before they could even draw close to the shoal. “Yung huling punta namin doon noong 2024, ni-radyo agad kami. Andun ‘yung kaba at takot na baka masira ang bangka namin, kaya hindi na kami bumalik. Lahat kami dito sa buong Zambales apektado, at nawalan ng magandang kita kasi ‘yun talaga ang pangunahing pinagkukunan namin ng kabuhayan,” Paolo shared, adding that they even had to sell their boat just to make ends meet. (“Our last trip there was in 2024, and we were immediately warned through a radio. We felt the fear and anxiety that our boat might get damaged, so we never returned. All of us here in Zambales were affected and lost a good source of income because that was our main livelihood,” Paolo shared.) Charting a safer course with payaos As the country pursues diplomatic solutions to ease maritime tensions, Paolo’s family chose to chart a different course. In 2022, they established and registered LIMVQS Enterprise as a small business operating fish aggregating devices — locally called payaos — as an alternative method of drawing fish closer to shore. Since then, Paolo’s family has acquired a fishing vessel to sustain their operations. These fish aggregating devices, typically made from styrofoam, old tires and net, are set up about 15 nautical miles offshore to attract fish and encourage spawning. After about three weeks, the fish can be harvested using large nets. This has allowed Paolo’s family to secure a steady catch and income without venturing into the contested waters of Scarborough Shoal. Scaling up with LANDBANK’s support Recognizing the potential of payaos as a safer and more sustainable alternative to traditional fishing, Paolo turned to LANDBANK in 2024 to scale up their operations. He applied for financial assistance to construct 10 new payao units, each costing around P100,000. Through the Agricultural Competitiveness Enhancement Fund (ACEF) Lending Program, jointly implemented by LANDBANK and the Department of Agriculture (DA), Paolo was granted a loan with a low annual interest rate of only 2%. Under this Program, farmers and fishers can borrow up to ₱1 million, while cooperatives, associations, and micro, small, and medium enterprises (MSMEs) can access loans up to ₱5 million. “Nagulat kami — mayroon pa palang ganitong bangko. Hindi ako nahirapan, very friendly ang mga staff. Binigyan nila ako ng magagandang options at inalalayang makumpleto ang mga requirements. Ganoon pala ang LANDBANK — tutulungan ka para maiangat ka, para makakuha ka ng magandang kabuhayan,” said Paolo (“We were surprised — we didn’t know there was still a bank like this. I didn’t have a hard time, the staff are very friendly. They gave me good options and guided me through the requirements. That’s what LANDBANK is like — they help you rise, so that you can build a better livelihood,” said Paolo.) In January 2025, Paolo’s family deployed their new payaos off the coast of Zambales. Their catch grew significantly from roughly 16,000 kilos to nearly 50,000 kilos per month, allowing them to supply public markets as far as Malabon, where prices are more favorable. With a steady income, they were able to save enough to place a down payment on their first delivery truck, saving P25,000 on truck rental costs for every trip to Malabon Public Market. Now, they keep more of their earnings to better support their family’s needs. From safer seas to thriving communities With support from LANDBANK, Paolo’s family has provided safe and sustainable livelihoods for 36 local workers, while ensuring a steady supply of fresh fish from Zambales to Metro Manila. What began as a lifeline for Paolo’s family has since become a source of hope for others. The LIMVQS Enterprise now provides livelihood for 36 local workers hired as harvesters and porters, who no longer risk their safety at sea to earn a living. Local dealers across Zambales have also benefited from the increased fish supply, which has helped stabilize market availability and prices. The ripple effect extends to Metro Manila, where consumers now enjoy a steady supply of affordable, fresh, and responsibly-sourced fish. “Nagpapasalamat po ako sa LANDBANK, sa Department of Agriculture, at sa aming LGU na nagbigay ng endorsement at suporta para kami ay makahiram ng sapat na puhunan. Kahit kami ay mula sa marginalized sector, pinaramdam ninyo ang tiwala at suporta para kami’y makabangon at umasenso,” Paolo expressed. (“I am grateful to LANDBANK, the Department of Agriculture, and our LGU for the endorsement and support that allowed us to secure enough capital. Even though we come from the marginalized sector, you showed us trust and support to help us recover and improve our livelihood,” Paolo expressed.) Looking ahead, Paolo plans to apply for another loan from LANDBANK once the first loan is fully paid. He will use the fund to purchase a second truck to expand deliveries to other provinces, such as Laguna. Fueling the current of progress LANDBANK continues to intensify its support across the entire agriculture value chain — from small farmers and fishers to agribusinesses. As of March 2025, the Bank’s agriculture, fisheries, and rural development (AFRD) loan portfolio has grown to ₱844.61 billion, accounting for 53.4% of its total gross loans of ₱1.58 trillion. Between January and March alone, LANDBANK assisted almost 28,000 new small farmers and fishers, bringing total beneficiaries nationwide to 4.04 million. These were supported through direct lending, partnerships with credit conduits, and capacity-building initiatives. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK, Water.org partner to expand access to safe water nationwide

LANDBANK President and CEO Lynette V. Ortiz and Water.org Regional Director for Southeast Asia Griselda G. Santos, have partnered to provide sustainable financing solutions for water and sanitation projects, especially in underserved communities. LANDBANK Director Gaudencio S. Hernandez Jr., Executive Vice President Ma. Celeste A. Burgos, and Water.org Portfolio Lead Floredick B. Pajarillo witnessed the event. MANILA, Philippines — In a move to improve access to safe, affordable water across the country, LANDBANK and international non-profit organization Water.org have formalized a strategic partnership to scale up investments for water and sanitation projects. The collaboration aims to deliver sustainable financing solutions for water and sanitation projects, particularly in underserved communities. This is in support of the national government’s commitment to Sustainable Development Goal 6 (SDG 6), which calls for universal access to clean water, sanitation, and hygiene by 2030. Under the partnership, LANDBANK will share its lending guidelines to support Water.org identify qualified borrowers. In turn, Water.org will provide technical assistance to improve project preparedness and viability, including support for documentation, loan applications, and technical assessments. LANDBANK President and CEO Lynette V. Ortiz and Water.org Regional Director for Southeast Asia Griselda G. Santos inked the Memorandum of Understanding (MOU) on 15 May 2025 at the LANDBANK Plaza in Manila, witnessed by LANDBANK Director Gaudencio S. Hernandez Jr., Executive Vice President Ma. Celeste A. Burgos and Water.org Portfolio Lead Floredick B. Pajarillo. “By combining LANDBANK’s nationwide reach and financing capacity with Water.org’s expertise in community engagement, technical support, and impact evaluation, we are building a powerful alliance,” said LANDBANK President Ortiz. The collaboration brings together LANDBANK’s strong track record in public infrastructure financing and Water.org’s market-based approach to expanding access to safe water. The partnership is set to benefit local water service providers—including water districts, financial institutions, local government units (LGUs), cooperatives, and micro, small, and medium enterprises (MSMEs). “There's still a long way to go towards a sustainable solution in the Philippines. No one institution—government nor NGO—can do it alone. This challenge provides an opportunity for us to work together for a more sustainable and resilient country,” said Water.org Regional Director Santos, welcoming the partnership as a key milestone in enabling inclusive water solutions in the country. Water.org will identify potential borrowers for water and sanitation projects and refer them to LANDBANK based on the Bank’s eligibility criteria, while also assisting loan applicants in completing documentary requirements. Implementation of the partnership will be carried out under LANDBANK’s Water for Everyone (H2OPE) Program, which supports the development of sustainable water sources, improvement of distribution systems, and construction of sanitation and wastewater treatment facilities nationwide. As of March 2025, LANDBANK has approved P8.8 billion in loans to 36 borrowers under the H2OPE program. The partnership with Water.org is expected to scale the program’s reach and impact, accelerating the delivery of safe water and sanitation across the country. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide. ABOUT Water.org Water.org is a global non-profit organization that has helped transform the lives of more than 56 million people around the world through access to safe water and sanitation. For over three decades, Water.org pioneers market-driven financial solutions to address the global water crisis, empowering families with the resources and opportunities to build healthier, more resilient futures.

LEARN MORE