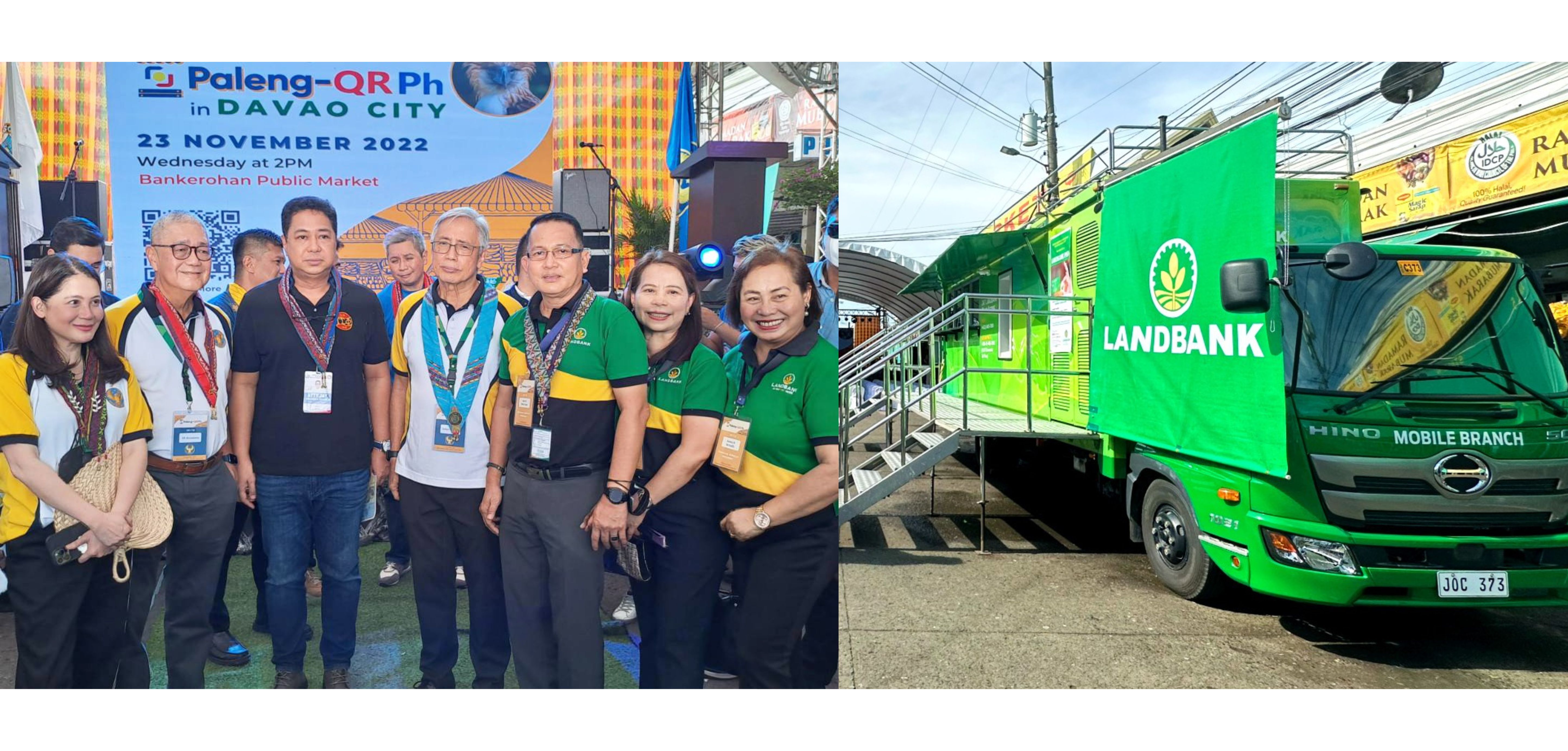

(left photo) Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla (4th from left), Monetary Board Member Eli M. Remolona (2nd from left), Deputy Governor Bernadette Romulo-Puyat (leftmost), and Davao City Vice Mayor Jay Melchor B. Quitain, Jr. (3rd from left) are joined by LANDBANK officers during the launch of the Paleng-QR Ph at the Bankerohan Public Market in Davao City on 23 November 2022. (right photo) A LANDBANK Mobile Branch is deployed during the launch event to facilitate on site LANDBANK account opening among market vendors, shop owners and market goers.

DAVAO CITY – The Land Bank of the Philippines (LANDBANK) is stepping-up to accelerate the adoption of cashless transactions in this City’s biggest public market, in support of the Central Bank's thrust of transforming the country into a cash-lite economy.

LANDBANK joined the Bangko Sentral ng Pilipinas (BSP), the Department of Interior and Local Government (DILG), and the City Government of Davao during the launch of the Paleng-QR Ph program at the Bankerohan Public Market last 23 November, to provide local stakeholders with their own bank accounts.

The LANDBANK Mobile Branch was deployed to facilitate on-the-spot account opening among market vendors and shop owners, as well as market goers. New LANDBANK account holders were automatically enrolled in the LANDBANK Mobile Banking App (MBA), which can facilitate the transfer and receipt of funds via Quick Response (QR) code.

“LANDBANK fully supports the Paleng-QR Ph program in encouraging local communities to adopt cashless payments. We are bringing digital payments closer to consumers to make everyday transactions faster, safer and more convenient, where development is truly inclusive,” said LANDBANK President and CEO Cecilia C. Borromeo.

The Overseas Filipino Bank (OFBank), the official digital bank of the Philippine government and a subsidiary of LANDBANK, also participated in the event and offered its deposit products to Davaoeños.

The launch of Paleng-QR Ph in Davao City was spearheaded by BSP Governor Felipe M. Medalla and Mayor Sebastian Z. Duterte. They were joined by BSP Monetary Board Members Antonio S. Abacan, Jr., V. Bruce J. Tolentino, Anita Linda R. Aquino and Eli M. Remolona, and Deputy Governors Eduardo G. Bobier and Bernadette Romulo-Puyat, DILG XI Assistant Regional Director Abdullah Matalam, and Vice Mayor Jay Melchor B. Quitain, Jr.

Jointly developed by the BSP and DILG, the Paleng-QR Ph program aims to build the digital payments ecosystem in the country by promoting cashless payments in public markets and local transportation, particularly tricycles.

LANDBANK has been supporting the BSP’s digitalization thrust by providing its customers with innovative digital banking platforms.

Most recently, the Bank launched the LANDBANKPay, an all-in-one mobile wallet that allows users to conveniently pay bills, load up mobile phones and tollway RFID accounts, make online purchases, as well as transfer funds anytime, anywhere.

Since the pandemic started, LANDBANK has also recorded a consistent increase in customer demand for digital financial transactions.

In the first three quarters of the year alone, the Bank facilitated a total of 111.3 million transactions amounting to P4.6 trillion across its major digital platforms, for 15% and 169% year-on-year growths in volume and value, respectively.

The LANDBANK MBA topped the list in terms of transaction volume facilitated, after recording 87.6 million transactions worth P154.3 billion.

.png)

LANDBANK shines with dual honors at PDS Awards

LANDBANK bags two awards at the Philippine Dealing System (PDS) Annual Awards Night in recognition of its contributions to advancing the Philippine capital market. (Right photo) Accepting the awards on behalf of LANDBANK are Senior Vice President Gonzalo Benjamin A. Bongolan (2nd from left) and Assistant Vice President Glenn R. Aguda (3rd from left), presented by PDS Group President Ramon S. Monzon (leftmost) and PDEx President and CEO Antonio A. Nakpil (rightmost). MAKATI CITY, Philippines—Highlighting its growing contribution to advancing the Philippine capital market, LANDBANK was honored as one of the top-performing institutions at the 2025 Philippine Dealing System (PDS) Annual Awards Night. The state-run bank clinched 3rd place in the Top 5 Corporate Issue Managers/Arrangers – Bank Category, in recognition of its vital role in facilitating the issuance of corporate fixed-income securities in 2024. The award honors institutions that led or arranged the largest volume of listed corporate securities offered during the year. The Bank also ranked 4th among the Top 5 Fixed-Income Brokering Participants, highlighting the Bank’s strong presence in the fixed-income market and significant contribution to overall trading volume by face amount. LANDBANK Senior Vice President Gonzalo Benjamin A. Bongolan and Assistant Vice President Glenn R. Aguda accepted the awards on behalf of the Bank on 4 April 2025 at the Makati Diamond Residences. Since 2005, the PDS Group, comprising the Philippine Dealing System Holdings Corp. and its subsidiaries, has been recognizing outstanding performance, leadership, innovation, and contributions to the capital market through its annual awards. These accolades underscore LANDBANK's strategic role in deepening the local capital markets, in line with its broader mission of supporting agriculture and other key development sectors in driving inclusive and sustainable development. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK extends P1.3-B financing for Isabela Feed Mill Complex

ILAGAN CITY, ISABELA — LANDBANK has sealed a financing deal with Sagittarian Agricultural Philippines, Inc. (SAPI) to support the construction of the Isabela Feed Mill Complex, reinforcing its commitment to advancing the country’s agricultural sector. Under the partnership, LANDBANK will provide a P1.2 billion loan to partially fund the development of the 15-hectare feed mill facility in the country’s corn capital, plus an additional P100 million credit line to support SAPI’s working capital needs. Strategically located in this city to maximize Isabela’s abundant corn supply, the Feed Mill Complex will be leased to Charoen Pokphand Philippines Corporation (CPFPC), a leading food and agro-industrial company and a long-standing LANDBANK client. The project is expected to increase corn prices from P1.00 to P2.00 per kilogram, benefiting an estimated 97,734 small farmers across Isabela and neighboring provinces. “With this investment, LANDBANK reaffirms its commitment to modernizing the agricultural sector, empowering local farmers, and strengthening the country’s food security and support the agriculture value chain,” said LANDBANK President and CEO Lynette V. Ortiz. The loan and credit line signing ceremony was led by LANDBANK Northern Luzon Lending Group Head First Vice President Eduardo N. Reyes Jr. and Northern Isabela Lending Center Head Myra Myrtha M. Padolina, alongside SAPI President and CEO Jose Avelino C. Diaz and Corporate Secretary Atty. Danver Albert R. Arzaga. Also present as witnesses were City of Ilagan Mayor Josemarie L. Diaz, Vice Mayor Kyrill S. Bello, CPFPC Vice President Suchart Panparn, Assistant Vice President Darwin Lictawa, and LANDBANK Account Officer Honeylee B. Gomez. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE.jpg)

LANDBANK sees surge in digital banking usage in 2024

The LANDBANK Mobile Banking App (MBA) powered the Bank’s digital surge in 2024, logging 106.82 million transactions or almost double the previous year’s total of 55.2 million. LANDBANK recorded a significant increase in digital banking transactions in 2024, driven by the growing shift of customers to online banking services and the Bank’s sustained investments in enhancing its digital platforms. The Bank facilitated a total of 162.28 million digital transactions, marking a 67% expansion from 97.08 million in 2023, with a total value of ₱3.38 trillion, up 38% from ₱2.45 trillion. “Digital banking is not just about convenience—it’s about inclusion. Through our digital banking channels, we are empowering every Filipino to take control of their finances. Our goal is to make safe, reliable, and convenient banking accessible to all, especially our farmers and fishers, business owners, OFWs, and government agencies,” said LANDBANK President and CEO Lynette V. Ortiz. The LANDBANK Mobile Banking App (MBA) led the growth in the Bank’s total transaction volume, with a record 106.82 million transactions in 2024—nearly double the 55.2 million transactions recorded in the prior year. Through the MBA, users can perform a wide range of banking services, including fund transfers, bill payments, and investing in government securities. Among the App’s major enhancements last year was the straight-through account opening feature, which allows customers to open a digital account online via smartphones without visiting a branch. In terms of transaction value, the Bank’s corporate Internet banking platform, weAccess, recorded the highest volume at ₱1.36 trillion. This marks a 43% year-on-year growth from ₱952.14 billion in 2023. LANDBANK’s other major digital channels include iAccess, an online retail banking channel; Link.BizPortal, a web-based payment channel; Electronic Modified Disbursement System (eMDS), a facility for institutional clients and national government partners; and LANDBANK Bulk Crediting System (LBCS), an electronic bulk disbursement facility. The LANDBANK MBA was named the “Most Innovative Banking Application” at the 12th Annual International Finance Awards 2024 in Bangkok, Thailand. The Bank was likewise recently recognized as the “Best e-Banking Services Provider” and “Most Reliable Mobile Banking App Provider” at the World Business Outlook Awards 2025 by Singapore-based business magazine, World Business Outlook. Bringing banking closer to more Filipinos As part of its broader digital transformation agenda, LANDBANK continues to innovate how it brings banking services closer to more Filipinos—especially those in underserved and remote areas. LANDBANK began rolling out “phygital” branches in December 2024 that combine physical and digital services for a more streamlined, seamless, and delightful customer experience. These branches showcase a refreshed look, equipped with self-service machines, new queuing and tellering systems, meeting pods, and interactive zones. To further extend its reach, the Bank is ramping up its LANDBANKasama Program, which brings basic banking services to far-flung and underserved areas. By partnering with local cooperatives, associations, rural banks, LGUs, MSMEs, and private entities, the Bank empowers these community-based partners to serve as LANDBANKasama partners, providing services such as cash withdrawal, deposit, fund transfers, bills payment, and balance inquiry. LANDBANK is also pioneering cash-lite ecosystems in key areas, starting with the Province of Batanes. By promoting the use of digital payments and equipping local merchants, residents, students and LGUs with digital financial tools and skills, the initiative promotes the use of cashless transactions as a safer, faster, and more convenient way to manage daily financial needs—ultimately reducing reliance on physical cash and fostering a digitally inclusive local economy. With its digital strategy in full swing, LANDBANK remains committed to accelerating digital transformation and delivering enhanced customer experience across the country—anchored on its mandate to serve the agriculture sector, empower small farmers and fishers, and drive inclusive and sustainable national development for all Filipinos. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE