Cumulative loan releases of two lending programs to support the country’s agrarian reform beneficiaries and small farmers as of the first half of the year has reached P583.35 million, the Land Bank of the Philippines (LANDBANK) announced.

About P12.05 million in fund assistance was released under LANDBANK’s expanded E-ARISE-ARBs (Expanded Assistance to Restore and Install Sustainable Enterprises for Agrarian Reform Beneficiaries and Small Farm Holders) loan program that targets beneficiaries and small farmers whose livelihood were adversely affected by the COVID-19 crisis, as well as pest and diseases. Prior to the program relaunch, this credit facility was only available to agrarian reform beneficiaries’ organizations (ARBO) whose members were affected by natural calamities and disasters.

LANDBANK President and CEO Cecilia C. Borromeo said the program revamp was made in line with the national government’s aggressive drive to support ARBs and small farm holders amid the ongoing COVID-19 pandemic. In partnership with the Department of Agrarian Reform (DAR), the expanded credit assistance will provide ARB cooperatives and farmers’ associations and small farm holder members greater access to credit. As of June 30, 2020 a total of 928 beneficiaries through 12 ARBOs have availed of this loan facility.

Eligible ARBOs can avail of the loan to finance agro-enterprise/livelihood projects and for providential purposes (i.e., house repairs for members and office repairs for ARBOs) at interest rates of 3% per annum and 0%, respectively. In turn, ARBOs are allowed to relend the fund to members at 6% per annum and 3% per annum, respectively. The loans can be paid up to three (3) years, depending on the project/household cash flow.

Another loan facility offered by LANDBANK and DAR, the CAP-PBD (Credit Assistance Program for Program Beneficiaries Development) Window III Program Extension, has released P571.3 million in loans as of end-June 2020 and benefited 6,854 beneficiaries through 112 ARBOs.

CAP-PBD, which has been extended for another year or until March 15, 2021, aims to address the financing requirements of newly-accessing ARBOs and the existing CAP-PBD borrowers for agricultural production and other livelihood/agri-enterprise projects.

The CAP-PBD Window III Program Extension was designed as a flexible credit facility for ARBOs that are not yet qualified to borrow under the regular lending window of LANDBANK. The ARBOs may use the loan as additional working capital for on-lending to their ARB-members, and/or to finance ARBO-managed projects.

Under the Program, eligible ARBOs may borrow an amount equivalent to up to 80% of the total project cost, but not to exceed P5 million, at an affordable interest rate of six percent (6%) per annum, payable up to two years based on the crop cycle/project cash flow.

“We will continue to work hand in hand with DAR, as well as other government agencies, to ensure that ARBOs have enough funds to lend to their members, and help them get through this health and economic crisis,” Borromeo said.

Interested ARBOs may contact the nearest open LANDBANK Lending Center or branch nationwide, or call LANDBANK’s customer service hotline at (02) 8-405-7000 or at PLDT Domestic Toll Free 1-800-10-405-7000.

Deepening roots, widening reach: LANDBANK helps Bulacan co-op grow with its community

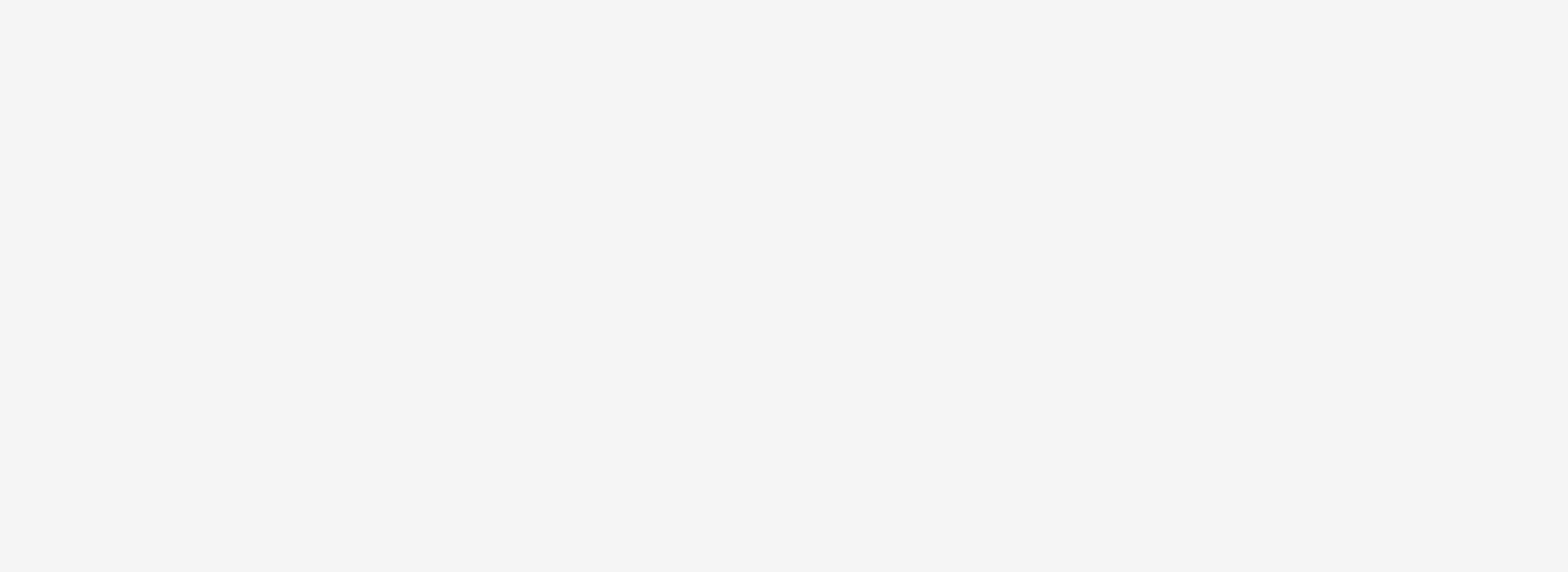

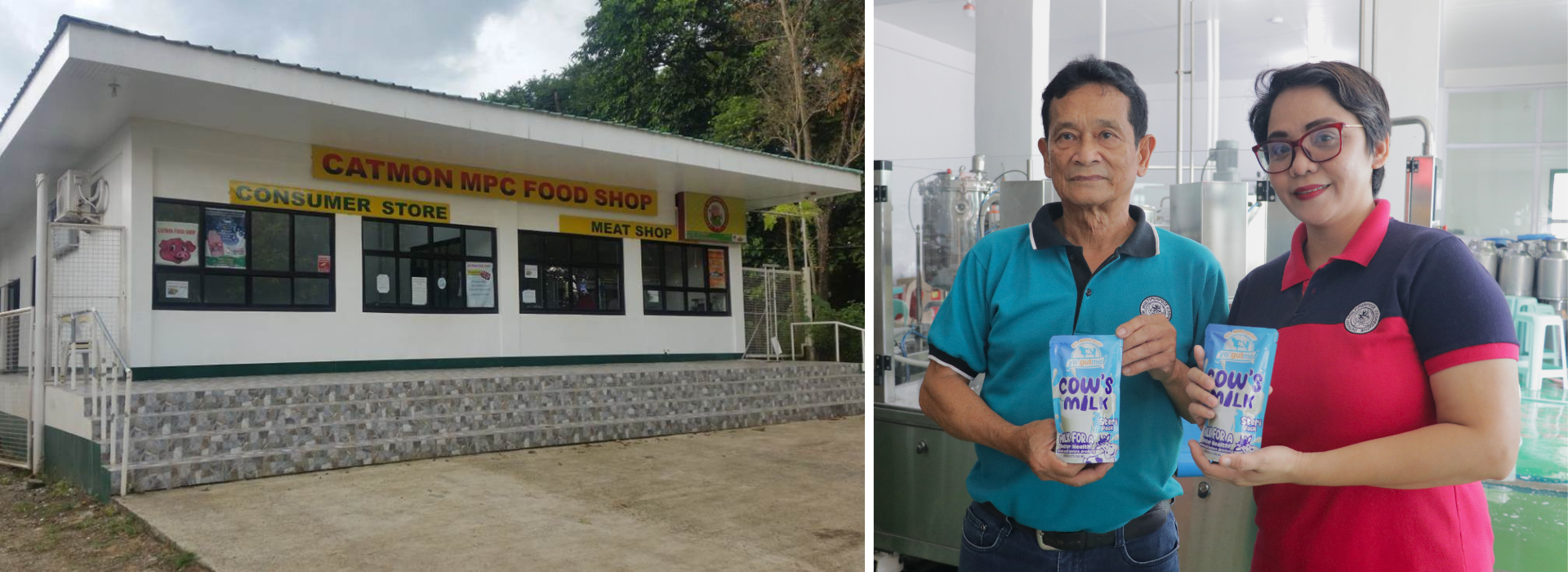

CATMON, Bulacan – In what was once a predominantly agricultural barangay of Santa Maria, Bulacan, a grassroots initiative that began with a handful of farmers under a sampaloc tree has blossomed into one of the province’s most progressive cooperatives. Backed by the steadfast support of LANDBANK, Catmon Multi-Purpose Cooperative (MPC) has thrived by growing alongside its community—evolving to meet changing needs while staying true to its agricultural roots. Growing up in Catmon, Emeliza Laurenciana, now the Chairperson of Catmon MPC, recalls the Cooperative as a constant in a community once surrounded by rice fields and backyard farms. “It’s all thanks to the unwavering support of LANDBANK that our Cooperative has flourished, allowing us to uplift the lives of so many in our community, including mine,” Laurenciana shared. From a Tree to a Vision Catmon MPC’s journey started in 1987, when 26 farmers and livestock raisers came together with a shared mission—to improve their lives and uplift their community through agriculture. Each contributed ₱500, pooling a total initial capital of ₱12,500 that would mark the foundation of what is now a pillar of grassroots development in the area. “Back then, local farmers struggled with limited access to capital, technical know-how, and reliable markets. We saw those gaps firsthand, and that became our driving force—to build a Cooperative that could offer real, lasting support where it was most needed,” shared Luisito dela Rosa, one of the 26 founding members who now serves as Catmon MPC’s General Manager. The Cooperative initially focused on livestock production, and with a small grant from the Department of Agriculture (DA), it built a feed mill—a critical asset that improved access to affordable, high-quality animal feeds for farmers across Catmon. A Timely Opportunity A pivotal moment in Catmon MPC’s history was when a representative from LANDBANK visited the Cooperative in 1989 and offered financial access. “We didn’t let that opportunity pass. Because of LANDBANK, we secured the capital we needed for rice production and other ventures,” said Dela Rosa. What started as a single loan to fund agricultural production evolved into a long-term partnership. As the landscape of Catmon shifted from farmlands to residential areas, the Cooperative kept pace by expanding its services to remain a relevant support system for its members. Through all these developments, LANDBANK remained a steadfast partner, providing not only financing but also guidance to help the co-op adapt and expand its reach. “LANDBANK’s support has always allowed us to think ahead. They helped us adapt as our surroundings changed. We’ve expanded our services not just to sustain livelihoods, but to help our members and their families build better lives,” added Laurenciana. New Products, New Purpose Today, Catmon MPC has expanded into dairy production, offering yogurt, flavored milk, and sterilized milk—products that are especially popular among the younger residents in Sta. Maria. The Cooperative also continues to provide financial and livelihood assistance to both long-time members and new households in the community. “What began under a sampaloc tree has now grown into offices and facilities serving communities across Sta. Maria, Bulacan,” shared Dela Rosa, reflecting on the Cooperative’s journey. “To grow with the community means evolving with it. We were founded on agriculture, and that will always be our foundation. But LANDBANK has helped us build on that, expanding our reach without losing sight of where we came from,” he added. Empowering Through Capacity-Building Like its partner LANDBANK, Catmon MPC emphasizes capacity-building as a core value. It regularly conducts training programs to equip members with tools to turn financial and livelihood assistance into sustainable, long-term development. Today, more than three decades since its founding, with over 14,000 members and an asset base exceeding P900 million, Catmon MPC’s continued growth is rooted in a clear vision, strong leadership, and deep ties to its community. Even amid rapid change, it embraces new opportunities, and the Cooperative remains grounded in its original mission: to serve and uplift the community of Catmon. The enduring partnership between LANDBANK and Catmon MPC reflects a shared commitment to driving local development. From a modest effort by a small group of determined farmers that has become a multi-sector cooperative, their story stands as an inspiring example of what can be achieved through trust, adaptability, and a shared mission to empower communities and build a more inclusive, sustainable future. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

Farmers pay back loans with palay: Cagayan co-op scales up with LANDBANK backing

SOWESFACO General Manager Christopher Barlaan showcases a handful of freshly harvested palay inside the co-op’s storage facility in Solana, Cagayan—where rice sacks line the walls as a testament to the farmers’ collective efforts and growing productivity. With support from LANDBANK, the co-op continues to modernize its operations and empower smallholder farmers to become agripreneurs. SOLANA, Cagayan — Farmers in this quiet agricultural town in northern Philippines have long relied on agriculture as their primary source of livelihood despite many challenges. Yet, Solana West Farmers Cooperative (SOWESFACO) is rewriting the story of smallholder farming by turning subsistence growers into market players, improving livelihoods, and fostering long-term sustainability. Founded nearly three decades ago with 23 pioneering members contributing P5,000 each, SOWESFACO began with a pooled capital of just P115,000. Despite starting small, the cooperative has evolved into a model of self-reliance and collective empowerment with a clear vision to provide financial support, agricultural resources, and opportunities for growth to the farming community of Solana. Strengthening farmers through financial access From the outset, SOWESFACO has remained true to its founding principle to help farmers help themselves. By providing affordable credit, access to farm inputs, and a community of shared purpose, the cooperative has enabled its members to build more secure and sustainable livelihoods. Central to this progress is SOWESFACO’s long-standing partnership with LANDBANK since 1996. SOWESFACO General Manager Christopher M. Barlaan attests to the Bank’s steady backing, which has been crucial in expanding the co-op’s reach and capacity to serve more members. “LANDBANK has been instrumental in our growth. More than a financial institution, they’re a partner who understands what we’re trying to do for our farmers,” said Barlaan. Paying back loans in kind Among SOWESFACO’s most innovative and impactful initiatives is its "Payment in Kind" policy, which allows members to repay their loans with harvested palay instead of cash. This was made possible through LANDBANK’s flexible financial solutions, supporting the co-op’s efforts to create a system that benefits both farmers and the cooperative. “We believe that progress should be shared. That’s why we make every effort to ensure LANDBANK’s support directly benefits our members. Through our payment-in-kind system, they’re able to repay loans using their harvest, not just cash—giving them more breathing room and better control over their income,” added Barlaan. By repaying loans in kind, SOWESFACO shields Solana farmers from exploitative market practices where palay prices are often dictated by middlemen, and ensures fair compensation to help farmers retain more of their hard-earned income. This system also lessens the stress of cash-based repayments during lean seasons, allowing farmers to focus on improving crop yields and productivity. Building modern, resilient farms The partnership with LANDBANK has also fueled infrastructure upgrades critical to SOWESFACO’s competitiveness. Investments in post-harvest facilities, including dryers and milling equipment, have significantly reduced losses and improved rice quality — positioning the cooperative to meet the demands of institutional buyers and larger markets. “With LANDBANK’s help, we’ve been able to modernize our operations. The support has made us more efficient, competitive, and responsive to our members’ needs,” Barlaan said. This physical expansion has been matched by investments in human capital. The co-op also invests heavily in training programs, including farm management, financial literacy, and cooperative governance, raising the skillset of members to thrive in a changing agricultural landscape. “LANDBANK helped us not just to support our farmers today, but we’re also preparing them for tomorrow. Through skills training and insurance, we’re helping build more resilient and sustainable livelihoods,” he added. To reinforce resilience, SOWESFACO also provides insurance coverage for natural calamities and other unforeseen events, protecting its farmers with a crucial safety net during times of crisis. A vision for wider impact With its foundation firmly established, SOWESFACO plans to expand its operations and reach a broader market, including potential international buyers. Continued financial and technical support from LANDBANK is expected to help the co-op scale up operations and make a more significant impact on the agricultural value chain. “Our dream is to go beyond Solana, to bring our rice, which we’ve worked so hard to produce, to other provinces and regions. We want people across the country to recognize the quality of our products and the story of our farmers,” said Barlaan. Together, SOWESFACO and LANDBANK represent a working model for inclusive, scalable, and sustainable agricultural development — one rooted in long-term partnerships, capacity-building, and trust. As LANDBANK continues to serve as a steadfast ally to the agricultural sector, stories like SOWESFACO’s underscore how targeted support can deliver both economic returns and lasting social impact, empowering farmers and rural communities across the country. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK, UTAC partner to support 8,000 farmers

LANDBANK President and CEO Lynette V. Ortiz (4th from left) and Unified Tiller Agriculture Cooperative (UTAC) CEO Artemio N. Guzman (5th from left) ink the collaboration through the LANDBANK AGRISENSO Plus Lending Program to empower over 8,000 farmers and ARB members of UTAC. Also present are Department of Agriculture (DA) Undersecretary Roger V. Navarro (leftmost), LANDBANK Executive Vice President Ma. Celeste A. Burgos (3rd from left), First Vice President Eden B. Japitana (2nd from left), UTAC Vice Chairman Earl P. Gorospe Jr. (6th from left), Treasurer Rizzean B. Jose (7th from left), Board Member Angelo S. Pineda (rightmost), and Agricultural Credit Policy Council (ACPC) Executive Director Ma. Cristina Lopez (8th from left). MANILA, Philippines — In a move to help boost rice production and cushion farmers from rising input costs, LANDBANK has partnered with the Unified Tiller Agriculture Cooperative (UTAC) under the Bank’s flagship AGRISENSO Plus Lending Program, further strengthening its support for rural livelihoods and the national food supply chain. The partnership aims to empower more than 8,000 farmers and Agrarian Reform Beneficiaries (ARBs) with access to affordable financing, technical support, and stable market channels for their produce. “We firmly believe that meaningful change begins with meaningful collaborations. LANDBANK remains fully committed to supporting UTAC and their partners through accessible financing, technical assistance, and dedicated loan servicing—ensuring that no farmer is left behind in our shared journey,” said LANDBANK President and CEO Lynette V. Ortiz. Under the collaboration, LANDBANK will provide the financing backbone and training support through its AGRISENSO Plus and ASCEND Programs. UTAC will provide the technology of Regenerative Farming protocols, supplies agricultural inputs, buy, process and sell agricultural outputs, extensive support and comprehensive assistance and increasing farmers’ profitability. The partnership signing on 14 April 2025 was led by LANDBANK President and CEO Ortiz and UTAC CEO Artemio N. Guzman, with LANDBANK Executive Vice President Ma. Celeste A. Burgos, First Vice President Eden B. Japitana, UTAC Vice Chairman Earl P. Gorospe Jr., and Treasurer Rizzean B. Jose as witnesses. “We appreciate LANDBANK's steadfast support, and we are dedicated to uplifting our farmers not only through financial services but also by nurturing long-term growth opportunities,” said UTAC CEO Guzman. UTAC becomes the sixth anchor partner under the AGRISENSO Plus Lending Program, joining SariSuki, TAO Foods, KITA Agritech, Syntegral Global Solutions, and Yovel East in advancing modernization of the agriculture sector across the country. As of March 2025, LANDBANK has released P877.98 million in loans under AGRISENSO Plus, benefitting nearly 4,700 borrowers nationwide. This partnership underscores LANDBANK’s mandate to advance Philippine agriculture by empowering smallholder farmers and supporting the entire agri value chain. Through targeted financing and strong partnerships, the Bank continues to drive inclusive growth and strengthen national food security. About LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide. About UTAC The Unified Tiller Agriculture Cooperative (UTAC) is a cooperative based in Cagayan, Isabela, dedicated to improving the lives of rice farmers. UTAC focuses on enhancing agricultural productivity, promoting sustainable farming practices, and providing its members with the resources and support they need to thrive.

LEARN MORE