LANDBANK, Pangasinan LGU sign P500-million loan to boost income of rice farmers

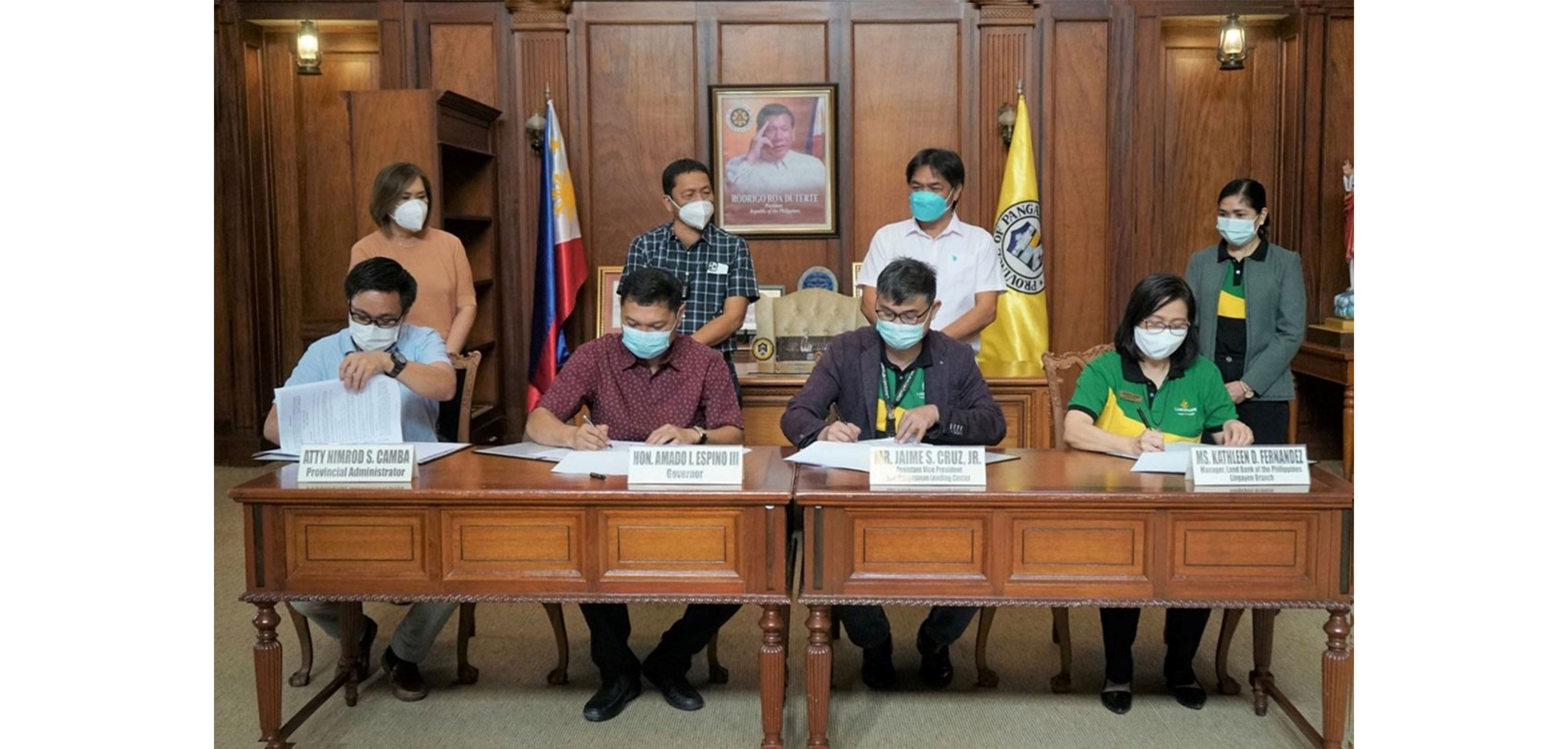

Pangasinan Governor Amado I. Espino III (2nd from left) and LANDBANK Pangasinan Lending Center Head, Assistant Vice President Jaime S. Cruz (3rd from left), sign a P500-million loan agreement on 24 September 2021 at the Provincial Capitol in Lingayen, Pangasinan to help boost the income of rice farmers in the province. They are joined by Provincial Administrator Atty. Nimrod S. Camba (leftmost) and LANDBANK Lingayen Branch Head, Assistant Vice President Kathleen D. Fernandez (rightmost).

LINGAYEN, Pangasinan – State-run Land Bank of the Philippines (LANDBANK) and the Provincial Government of Pangasinan have signed a P500-million loan to finance agricultural projects aimed at boosting the productivity and income of local rice farmers in the Province of Pangasinan.

Under the LANDBANK Palay at Mais ng Lalawigan Lending Program, P400 million of the total loan will be used by the Local Government Unit (LGU) to purchase palay produced by small farmers with less than two (2) hectares of land each.

Around 20,000,000 kilos of palay will be purchased by the Provincial LGU at higher prices than the prevailing market in the Province benefitting around 16,000 farmers in Pangasinan.

The Provincial Government shall process the milling of the purchased palay and sell them to 14 provincial government-owned hospitals, the Pangasinan Provincial Jail, as well as other LGUs as part of relief operations and other related social services. The rice may also be distributed to Bigasan ng Bayan centers owned by Overseas Filipino Workers (OFWs) to be sold to local communities.

The remaining P100 million will be used for the construction of a second Rice Processing Complex (RPC) in Pangasinan, together with the purchase of a rice mill, dryer, and industrial vehicles to transport agriculture products.

“LANDBANK continues to answer the call of small farmers for an assured market and reasonable prices for their produce. We stand together with our LGU partners towards helping farmers increase their productivity and income, especially during this ongoing pandemic,” said LANDBANK President and CEO Cecilia C. Borromeo.

Through the Palay at Mais ng Lalawigan Program, LANDBANK has approved loans amounting to P3.78 billion to eight (8) LGU-borrowers intended for palay procurement and acquisition of farm machineries and equipment (post-harvest facilities). Of this amount, P115 million has been availed by two (2) LGUs as working capital loan for palay procurement, benefitting more than 1,800 small farmers as of August 2021.

From January to August 2021, LANDBANK has extended a total of P21.27 billion in outstanding loans in support of agri- and aquaculture projects of LGUs nationwide.

LANDBANK remains committed to providing intensified support to the agriculture sector to fast-track its growth and recovery from the impact of the pandemic.