Be in the know of the latest news and updates about LANDBANK.

LANDBANK installs new ATM in Pamplona, Cagayan

Pamplona Vice Mayor Arnie Angelica S. Fernandez (4th from left) and Land Bank of the Philippines (LANDBANK) Northern Luzon Branches Group Head, Senior Vice President Ma. Belma T. Turla (5th from left) lead the inauguration of the LANDBANK offsite ATM located at the Municipal Hall of Pamplona, Cagayan on 12 December 2022. They are joined by members of the Sangguniang Bayan, local officials, and other LANDBANK officers. The new LANDBANK ATM will serve customers in all 18 barangays in the Municipality, which includes government employees, private citizens, and beneficiaries of Conditional and Unconditional Cash Transfer (CCT/UCT) Programs, among others, who will no longer need to wait in long queues or travel to neighboring towns for their cash requirements.

LEARN MORE

LANDBANK backs fisheries sector with P2.8-B credit

(clockwise from upper left) Bureau of Fisheries and Aquatic Resources (BFAR) Fisheries Planning and Economics Division Chief Maria Abegail A. Albaladejo and LANDBANK Corporate Affairs Group Head, Vice President Vivian M. Cañonero lead the fifth run of the LANDBANK AgriSenso Virtual Forum to discuss opportunities in boosting the local fisheries sector. Joining them are LANDBANK Program Management Department I Program Officer Edgardo C. De Guzman and client Joseph Anthony P. Lanzar. State-run Land Bank of the Philippines (LANDBANK) continues to intensify its support to the fisheries sector, with outstanding loans reaching P2.8 billion as of end-November 2022. In the fifth run of the LANDBANK AgriSenso Virtual Forum which recently gathered over 115 fishers and other stakeholders nationwide, LANDBANK shared available lending programs designed to boost the contribution of the fisheries sector in achieving food self-sufficiency in the country. LANDBANK Corporate Affairs Group Head, Vice President Vivian M. Cañonero, and Program Management Department I Program Officer Edgardo C. De Guzman led the discussions, as Department of Agriculture - Bureau of Fisheries and Aquatic Resources (DA-BFAR) Fisheries Planning and Economics Division Chief Maria Abegail A. Albaladejo presented the National Government’s development plan to further boost the local fisheries value chain, including ramping up activities to increase the country’s fish production. LANDBANK loan availer Joseph Anthony P. Lanzar from Davao del Sur also shared the successful expansion of his aquaculture business through LANDBANK’s support. The Bank is offering the Sustainable Aquaculture Lending Program (SALP) or “Pagsasakang Pantubig” to provide credit assistance to fishers’ associations, cooperatives or federations, non-government organizations (NGOs), micro, small and medium enterprises (MSMEs), large agribusiness enterprises, and countryside financial institutions (CFIs). Eligible projects under the program cover the whole value chain of fishery, mariculture, aquaculture and supporting economic activities, such as breeding, hatchery, nursery, production, grow out, fish culture, seaweed farming, processing, trading and other ancillary services. The LANDBANK SALP or “Pagsasakang Pantubig” is anchored on institutional buyers or processing and canning companies linked with fishers’ cooperatives associations or MSMEs as growers or suppliers. LANDBANK also provides credit assistance under the Commercial Fishing Vessel Financing Program to assist existing and prospective commercial fishing operators in acquiring fishing vessels for domestic or overseas use. The program caters to single proprietorships, partnerships, cooperatives and corporations, for the purchase or acquisition of brand-new, second-hand or refurbished commercial fishing boats and related equipment. The LANDBANK AgriSenso Virtual Forum forms part of the Bank’s overall support to the agriculture sector, facilitated by the LANDBANK Corporate Affairs Group (CAG) together with the National Development Lending Sector (NDLS) – Lending Program Management Group (LPMG).

LEARN MORE

LANDBANK finances first palm oil refinery in SOCCSKSARGEN

LANDBANK Senior Vice President Charlotte I. Conde (3rd from right) and Garcia Refinery Corporation (GARECO) President and CEO Erwin Anthony Y. Garcia (2nd from right) lead the signing of a loan agreement to finance the construction of the very first palm oil refinery mill in SOCCSKSARGEN, which is expected to be completed by the first quarter of 2024. They were joined by (from right to left) GARECO Secretary Marina Carmella L. Garcia, LANDBANK Sultan Kudarat Lending Center Head Assistant Vice President Harold P. Celestial and LANDBANK Tacurong Branch Head Department Manager Joel A. Argonza. TACURONG CITY, Sultan Kudarat – When the pandemic caused severe mobility restrictions nationwide, Erwin Y. Garcia sought to turn the crisis into an opportunity for the palm oil industry in the province of Sultan Kudarat. Garcia conducted research on the industry and saw potential in the 14,000 hectares of palm oil fully-planted within the province. He envisioned the benefits of an Integrated Palm Oil Processing Facility that will refine crude palm oil and produce a variety of products such as cooking oil, confectionaries, cream, margarine, and shortening. The available crops and the potential market soon convinced Garcia to expand his family’s business and establish the Garcia Refinery Corporation (GARECO) under the A.C. Garcia Group of Companies in 2021. With the goal of being the first modern homegrown refinery in Mindanao, GARECO availed of a P450 million loan from the Land Bank of the Philippines (LANDBANK) to make this a reality. The LANDBANK loan has bankrolled the construction of GARECO’s main facility, which will become the first palm oil refinery plant in the South Cotabato, Cotabato, Sultan Kudarat, Sarangani, and General Santos (SOCCSKSARGEN) region. The refinery mill is expected to make oil palm products more accessible and affordable for the local market, and serve as a stable source of income for oil palm growers from Sultan Kudarat and Maguindanao. More than being a private enterprise, GARECO aims to improve the socioeconomic status of oil palm growers in the area. GARECO and its parent company have thus partnered with 63 farmers to manage their combined 3,065 hectares of oil palm. “Our vision is to engage communities in palm oil production that will take them out of poverty and bring peace to the community, in the hopes of becoming a driving force for the Philippine economy,” said Garcia. Through the LANDBANK term loan, the construction of the GARECO refinery mill started in July 2022 and is expected to be completed by the first quarter of 2024. Its completion will likewise generate employment opportunities and expand the company’s workforce from five to about 35 to 50 workers composed of a mill manager, supervisors, operators, mechanics, electricians, laboratory analysts, and staff for administrative and marketing functions. “LANDBANK looks forward to the completion of the very-first refinery mill in SOCCSKSARGEN. We remain committed to serve the development requirements of the palm oil industry and the whole agriculture sector towards inclusive and sustainable countryside development,” said LANDBANK President and CEO Cecilia C. Borromeo. LANDBANK’s Term Loan Facility finances capital expenditures for businesses, including expansion, purchasing of additional machinery and equipment, and permanent working capital arising from expanded operations. Interested borrowers can be a single proprietor, partners, or corporation which have projects on agri-business, manufacturing, trading, and other services.

LEARN MORE

LANDBANK to fund P2.6-B hydropower plant in Bukidnon

LANDBANK President and CEO Cecilia C. Borromeo (5th from right) and Pure Energy Holdings Corp. and Cabanglasan Hydropower Corp. (CHC) Chairman Dexter Y. Tiu (4th from right) sign a P2.6-billion loan agreement to partially finance a 15-megawatt hydropower plant in Valencia City, Bukidnon, under the LANDBANK Renewable Energy Program. They are joined by (from R-L) CHC Chief Finance Officer Atty. Rolando Domingo, CHC President Johnson A. Sanhi, Jr., Repower Energy Development Corporation (REDC) President and CHC Director Eric Peter Y. Roxas, and from LANDBANK, Senior Vice Presidents Celeste A. Burgos and Lucila E. Tesorero, and Vice President Emma M. Brosas. The Land Bank of the Philippines (LANDBANK) and Cabanglasan Hydropower Corporation (CHC), a wholly-owned subsidiary of Repower Energy Development Corporation (REDC), have signed a P2.6-billion loan agreement to partially finance the construction of a 15-megawatt hydropower plant in the Province of Bukidnon, that will help advance the country’s climate change mitigation and adaptation efforts. Under the LANDBANK Renewable Energy Program, the run-of-river hydropower plant will be developed on the Pulangi River in Barangay Lumbayao, Valencia City, to sustainably improve the quality and reliability of energy supply in nearby cities and towns in the Province. The loan signing was led by LANDBANK President and CEO Cecilia C. Borromeo and Pure Energy Holdings Corporation and CHC Chairman Dexter Y. Tiu on 6 December 2022 at the LANDBANK Plaza in Manila. They were joined by REDC President and CHC Director Eric Peter Y. Roxas, CHC President Johnson A. Sanhi, Jr., and from LANDBANK, Senior Vice Presidents Celeste A. Burgos and Lucila E. Tesorero, among other Bank officers. “Through the years, LANDBANK has collaborated with REDC and its subsidiaries towards advancing clean, sustainable, and reliable sources of renewable energy. We actively support local projects that aim to secure a safe and sustainable future for the country, as part of our broader commitment to help build sustainable and resilient communities,” said President Borromeo. Upon its completion in 2025, the hydropower plant is estimated to power around 130,000 households in 15 municipalities in the Province. The stable energy supply is likewise expected to benefit Bukidnon’s local economy, particularly its tourism, agriculture and industrial sectors. “In just six short years of development, our group has brought 10 renewable energy power plants to operations – of which six are run-of-river hydropower, contributing around 50MW of clean energy to the grid. We have several hydropower projects under construction and in the pipeline, which we intend to bring to operations in the near future to help the country transition into a clean renewable, energy phase,” said REDC President Roxas. “We would like to extend our deepest gratitude to the financial institutions who stood by us and provided project finance like LANDBANK, led by President Cecilia Borromeo, for their trust and confidence in the Pure Energy-REDC Group time and again,” Roxas added. LANDBANK is at the forefront of promoting environmental sustainability in the country by supporting initiatives aimed at protecting the environment. As of end-October this year, the Bank has approved a total of P20.1 Billion in loans to 56 borrowers under the LANDBANK Renewable Energy Program, in support of local projects that harness solar, hydro, and biomass energy sources.

LEARN MORE

LANDBANK, DBM team-up for online release of cash allocation notices

Budget Secretary Amenah F. Pangandaman (2nd from left) and LANDBANK First Vice President Reynaldo C. Capa (rightmost), together with representatives from other partner banks, lead the signing of the Memorandum of Agreement for the Online Release of Notice of Cash Allocation (NCA) on 07 December 2022 at the DBM Head Office in Manila. The Department of Budget and Management (DBM) and the Land Bank of the Philippines (LANDBANK) have joined hands for the online release of Notice of Cash Allocation (NCA) to expedite the crediting of funds to government agencies. Budget Secretary Amenah F. Pangandaman and LANDBANK Banking Services Group First Vice President Reynaldo C. Capa signed the Memorandum of Agreement for the Online Release of NCA in the Action Document Releasing System (ADRS) on 07 December 2022 at the DBM Head Office in Manila to formalize the partnership. They were joined by Deputy Treasurer Eduardo Anthony G. Mariño III, Anti-Red Tape Authority Officer-in-Charge Ernesto V. Perez, and representatives from other partner banks. Under the agreement, the DBM and LANDBANK will be working together to institutionalize the release of NCAs in digital format. This will eliminate the unnecessary steps of printing, signing, routing and releasing of printed documents, thus making the funds available for the programs, activities, and projects of agencies in the most immediate time. “LANDBANK is committed to play our role in ensuring a more streamlined and efficient process in releasing NCAs. We will continue to find avenues for collaboration to promote the immediate delivery of efficient and meaningful public service,” said LANDBANK President and CEO Cecilia C. Borromeo. The digital release of NCAs is in line with the implementation of Republic Act No. 8792 or the Electronic Commerce Act of 2000, and Republic Act No. 11032 or the Ease of Doing Business and Efficient Government Service Delivery Act of 2018. LANDBANK has been doing its share in establishing a digital payment ecosystem, as part of promoting the Ease of Doing Business and efficient government service delivery. From January to October 2022, LANDBANK’s major digital banking platforms have facilitated a total of 123.3 million transactions amounting to P4.8 trillion, for 14% and 156% year-on-year growths in volume and value, respectively.

LEARN MORE

Seaman-turned-farmer reaps success with help from LANDBANK

Allan Ayco was one of the first availers of the LANDBANK Sikat Saka Program from Dumingag in 2013, and among the combined 655 rice farmers in Zamboanga del Sur and Zamboanga Sibugay who enjoy a low 2% per annum loan interest rate under the ACEF Lending Program. DUMINGAG, Zamboanga del Sur – Unhappy and longing for his family while working away at sea, Allan A. Ayco decided to disembark from the boat and his former life as a seafarer, returning to his home in Dumingag to make a living cultivating his farmland. But like the other small farmers in town in need of capital, Ayco was forced to deal with informal lenders who charged high interest rates from 10% to up to 20% per month. He felt helpless against the unfair interest rates brought about by the monopoly of the post-production market by informal lenders. But things started to look up for Ayco and other farmers in Dumingag when LANDBANK conducted site visits in the province and offered low-interest loans for production requirements under then newly-launched LANDBANK Sikat Saka Program. “Malaking tulong talaga ang pagpasok ng LANDBANK sa buhay ko. Tuwang-tuwa kami sa Sikat Saka Program. Hindi lang sa mababa ang interes, madali lang din ang proseso ng pag-apply,” said Ayco. Ayco was one of the first farmers in the area to avail of a loan under the Sikat Saka Program. Through the assistance of LANDBANK, Ayco enjoyed low interest of 0.75% to 1.25% per month under the Program from 2013 to 2019. Since joining the formal credit system, Ayco said his income increased with every cropping cycle, allowing him to provide a better life for his family. He was able to save enough income to hire other farmers for planting services, as well as procure tractors and harvesting services that he rented out to other farmers in the area. “Malaking tulong sa amin ang Sikat Saka Program. Kaya nga’t kusang loob akong nanghingkayat rin ng mga katulad kong magsasaka. Sinabi ko na maganda ito. Basta dapat aalagaan mo yung utang mo. Dapat maayos yung pagbayad mo para di siya mawala,” Ayco shared. Aside from accessible financial support, Ayco and the other farmers in the area were also provided with support services and capacity building trainings by LANDBANK and its partner agencies. However, the onset of the pandemic in 2020 closed the borders around the Zamboanga Peninsula and significantly affected their livelihood, which prevented them from renewing their credit line with LANDBANK for the next cropping season. Ayco shared that it was a difficult season. So he was grateful when the health restrictions were finally eased and the LANDBANK Zamboanga del Sur Lending Center reached out to him and other farmers and to introduce the Agricultural Competitiveness Enhancement Fund (ACEF) Lending Program. As a long-time client of the Bank, Ayco was granted financing anew with low interest rates under the ACEF Lending Program to fund his rice production. “Malaki talaga ang pasasalamat namin sa LANDBANK dahil sa naitulong nila sa aming mga magsasaka. Sana magpatuloy pa rin ang pagtulong ninyo sa amin,” Ayco said. The ACEF is a direct lending program administered by LANDBANK in partnership with the Department of Agriculture (DA), which aims to increase the productivity and income of farmers and fishers, their cooperatives and associations, as well as micro and small enterprises (MSEs). The ACEF Lending Program finances farming needs such as the acquisition and establishment of production, post-harvest and processing machineries, equipment and facilities, farm inputs, and improvements. As of 31 October 2022, LANDBANK has released under the ACEF lending program a total of P8.5 billion to support over 32,200 borrowers nationwide. Interested borrowers may contact the nearest open LANDBANK Lending Center or Branch nationwide or call LANDBANK’s customer service at (02) 8-405-7000 or at PLDT Domestic Toll Free 1-800-10-405-7000.

LEARN MORE

LANDBANK recognized for supporting BSP programs in Mindanao

Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla (4th from right) presents a citation to Land Bank of the Philippines (LANDBANK) represented by Assistant Vice Presidents Jose Dela Cruz (2nd from right) and Eunice Sumatra (3rd from right) during the 2022 Outstanding BSP Stakeholders Appreciation Ceremony for Mindanao on 23 November 2022 at the Dusit Thani Hotel in Davao City. The Cash Operations Units of the LANDBANK Branches in Davao City-Recto, Cotabato City and Ozamis City were recognized for supporting the programs and advocacies of the BSP covering the three pillars of central banking, which are price stability, financial stability, and efficient payments and settlements system. Joining them are BSP Monetary Board Member Anita Linda Aquino (leftmost) and BSP Deputy Governor Bernadette Puyat (rightmost).

LEARN MORE

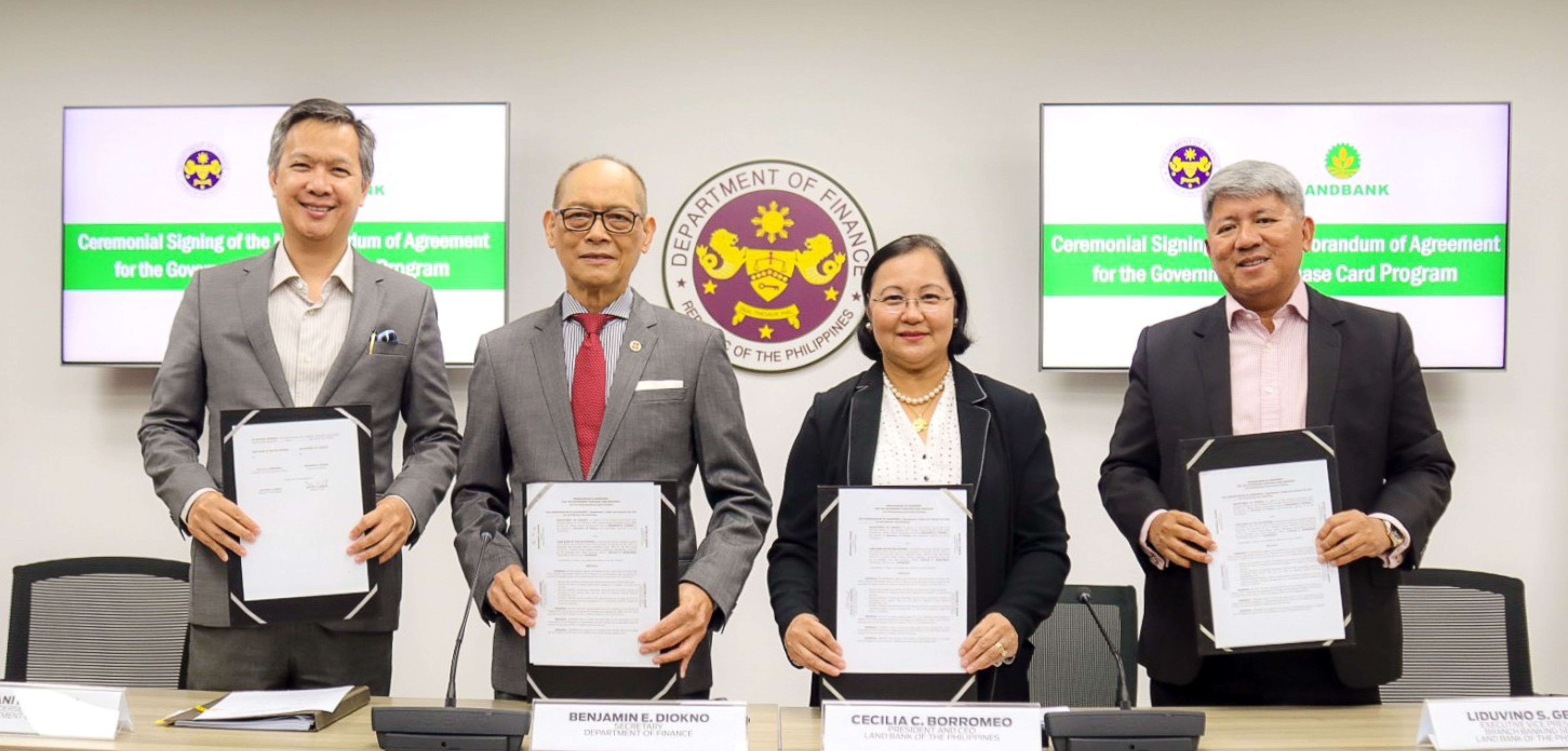

DOF, LANDBANK ink pact for efficient government purchases

Finance Secretary Benjamin E. Diokno (2nd from left) and LANDBANK President and CEO Cecilia C. Borromeo (3rd from left), together with Finance Undersecretary Bayani H. Agabin (leftmost) and LANDBANK Executive Vice President Liduvino S. Geron (rightmost), lead the signing of a Memorandum of Agreement for the Government Purchase Card (GPC) Program on 06 December 2022 at the DOF Building, Manila. The Department of Finance (DOF) and the Land Bank of the Philippines (LANDBANK) have signed a Memorandum of Agreement (MOA) for the Government Purchase Card (GPC) Program that will facilitate a more streamlined and efficient payment method for the procurement of goods and services. Under the agreement, authorized DOF employees will be provided with a LANDBANK Government Purchase Card to pay for eligible purchases, including travel and representation expenses; miscellaneous small-value purchases; hotel and lodging; computer software, services, and digital context; and fuel, automotive parts, and services, among others. Finance Secretary Benjamin E. Diokno and LANDBANK President and CEO Cecilia C. Borromeo led the ceremonial signing on 06 December 2022 at the DOF Building in Manila. They were joined by Finance Undersecretary Bayani H. Agabin and LANDBANK Executive Vice President Liduvino S. Geron. “The Government Purchase Card or GPC Program of LANDBANK will serve as an important tool that will eliminate procurement lead time, reduce procurement workload, facilitate quicker payments, and reduce administrative costs and time wasted in the liquidation process,” said Secretary Diokno. For her part, LANDBANK President and CEO Borromeo said the GPC Program will further support DOF in improving operational efficiency and promoting transparency in the disbursement of public funds. “We will continue to explore ways and meaningful initiatives in accelerating the country’s digital transformation journey for improved governance,” she added. The GPC Program is a joint initiative of the Bureau of the Treasury (BTr), Department of Budget and Management (DBM), and LANDBANK which aims to promote a convenient, transparent and efficient payment process to further drive public digital financial management. The program helps reduce cash handling by limiting the frequency and amount of cash advances, and shorten the liquidation period of obligations to suppliers of goods and services. It also enables government agencies to develop a database of financial information derived from the transaction records of purchasing card activities that can be used to improve overall financial management. The DOF is the second agency to implement the GPC program, following its successful pilot implementation with the BTr and approval by the Bangko Sentral ng Pilipinas (BSP) for full implementation.

LEARN MORE

LANDBANK, DICT sign MOU to bolster ICT dev’t

DICT Secretary Ivan John E. Uy (4th from right) and LANDBANK President and CEO Cecilia C. Borromeo (2nd from right) sign the Inter-Government Agency Memorandum of Understanding (MOU) for E-Governance on 2 December 2022 at the Marriot Hotel in Pasay City, Manila, together with (from L-R) MinDa Chairperson Maria Belen S. Acosta, GSIS President and General Manager Jose Arnulfo Veloso, DTI Usec. Herminio C. Bagro III, DILG Usec. Lord A. Villanueva, and SSS President Michael Regino. The Land Bank of the Philippines (LANDBANK) and the Department of Information and Communications Technology (DICT) have partnered to synergize initiatives in ensuring the interoperability of the applications and systems of both institutions. DICT Secretary Ivan John E. Uy and LANDBANK President and CEO Cecilia C. Borromeo formalized the collaboration with a Memorandum of Understanding (MOU) signed during the Inter-Government Agency MOU Ceremonial Signing for E-Governance event on 2 December 2022 at the Marriot Hotel in Pasay City, Manila. Under the MOU, LANDBANK and DICT will harmonize, coordinate, and integrate their Information and Communications Technology (ICT) efforts, which include resource sharing, database building and agency networking linkages. “Our Memorandum of Understanding with the DICT represents another significant step in LANDBANK’s digital transformation journey, leveraging on innovative partnerships and investing in digital solutions to deliver secure financial services and products to our customers,” said President Borromeo. From January to October 2022, LANDBANK’s major digital banking platforms have facilitated a total of 123.3 million transactions amounting to P4.8 trillion, translating to 14% and 156% year-on-year growths in volume and value, respectively. The LANDBANK Mobile Banking App (MBA) for retail customers recorded 97 million transactions amounting to P171.3 billion for 18% and 28% growth rates, respectively. The Bank’s corporate internet banking platform, the LANDBANK weAccess, facilitated 14.2 million transactions worth P3 trillion, representing an unprecedented 664% jump in value from the same period last year. The LANDBANK Electronic Modified Disbursement System (eMDS) for national government partners logged 1.9 million transactions with total value of P1.6 trillion, translating to increases of 17% and 20% in transactions and value, respectively. Meanwhile, the LANDBANK iAccess continued to post a 16% growth in transaction value amounting to P14.3 billion from 4.3 million transactions. The Bank’s web-based payment facility, the LANDBANK Link.BizPortal, likewise continued to record a 50% rise in transaction volume with 4.9 million transactions worth P9.8 billion. Lastly, the LANDBANK Bulk Crediting System (LBCS) facilitated transactions worth P18.9 billion for a significant 608% leap compared to the same period last year.

LEARN MORE

LANDBANK, South Cotabato co-op join hands anew to boost pineapple production

LANDBANK Senior Vice President Charlotte I. Conde (2nd from left) and Laconon 100 Multi-Purpose Cooperative (LMPC) Chairperson Rhoda O. Pecadizo (3rd from left) lead the signing of a P212.8-million loan agreement in Surallah, South Cotabato, on 25 November 2022 to finance the co-op’s pineapple production and other agri projects. Joining them from Dole Philippines, Inc. (Dolefil) are Vice President Reynaldo C. Doria (4th from left) and Finance and Supply Chain Director Jesusa Natividad-Rojas (rightmost) for the renewal of another pineapple growership tie-up agreement. SURALLAH, South Cotabato – The Land Bank of the Philippines (LANDBANK) and the Laconon 100 Multi-Purpose Cooperative (LMPC) have signed a P212.8-million loan to finance the co-op’s pineapple production and agricultural modernization efforts, to help sustain the growth of the local pineapple industry in the province. The financial support is expected to boost the production of pineapple farms managed by LMPC, with a combined area of over 1,400 hectares in the Municipalities of T’boli, Surallah, Lake Sebu and Banga. “LANDBANK remains committed to empowering agricultural cooperatives nationwide via accessible financing. Through co-ops like LMPC, we are able to extend a wide range of services and opportunities to farmers and fishers, while contributing to advance local food security,” said LANDBANK President and CEO Cecilia C. Borromeo. Of the total LANDBANK loan, LMPC will utilize P200 million as working capital to support the production requirements of its 445 pineapple farmer-members, including the purchase of farm inputs, while P7.8 million will finance the purchase of two (2) farm tractors and one (1) monitoring vehicle. The vehicles will be used for land preparation and field monitoring to effectively respond to urgent farm needs. The remaining P5-million will be allocated for LMPC’s cassava and corn trading activities. LMPC dealt with financial difficulties due to the unexpected closure of its anchor firm and primary pineapple produce buyer in 2003, but was able to recover with LANDBANK’s credit assistance in 2017. “Sa lahat ng pagsubok na dumating sa LMPC, hindi kami iniwan ng LANDBANK. Kami ay muling nakabangon mula sa pagkalugmok at ngayon ay mayroon na kaming mahigit sa P200 million na loan line para patuloy na maserbisyuhan ang aming mga miyembro at makapagbigay ng hanapbuhay sa komunidad,” said LMPC Chairperson Rhoda O. Pecadizo. LMPC was able to post steady growth in net income and grow its membership with LANDBANK’s timely assistance. The co-op likewise successfully paid 100% of its previously restructured loan with the Bank in 2021 amounting to P32.5 million. During the loan signing event, LANDBANK, LMPC and Dole Philippines, Inc. (Dolefil) also renewed their pineapple growership tie-up covered by a Tripartite Memorandum of Agreement, which was initially implemented in 2017. Under the agreement, LANDBANK will provide credit assistance and other loan support services to LMPC, with Dolefil serving as the exclusive market of the co-op’s pineapple produce while extending technical assistance throughout the whole production cycle.

LEARN MORE

SEC, LANDBANK enhance processing of applications, payments

(L-R) LANDBANK Senior Vice President Ramon R. Monteloyola, Securities and Exchange Commission (SEC) Commissioner McJill Bryant T. Fernandez and Director Dondie Q. Esguerra, lead the ceremonial signing of the amended Memorandum of Agreement (MOA) for the LANDBANK Online Collection (OnColl) facility on 28 November 2022 at the SEC Headquarters in Makati City. The Land Bank of the Philippines (LANDBANK) and the Securities and Exchange Commission (SEC) have strengthened their partnership for the efficient processing of registration applications and payments. Under the amended Memorandum of Agreement (MOA), LANDBANK and SEC have updated their processes for the acceptance of payments of all SEC fees and transactions covered by a Payment Assessment Form (PAF) through the LANDBANK Online Collection (OnColl) facility. The LANDBANK OnColl facility facilitates around 2,000 transactions per month for the SEC, which covers applications for company registrations, and the verification and reservation of corporate names, among others. New SEC Accounts shall also be enrolled in the LANDBANK weAccess, for the convenient online viewing and downloading of Online Collection Reports by the SEC. SEC Commissioner McJill Bryant T. Fernandez, Financial Management Department Director Dondie Q. Esguerra, and LANDBANK South NCR Branches Group Head, Senior Vice President Ramon R. Monteloyola, signed the amended MOA on 28 November 2022 at the SEC Headquarters in Makati City. “LANDBANK fully supports the digitalization journey of the SEC to respond to the evolving needs of its customers. Our renewed partnership furthers the ease of doing business with the Commission through the delivery of convenient services,” said LANDBANK President and CEO Cecilia C. Borromeo. For his part, SEC Commissioner Fernandez said that the LANDBANK OnColl will help in the Commission’s efforts to transition from over-the-counter transactions to online payments. “[This] will provide real-time and accurate reporting and monitoring made through online collections that will further strengthen our mandate towards transparency, accountability and good governance,” said Commissioner Fernandez. Payments to SEC applications can be made in 609 LANDBANK branches nationwide as of 31 October 2022. LANDBANK and SEC are likewise working towards upgrading current processes, from using the OnColl facility into the Link.BizPortal—LANDBANK’s web-based payment channel—to better serve the growing demand for safe and contactless online payment options.

LEARN MORE

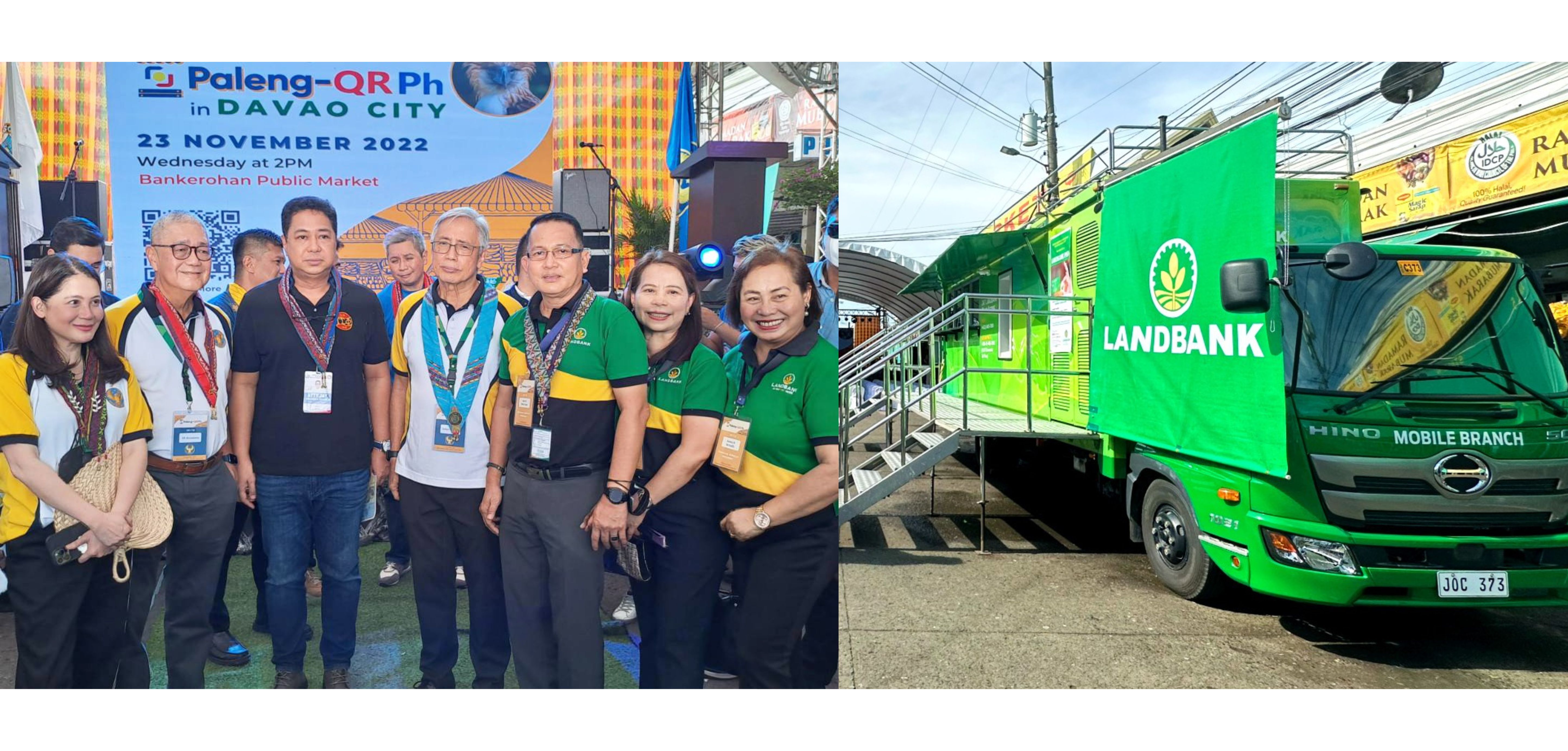

LANDBANK drives cashless payments in Davao City’s biggest public market

(left photo) Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla (4th from left), Monetary Board Member Eli M. Remolona (2nd from left), Deputy Governor Bernadette Romulo-Puyat (leftmost), and Davao City Vice Mayor Jay Melchor B. Quitain, Jr. (3rd from left) are joined by LANDBANK officers during the launch of the Paleng-QR Ph at the Bankerohan Public Market in Davao City on 23 November 2022. (right photo) A LANDBANK Mobile Branch is deployed during the launch event to facilitate on site LANDBANK account opening among market vendors, shop owners and market goers. DAVAO CITY – The Land Bank of the Philippines (LANDBANK) is stepping-up to accelerate the adoption of cashless transactions in this City’s biggest public market, in support of the Central Bank's thrust of transforming the country into a cash-lite economy. LANDBANK joined the Bangko Sentral ng Pilipinas (BSP), the Department of Interior and Local Government (DILG), and the City Government of Davao during the launch of the Paleng-QR Ph program at the Bankerohan Public Market last 23 November, to provide local stakeholders with their own bank accounts. The LANDBANK Mobile Branch was deployed to facilitate on-the-spot account opening among market vendors and shop owners, as well as market goers. New LANDBANK account holders were automatically enrolled in the LANDBANK Mobile Banking App (MBA), which can facilitate the transfer and receipt of funds via Quick Response (QR) code. “LANDBANK fully supports the Paleng-QR Ph program in encouraging local communities to adopt cashless payments. We are bringing digital payments closer to consumers to make everyday transactions faster, safer and more convenient, where development is truly inclusive,” said LANDBANK President and CEO Cecilia C. Borromeo. The Overseas Filipino Bank (OFBank), the official digital bank of the Philippine government and a subsidiary of LANDBANK, also participated in the event and offered its deposit products to Davaoeños. The launch of Paleng-QR Ph in Davao City was spearheaded by BSP Governor Felipe M. Medalla and Mayor Sebastian Z. Duterte. They were joined by BSP Monetary Board Members Antonio S. Abacan, Jr., V. Bruce J. Tolentino, Anita Linda R. Aquino and Eli M. Remolona, and Deputy Governors Eduardo G. Bobier and Bernadette Romulo-Puyat, DILG XI Assistant Regional Director Abdullah Matalam, and Vice Mayor Jay Melchor B. Quitain, Jr. Jointly developed by the BSP and DILG, the Paleng-QR Ph program aims to build the digital payments ecosystem in the country by promoting cashless payments in public markets and local transportation, particularly tricycles. LANDBANK has been supporting the BSP’s digitalization thrust by providing its customers with innovative digital banking platforms. Most recently, the Bank launched the LANDBANKPay, an all-in-one mobile wallet that allows users to conveniently pay bills, load up mobile phones and tollway RFID accounts, make online purchases, as well as transfer funds anytime, anywhere. Since the pandemic started, LANDBANK has also recorded a consistent increase in customer demand for digital financial transactions. In the first three quarters of the year alone, the Bank facilitated a total of 111.3 million transactions amounting to P4.6 trillion across its major digital platforms, for 15% and 169% year-on-year growths in volume and value, respectively. The LANDBANK MBA topped the list in terms of transaction volume facilitated, after recording 87.6 million transactions worth P154.3 billion.

LEARN MORE