Be in the know of the latest news and updates about LANDBANK.

Pag-IBIG honors LANDBANK as top government employer

Land Bank of the Philippines (LANDBANK) was recently honored as Top Government Employer under the National Government category during the Home Development Mutual Fund Stakeholder Accomplishment Report (Pag-IBIG StAR) in the National Capital Region, for having the most number of employees who voluntarily raised their contributions in 2024. LANDBANK Executive Vice President Alan V. Bornas (3rd from right) accepted the citation from Pag-IBIG CEO Marilene C. Acosta (center), alongside Deputy Chief Executive Officer Benjamin R. Felix Jr. (3rd from left), Senior Vice President Atty. Marie Antoniette D. Diaz (2nd from right), and Vice Presidents Perlacita A. Roldan (rightmost), Florencio Pedro O. Galang Jr. (leftmost), and Atty. Marciano C. Pimentel Jr. (2nd from left). (photo courtesy of Pag-IBIG Fund)

LEARN MORE

LANDBANK offers enhanced loans, cash support for emergencies

To address urgent financial needs during emergencies, Land Bank of the Philippines (LANDBANK) has expanded its available loan packages for businesses and individuals affected by calamities and natural disasters to help facilitate and fast-track rebuilding efforts. Under the enhanced LANDBANK CARES+ (Community Assistance and REintegration Support Plus) Lending Program, affected farmers and fishers, cooperatives, micro, small and medium enterprises (MSMEs), corporations, and electric distribution utilities may access loans to finance their recovery and restore regular business operations. Eligible borrowers may use the funds for working capital, capital expenditures, and the construction, repair or acquisition of disaster-damaged equipment, facilities and structures. Electric distribution utilities can also use the loan as short-term working capital for the incremental increase in generation and distribution expenses. “We want to boost the ability of our clients and partners to recover quickly from calamities and disasters. We have expanded our accessible financial support interventions to help build resilience and expedite response and rehabilitation efforts,” said LANDBANK President and CEO Lynette V. Ortiz. For employees of government agencies and companies with LANDBANK payrolls, the state-run Bank is also offering Electronic Salary Loan (eSL) that provides convenient and quick access to funds. Eligible borrowers can apply for the eSL online via the LANDBANK website, iAccess, or Mobile Banking App (MBA), with loan proceeds directly credited to their accounts. Existing eSL borrowers who have maintained good payment standing for at least three months can also quickly renew their loans. The Bank will also soon introduce its new “EasyCash for Emergencies” feature for LANDBANK credit cardholders, which allows clients to convert their available credit limits into emergency cash with flexible repayment options of up to 36 months. Eligible cardholders will receive an SMS and email from LANDBANK confirming their eligibility for the credit limit conversion, and the funds will be credited to their LANDBANK deposit account. Customers may also call the Bank’s Customer Care to request for the cash conversion. ABOUT LANDBANK LANDBANK is the largest development financial institution in the Philippines promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the country, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK recognized as outstanding BSP partner

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. (leftmost) and Deputy Governor Bernadette Romulo-Puyat (rightmost) present a plaque of recognition and a special token to Land Bank of the Philippines (LANDBANK) President and CEO Lynette V. Ortiz (center), along with Executive Vice Presidents Liduvino S. Geron (2nd from right) and Leila C. Martin (4th from right), during the 2024 Outstanding BSP Stakeholders Appreciation Ceremony on 02 August 2024 at the BSP Head Office in Manila. LANDBANK was recognized for its strong support in the circulation and usage of the 1000-Piso polymer banknotes. The state-run Bank was also lauded for its vital role as the distribution arm of the National Government’s social welfare programs, ensuring the timely, safe, and efficient disbursement of cash aid to Pantawid Pamilyang Pilipino Program (4Ps) beneficiaries. ABOUT LANDBANK LANDBANK is the largest development financial institution in the Philippines promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the country, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LLFC-ULFC merger to boost financing for enterprise expansion

Land Bank of the Philippines (LANDBANK) welcomed the recent issuance of Executive Order No. 65, which authorizes the merger of the LANDBANK Leasing and Finance Corporation (LLFC) and UCPB Leasing and Finance Corporation (ULFC). President Ferdinand R. Marcos Jr. signed EO 65 on 6 August 2024, which effectively merges the two leasing and finance corporations, with LLFC as the surviving entity. Both LLFC and ULFC are subsidiaries of LANDBANK, with the latter becoming a subsidiary upon the merger of LANDBANK and the United Coconut Planters Bank (UCPB) in 2022. “Given the similar product and service offerings, this synergy will enhance LANDBANK’s leasing and financing market power and reach. The move is also consistent with the national government’s streamlining to address duplication of functions, and organizational right-sizing to reduce the demand on government resources such as personnel and infrastructure, among others,” said LANDBANK President and CEO Lynette V. Ortiz. The merger positions LLFC to better support the national government’s development agenda, with its strengthened capital base and improved operational capacity. The state-run Bank also assured the clients of LLFC and ULFC that the merger will be smooth and orderly—with customer servicing unhampered—and conducted with the welfare of all stakeholders in mind. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK leads P110-B syndicated loan to fuel the local power sector

PSALM President and CEO Dennis Edward A. Dela Serna (2nd from right), LANDBANK President and CEO Lynette V. Ortiz (rightmost), and DBP President and CEO Michael O. de Jesus (3rd from right) lead the ceremonial signing for the P110-billion syndicated loan for PSALM on 30 July 2024 in Quezon City, witnessed by Assistant Government Corporate Counsel Judge Basilia Serrano-Angeles (leftmost). Land Bank of the Philippines (LANDBANK) has extended the majority of the P110-billion syndicated loan facility to state-owned Power Sector Assets and Liabilities Management (PSALM) Corporation in support of strengthening and enhancing the competitiveness of the country’s local power industry. LANDBANK committed to financing P60 billion of the total facility amount. The proceeds will be used by PSALM to augment its working capital requirements, refinance existing liabilities, and settle domestic contractual obligations. “LANDBANK has a long-standing history of supporting the National Government’s electrification initiatives, with our loan portfolio encompassing a wide range of energy-related projects. We will continue to support PSALM in addressing the energy needs of the country today and in the future,” said LANDBANK President and CEO Lynette V. Ortiz. PSALM President and CEO Dennis Edward A. Dela Serna, together with LANDBANK President and CEO Ortiz and Development Bank of the Philippines (DBP) President and CEO Michael O. de Jesus, led the ceremonial signing for the Php 110.0 billion syndicated term loan facility agreement on 30 July 2024 in Quezon City. Assistant Government Corporate Counsel Judge Basilia Serrano-Angeles witnessed the event. “We express our heartfelt gratitude to LANDBANK, DBP and OGCC for their continued support in attaining PSALM’s financial objectives. PSALM’s liability management program has presented significant challenges as we strive to fulfill our mandate of liquidating the financial obligations we have assumed. This syndicated loan provides additional financial support to PSALM, ensuring our continued progress and assist our asset management and privatization strategies,” said PSALM President and CEO Dela Serna. “With this loan, we are projecting a net reduction of PHP12.9 billion in our financial obligations for CY 2024,” he added. LANDBANK and DBP acted as the Joint Lead Arrangers for the syndicated deal, with the DBP - Trust Banking Group as the Facility and Paying Agent, and the Office of the Government Corporate Counsel (OGCC) as the Transaction Counsel. PSALM is a wholly-owned and controlled government entity mandated under the Electric Power Industry Reform Act (EPIRA) to take over the ownership of all existing generation assets of the National Power Corporation (NPC), independent power producer (IPP) contracts, real estate, and all other disposable assets, including the transmission business of the National Transmission Corporation (TransCo). The agency also manages the orderly sale and privatization of these assets with the objective of liquidating all of NPC's financial obligations in an optimal manner. LANDBANK has been a steadfast partner of PSALM since 2008, providing essential financing in support of its mandate under the EPIRA law. The Bank also continues to service the development requirements of the energy sector, including other industry players such as large oil companies, power producers, and distribution utilities. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

Celebrating 61 years of serving the nation: LANDBANK honors outstanding partners in countryside, national development

Finance Secretary and LANDBANK Chairman Ralph G. Recto (2nd from left), Bangko Sentral ng Pilipinas Governor Eli M. Remolona, Jr. (leftmost), and LANDBANK President and CEO Lynette V. Ortiz (center) confer the Ulirang Magsasaka Award to Deodany L. Cara (3rd from left) with his wife, Ma. Cecilia Cara (4th from left) during the LANDBANK 2024 MERIT Awards on 8 August 2024 in Malate, Manila. Joining them are LANDBANK Directors Virginia N. Orogo (6th from left) and Nancy D. Irlanda (7th from left), together with Executive Vice President Ma. Celeste A. Burgos (8th from left) and Vice President Rolando G. Santos. (rightmost). Land Bank of the Philippines (LANDBANK) celebrated its 61st anniversary by recognizing its exceptional development partners in the delivery of essential financial and support services in local communities nationwide. During an appreciation event held on 08 August 2024 at LANDBANK Plaza in Manila, the Bank honored outstanding clients and partners across various sectors through the Models of Excellence Recognition Initiative for Top Bank Clients (MERIT) Awards. “The success stories of our awardees mirror the potential of our nation. It illustrates how far we can progress when we commit to being each other’s steadfast partners in development,” said Finance Secretary and LANDBANK Chairman Ralph G. Recto in addressing the MERIT awardees. “Your work and contributions send a powerful message—that we can put an end to poverty not by looking out only for ourselves, but by working hand in hand together,” he added. (Left) Finance Secretary and LANDBANK Chairman Ralph G. Recto congratulates the MERIT awardees for their achievements and contributions to building a more resilient, inclusive, and sustainable economy. (Right) LANDBANK President and CEO Lynette V. Ortiz expresses her gratitude to clients and partners for their continued trust and support for the Bank. The LANDBANK MERIT Awards recognized the Bank’s high-performing clients who have become models of operational excellence, which include cooperatives, micro, small and medium enterprises (MSMEs), corporations and large enterprises, countryside financial institutions (CFIs), microfinance institutions (MFIs), and individual farmers. LANDBANK President and CEO Lynette V. Ortiz expressed appreciation to the MERIT awardees for their contributions to advancing agriculture, entrepreneurship, and financial inclusion, and reaffirmed the Bank’s commitment to helping them achieve their full potential. "When our clients thrive, we thrive. Every achievement represents our shared success; each milestone is a reflection of the strength of our partnership. That’s why it is only fitting that we pay tribute to you—our dear clients and partners—for your steadfast support and invaluable contributions on this meaningful journey," said LANDBANK President and CEO Ortiz. Finance Secretary Recto and LANDBANK President and CEO Ortiz were joined by Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr., LANDBANK Directors Virginia N. Orogo, Nancy D. Irlanda, and David D. Erro, and LANDBANK Executive Vice President Ma. Celeste A. Burgos and Vice President Rolando G. Santos in presenting the awards to 14 MERIT awardees. Department of Finance (DOF) Undersecretary Maria Luwalhati C. Dorotan-Tiuseco, Department of Agriculture (DA) Undersecretary Atty. Asis G. Perez, Department of Labor and Employment (DOLE) Assistant Secretary Lennard Constantine C. Serrano, Cooperative Development Authority (CDA) Assistant Secretary Santiago S. Lim, Securities and Exchange Commission (SEC) Assistant Director Daisy B. Pabuaya, and Philippine Guarantee Corporation (PGC) Senior Vice President Emmanuel R. Torres also graced the event. Under the Gawad sa Pinakatanging Kooperatiba (Gawad PITAK), the Alicia Neighborhood Multi-Purpose Cooperative and Sorosoro Ibaba Development Cooperative were hailed as outstanding agri-based cooperatives in the medium and large categories, respectively. The Ating Ani Nueva Ecija Multipurpose Cooperative and Ligas Kooperatiba ng Bayan sa Pagpapaunlad were likewise honored for their outstanding contributions under the non-agricultural category. The Gawad MSME was awarded to Ms. Fralyn B. Cruz and Sandig Medical Clinic and Hospital under the agri-based and non-agri-based sectors, respectively. The Gawad Kaagapay was given to DoubleDragon Corporation, Asialink Finance Corporation, and Soliman E.C. Septic Tank Disposal for their contributions as corporations and large enterprises to growing the local economy. ProFarmers Rural Banking Corporation, Producers Savings Bank Corporation, and ASA Philippines Foundation, Inc. were recognized with the Gawad PFI for their exceptional performance under the rural bank, thrift bank, and microfinance categories, respectively. The Ulirang Magsasaka award was awarded to Mr. Deodany L. Cara, while Mr. Roderick G. Capalongan received a special citation for his innovative approach to integrated farming. LANDBANK is celebrating its 61st anniversary this month, representing more than six decades of advancing development, inclusion, and sustainability in serving the nation. About LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation, and sustainable national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive financial solutions to empower Filipinos from countryside to countrywide.

LEARN MORE

LANDBANK branch rises in Burauen, Leyte

(front) LANDBANK President and CEO Lynette V. Ortiz (center) and Burauen Mayor Juanito E. Renomeron (rightmost) lead the opening of the LANDBANK Burauen Branch on 18 July 2024, alongside Julita Mayor Atty. Percival S. Cana (2nd from left), Burauen’s Association of Barangay Captains President Fe S. Renomeron (4th from left), and LANDBANK Executive Vice President Liduvino S. Geron (leftmost). BURAUEN, Leyte – As part of its continuing commitment to bringing banking services closer to local communities, Land Bank of the Philippines (LANDBANK) has officially inaugurated a branch in Burauen, and its eighth in the Province of Leyte. LANDBANK President and CEO Lynette V. Ortiz and Burauen Mayor Juanito E. Renomeron led the inauguration rites for the branch on 18 July 2024. They were joined by Julita Mayor Atty. Percival S. Cana, Burauen’s Association of Barangay Captains President Fe S. Renomeron, LANDBANK Executive Vice President Liduvino S. Geron, and other local government officials. Located in Brgy. Poblacion District 8, the LANDBANK Burauen Branch will cater to the banking needs of residents from the 77 barangays of the town. This eliminates the need to travel to the Tacloban City branches, saving clients two (2) hours of travel time and approximately P200 in round-trip expenses. The branch’s strategic location also allows it to reach the 142 combined barangays of the municipalities of Dagami, Julita, Tabontabon, and La Paz, servicing over 11,000 farmers and fishers, 16,700 beneficiaries of the Conditional and Unconditional Cash Transfer (CCT/UCT) programs of the Department of Social Welfare and Development (DSWD), government employees, and private depositors. “Our mission is clear – to drive transformative progress from countryside to countrywide by delivering secure and reliable financial services up to the farthest corners of the archipelago. With the new LANDBANK Burauen Branch, we aim to enhance the accessibility of banking services for local residents,” said LANDBANK President and CEO Ortiz. She also committed to supporting the Province’s entire agricultural value chain by continuously extending loans to local farmers, fishers, and other players from the sector, as well as local government units for the development of essential infrastructure. The LANDBANK Burauen Branch is equipped with two automated teller machines (ATM) and features a Digital Corner where clients can open a deposit account in 15 minutes or less using the LANDBANK Digital Onboarding System (DOBS). “All of this means only one thing and that is more opportunities for us, Burawanons, in terms of financial inclusion, financial growth, and financial development. As an agricultural municipality, this would mean a lot to our farmers and to our business sector who would no longer need to travel just to inquire and avail the services of this financial institution. Truly, LANDBANK in Burauen is a blessing for us,” said Burauen Mayor Renomeron. The new branch complements the operations of seven other LANDBANK branches in Leyte located in the cities of Baybay, Ormoc and Tacloban, and the municipalities of Carigara and Hilongos. For fast, safe, and convenient cash withdrawals and transactions, LANDBANK has 61 automated teller machines (ATMs), six cash deposit machines (CDMs), and a LANDBANKasama Agent Banking Partner strategically located across the Province. Customers can also enjoy free cash withdrawals at 43 ATMs in 7-Eleven convenience stores, as part of the Bank’s partnership with Pito Axm Platform, Inc. (PAPI). As of end-June 2024, LANDBANK operates 607 branches and branch-lite units, along with 60 lending centers nationwide. This extensive network is complemented by 3,112 ATMs and 232 CDMs, 3,399 7-Eleven ATMs, and 1,101 LANDBANKasama Partners operating 1,859 point-of-sale (POS) terminals. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion and digital transformation to advance national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive services to empower Filipinos towards a better future of inclusive and sustainable development from countryside to countrywide.

LEARN MORE

A-FLOW signs P2.4-billion Tranche 1 Loan of a P10.8-billion 10-Year Facility with LANDBANK

In the photo from left are Ayala Land, Inc. (ALI) Vice President and Treasurer Jose Eduardo A. Quimpo II, ALI Senior Vice President, Chief Finance Officer and Chief Compliance Officer Augusto D. Bengzon, ALI President and Chief Executive Officer (CEO) and AyalaLand Logistics Holdings Corp. (ALLHC) Chairman Anna Ma. Margarita B. Dy, FLOW Digital Infrastructure CEO and A-FLOW Properties I Corp. (A-FLOW) President Amandine Wang, ALI Senior Vice President, ALLHC President and CEO and A-FLOW Chairman Robert S. Lao, Land Bank of the Philippines (LANDBANK) President and CEO Lynette V. Ortiz, LANDBANK Executive Vice President and National Development Lending Sector Head Ma. Celeste A. Burgos, LANDBANK Vice President Lucila E. Tesorero and LANDBANK Vice President and Corporate Banking Department 1 Head Jell B. Ong. Makati City, Philippines – A-FLOW Properties I Corp. (A-FLOW), a joint venture between Ayala Land, Inc. (ALI) subsidiary AyalaLand Logistics Holdings Corp. (ALLHC) and FLOW Digital Infrastructure, and Land Bank of the Philippines (LANDBANK) announced the signing of a P2.4 billion loan agreement representing Tranche 1 of a P10.8 billion 10-year loan. The signing of the loan facility agreement underscores the mutual commitment to advancing the nation’s digital infrastructure and supporting the Philippines’ transition towards a more digitally integrated economy. The loan facility is intended for the development of the initial phase of the first A-FLOW data center campus located in Biñan, Laguna. Currently under construction, the 6MW-IT capacity Phase 1A of the three-building data center campus project is targeted to be ready-for-service by the end of the year. A-FLOW President Amandine Wang said, “This agreement marks a significant step forward in our shared commitment to develop the largest carrier-neutral data center campus in the Philippines. We are excited to build an ecosystem to attract a combination of international hyperscale customers and local enterprise customers.” LANDBANK President and CEO Lynette V. Ortiz emphasized the importance of collaborating with key stakeholders, “We recognize that partnering with key players like A-FLOW is essential for advancing national development. And in this era of rapid digitalization, we are likewise ready to drive investments into the local data center market, along with other sectors contributing to our nation’s technological progress,” she said. Ortiz further commented, “This is the first data center project financed by LANDBANK, and with this new partnership, we are confident that this project will yield significant economic benefits.” For ALI President and CEO and ALLHC Chairman Anna Ma. Margarita B. Dy, digital transformation, cloud computing, and the rise of artificial intelligence are technologies that require robust and scalable data center solutions. “Ayala Land is proud to be participating in this new opportunity leveraging our land and our capabilities to contribute to the country’s move towards a digital economy,” Dy said. “Like any other infrastructure project, capital is key. So, we thank LANDBANK for the P10.8 billion loan facility to A-FLOW, a critical enabler for this project,” she added. A-FLOW’s partnership with LANDBANK enables both companies to capitalize on each other’s strengths, marking a shared vision of fostering innovation and sustainable growth. This milestone collaboration underscores the importance of public-private partnerships in serving the country and achieving the nation’s development goals. About A-FLOW A-FLOW is a joint venture between FLOW Digital Infrastructure (“FLOW”), an investor, developer, and operator of digital infrastructure in Asia Pacific, and AyalaLand Logistics Holdings Corp. (“ALLHC”), the largest developer of industrial parks and real estate logistics facilities in the Philippines. A-FLOW’s first data center is strategically located in Laguna, accommodating a total of 36MW IT load capacity. With the launch of A-FLOW, the partnership supports the digital growth and expansion of businesses in the Philippines, leveraging FLOW's deep data center expertise and ALLHC's established record in industrial real estate development. About LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion and digital transformation to advance national development. Present in all 82 provinces in the country, the Bank is committed to provide accessible and responsive services to empower Filipinos towards a better future of inclusive and sustainable development from countryside to countrywide.

LEARN MORE

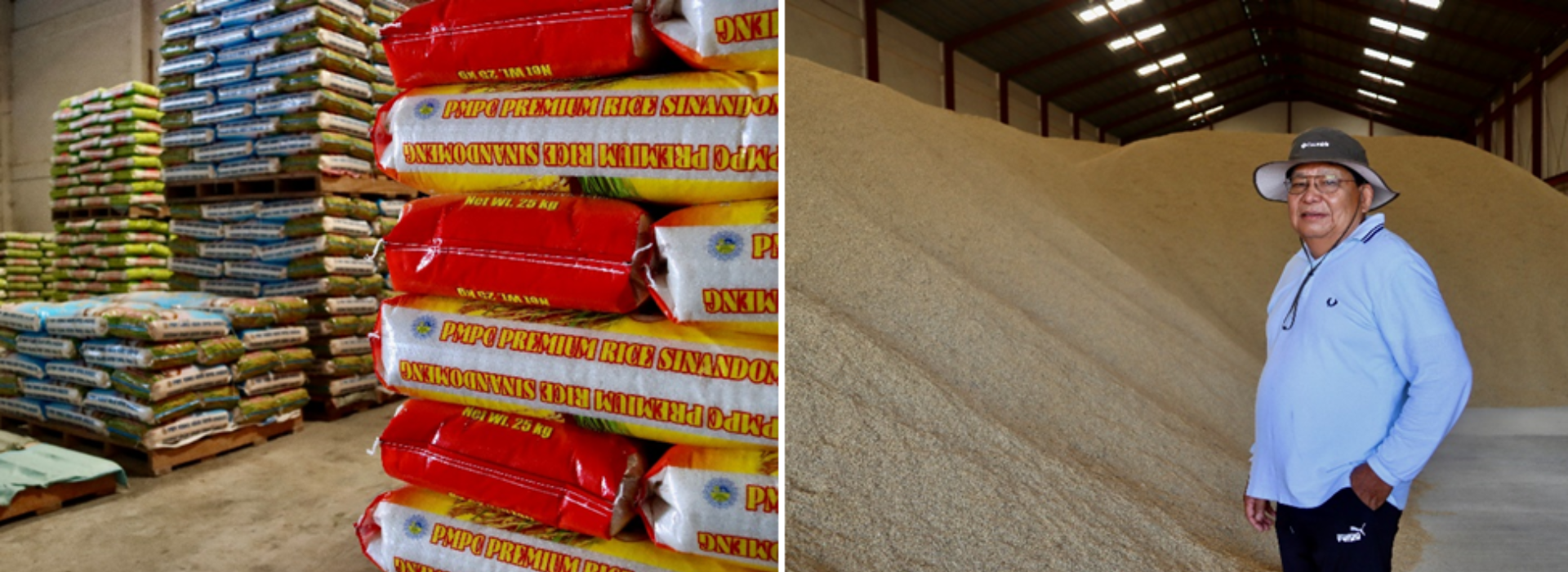

LANDBANK-backed co-op empowers rice, onion farmers in Nueva Ecija

TALAVERA, Nueva Ecija – For the longest time—despite working long, hard days in the field—rice farmer Ricardo Buenaventura struggled to improve his farm’s productivity and profitability due to lack of capital. Ricardo could not pursue opportunities that would help expand his operations, such as acquiring a bigger farmland or investing in farm mechanization, with income that was just enough to sustain his family’s daily needs. Determined to provide a better life for his family, Ricardo called on his fellow farmers facing similar challenges to work together to boost their production and income. They officially formed the Nagkakaisang Magsasaka Agricultural Primary Multi-Purpose Cooperative (PMPC) in 1992 with 16 members, and Ricardo as their Chairman. As a newly-established cooperative, seeking credit assistance to support their operations proved to be a hurdle seemingly too difficult to overcome. Lenders often turned them away or offered hefty interest rates they could not afford at the time. They found the boost they needed when Land Bank of the Philippines (LANDBANK) granted the co-op their very first loan amounting to P120,000.00 to fund their working capital. “Nagtiwala sa amin ang LANDBANK kahit nagsisimula pa lamang ang aming kooperatiba. Binigyan nila kami ng pagkakataon para palakasin ang aming koop at pagbutihin ang aming kabuhayan,” said Buenaventura. Growing with LANDBANK The co-op invested in farm machinery and equipment such as hauling trucks and mechanical dryers, and was able to improve its production to around 70,000 - 100,000 sacks of rice per cropping season. That initial partnership has come a long way. LANDBANK has since increased its total loan to Nagkakaisang Magsasaka Agricultural PMPC to P1 billion to fund its expanded operations, which now include relending to finance the production of its members, rice and agri-inputs trading, diesel retailing, rice milling, onion cold storage rental and trading, and importation of milled rice and fertilizers produced by the co-op. LANDBANK has also financed the construction of warehouses and an onion cold storage, as well as the purchase of farm machinery and equipment to improve agricultural productivity. From having only 16 members, Nagkakaisang Magsasaka Agricultural PMPC’s membership base has grown to 1,500 consisting of farmers producing rice, onion and other high-value crops, backyard poultry and livestock raisers, and micro, small and medium enterprises (MSMEs) such as sari-sari store owners. "By empowering agricultural cooperatives, we are also enhancing small farmers’ access to credit, technology and other critical resources for growth. We look forward to partnering with more agri co-ops towards increasing productivity and ensuring food security in the country,” said LANDBANK President and CEO Lynette V. Ortiz. Uplifting lives of Nueva Ecija farmers With their fully-integrated services, the Nagkakaisang Magsasaka Agricultural PMPC is now able to support the growth requirements of its members throughout the entire rice production process, from planting to marketing and distribution. Aside from financing the purchase of their members’ farm inputs, the co-op also serves as a ready market for their produce, buying wet palay at a fair price. The co-op produces around 70,000 to 100,000 sacks of rice per cropping season under its own rice brand and distributes rice to consumers in Metro Manila, Quezon City, Marikina, Taguig, Parañaque, Bohol, Pampanga, and Tarlac. The co-op is also diversifying its operations to provide more assistance to its onion farmer-members and strengthen the local onion value chain. Of their P1-billion LANDBANK loan, P112 million was allocated for the construction of an onion cold storage which has allowed their members to reduce agricultural losses and improve their income. The co-op’s cold storage has a capacity of 60,000 bags of onions, allowing farmers to reduce agricultural losses and improve their income. “Sa tulong ng LANDBANK, marami na ang naipundar ng aming kooperatiba at naitulong sa palay farmers. Ngayon, nakakatulong na din kami sa onion farmers dito sa Nueva Ecija na palakasin ang kanilang produksyon,” said Ricardo. Fully operational since April 2024, the co-op’s cold storage can accommodate up to 60,000 bags of onions and is expected to benefit onion growers from the municipalities of Bongabon, Guimba, Gabaldon, Llanera and Talavera. The co-op also extends credit support to finance onion production and buys members’ produce at a more lucrative price compared to other markets in the Province in support of the local onion industry. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country serving the growth requirements of the local agriculture sector and the entire agri-value chain. Present in all 82 provinces in the country, the Bank is committed to providing accessible and affordable financial support towards boosting food security and advancing inclusive and sustainable development from countryside to countrywide.

LEARN MORE

LANDBANK launches ‘save and win’ promo for depositors

Land Bank of the Philippines (LANDBANK) launched a new promo that gives depositors the chance to win up to P1 million in cash and gadgets by growing their savings with the Bank. Customers can earn e-raffle tickets and join the LANDBANK IpoNalo raffle promo by increasing their deposits in their LANDBANK accounts from 03 July 2024 to 31 January 2025. LANDBANK will be selecting one (1) winner via electronic raffle for each major cash prize of P1 million for the grand prize and P500,000.00 and P250,000.00 as the 2nd and 3rd prizes, respectively. Minor prizes also include iPhones, iPads and Macbook Airs, with 36 winners each. The campaign aims to empower the Bank’s clients to practice responsible financial habits and build financial security to help achieve their financial goals faster. “Through IpoNalo, we aim to help our clients build their savings through a broad range of secure and reliable deposit options, and possibly win prizes in the process. This is also our way of expressing our gratitude to our clients for their continued trust and loyalty,” said LANDBANK President and CEO Lynette V. Ortiz. The LANDBANK IpoNalo promo is available for new and existing clients with LANDBANK accounts, such as regular passbook and ATM savings account, dollar savings account, regular and interest-bearing current account, Easy Savings Plus (ESP), OptiSaver Account, Green Growth Account, High Yield Savings Account (HYSA), and peso or dollar time deposit account. Individual depositors will earn one (1) e-raffle ticket for every incremental average daily balance (ADB) of P100,000.00. Meanwhile, private institutional depositors will earn one (1) e-raffle ticket for every incremental ADB of P1,000,000.00. Participants must maintain their ADB until the end of the promo period on 31 January 2025 to remain eligible for the e-raffle draw on 14 February 2025. The proceeds of the promo campaign will help fund the Bank's developmental programs and initiatives in favor of its mandated and priority economic sectors. For complete details and mechanics on the LANDBANK IpoNalo promo, please visit the official LANDBANK website and social media channels, contact the nearest LANDBANK Branch nationwide, or call LANDBANK’s customer service hotline at (02) 8-405-7000 or at PLDT Domestic Toll Free 1-800-10-405-7000. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion and digital transformation to advance national development. Present in all 82 provinces in the county, the Bank is committed to provide accessible and responsive services to empower Filipinos towards a better future of inclusive and sustainable development from countryside to countrywide.

LEARN MORE

LANDBANK and Antonio’s partnership: Business recipe for success

From a single restaurant with 30 employees, Antonio "Chef Tony Boy" Escalante managed to translate his love for cooking into a culinary empire of multiple restaurants across the Philippines with support from LANDBANK. TAGAYTAY CITY – Just like having the right ingredients to create gastronomic experiences, to having an excellent team of chefs in the kitchen, it also takes the right people and partnerships to build a successful restaurant business. This adage rings true for Antonio "Chef Tony Boy" Escalante and the remarkable journey of the Antonio’s Group of Restaurants. Chef Tony Boy started his career not in the kitchen but in dentistry school. He then traded the dental chair for the open skies, working as a cabin crew member for Philippine Airlines for nearly a decade. However, he was only able to spread his wings and fly when he finally decided to pursue his ultimate passion – cooking. His culinary journey began at the Regency Park Institute of TAFE in Adelaide, Australia, where he honed his skills through various kitchen jobs before returning home to the Philippines. In Manila, he spent three years refining his culinary skills at the prestigious Tivoli Grill in the Mandarin Oriental Manila. In 2002, Chef Tony Boy's culinary dream materialized with the opening of his namesake restaurant in Tagaytay City. The establishment quickly became a hallmark of fine dining, lauded for its exquisite cuisine and impeccable service. Antonio’s Restaurant soon garnered numerous accolades as one of the country’s most celebrated restaurants. From 2007 to 2014, it consistently won the Best Continental Restaurant Award at Manila's Best Kept Restaurant Secrets Awards. From 2008 to 2013, it was the sole Filipino entry in the Miele Guide's Top 20 Southeast Asian restaurants, even reaching number five in the 2010 edition. Antonio's also secured the top 48th spot on Asia's Best Restaurants in 2015. Expanding the Culinary Vision with LANDBANK Chef Tony Boy wanted to expand Antonio’s operations beyond a single restaurant. In 2006, he established the Escanova Ventures which housed Antonio’s Restaurant and Breakfast at Antonio’s. He then embarked on a new venture in 2015 and put up “Balay Dako,” a restaurant offering traditional local fare and fusion cuisine with great views of Taal Lake. This required significant financial investment, with more capital needed to see plans for further expansion materialize. In 2017, Chef Tony Boy turned to Land Bank of the Philippines (LANDBANK) for a P113-million loan. This was the start of a productive partnership that laid the groundwork for sustained growth and success. The LANDBANK support supplemented Escanova Ventures’ capital, which enabled the expansion of Antonio's Fine Dining and the renovation of Breakfast at Antonio's. The loan also helped build BP One Foods Inc. to spearhead the restaurant chain's expansion across Luzon. The state-run Bank also remained a steadfast partner throughout crises, offering financial solutions and support when Antonio's Group was tested during the 2019 Taal Volcano eruption and the subsequent COVID-19 pandemic. "At the height of the pandemic, LANDBANK was there for us. They provided deferments, helped us analyze our finances, and offered tailored products that perfectly addressed our needs," shared Chef Tony Boy. Basti Escalante led the pivot to distribution and sale of Antonio’s popular products in Metro Manila during the pandemic through Pedro the Grocer. He has since played a significant role focusing on the retail side of the business. From then on, Basti became an active partner, focusing on the retail and business side of the Antonio’s chain of restaurants. This father-and-son collaboration further strengthened the Antonio's Group, allowing them to adapt and thrive amidst challenging circumstances. Empowered by LANDBANK's support, Chef Tony Boy emerged from the pandemic with renewed confidence to expand further. This financial backing and trust allowed the Antonio's Group to navigate the crises and adapt to grow amidst uncertainties. "LANDBANK believed in us, our goals, and how we run our business. This trust, even during the pandemic, was a stamp of approval that gave us the confidence to expand our ventures," said Chef Tony Boy. Cooking a Culinary Legacy What started as a single restaurant with a team of 30 has blossomed into a culinary empire of almost a thousand employees. Today, the Antonio's Group of Restaurants continues to flourish, driven by Chef Tony Boy's passion, Basti's innovative spirit, and the unwavering support of LANDBANK. "With LANDBANK's help, their banking expertise, and the dedication of their employees, we have been able to expand into Metro Manila and other cities. They have been instrumental in realizing our expansion plans," said Chef Tony Boy. Fueled by LANDBANK's commitment to empowering Filipino entrepreneurs, Chef Tony Boy’s story transcends mere culinary success. It's a narrative of how the right ingredients, the right people, and the right partnerships can create a recipe for business excellence. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting inclusive and sustainable development to benefit Filipinos. The Bank is present in all 82 provinces in the country, committed to providing accessible and responsive financial support to key players and industries as part of its broader thrust of serving the nation.

LEARN MORE

LANDBANK grants P120-M loan to boost Basilan town’s agri, infra dev’t

Tuburan Mayor Jhaber S. Kallahal (2nd from right) and LANDBANK Senior Vice President Charlotte I. Conde (center) lead the signing of a P120-million loan agreement to finance the Municipal Government of Tuburan’s acquisition of various heavy equipment. Joining them are Tuburan Municipal Treasurer Abubakar U. Mohammad (rightmost), LANDBANK Zamboanga City Lending Center Head Zenaida K. Valencia (4th from right) and Account Officer Jaydee N. Bongon (leftmost). TUBURAN, Basilan – Land Bank of the Philippines (LANDBANK) has extended a P120-million loan to the Municipal Government of Tuburan for the purchase of various heavy equipment to speed-up construction and maintenance of farm-to-market roads and other crucial infrastructure projects across the town. The new equipment financed by the state-run Bank will enhance the municipality’s road network and provide over 1,500 local farmers and fishers with improved access to agricultural technology and farm material inputs, plus reduced transportation costs for their produce. The agreement between the Municipal Government of Tuburan and LANDBANK was formalized through a loan signing event led by Tuburan Mayor Jhaber S. Kallahal and LANDBANK Senior Vice President Charlotte I. Conde last 23 May 2024 in Zamboanga City. They were joined by Tuburan Municipal Treasurer Abubakar U. Mohammad, LANDBANK Zamboanga City Lending Center Head Zenaida K. Valencia and Account Officer Jaydee N. Bongon. The loan will support the local government’s strategic investments in promoting economic growth especially in the town’s underserved communities. “LANDBANK stands ready to serve the growth needs of partner local government units to bankroll initiatives that stimulate economic activities. This complements our efforts in support of the agriculture sector and other key industries contributing to building inclusive and sustainable local communities,” said LANDBANK President and CEO Lynette V. Ortiz. The P120-million LANDBANK loan will be used by Tuburan LGU to purchase 10-wheeler dump trucks, 10-wheeler mixer trucks, wheel loaders, a hydraulic crawler excavator, and a 10-wheeler self-loading truck. This will help reduce operational costs associated with renting and subcontracting equipment for current and future construction projects across the town. The municipal government requires logistics to maintain existing road networks and other infrastructure projects. The funding from LANDBANK will be crucial in addressing this need and advancing local growth, considering that Tuburan is an agricultural community with most of its land area dedicated to coconuts, rubber, and cassava. “LANDBANK’s commitment to fostering economic growth and development in our region is truly commendable. The funds provided will enable us to implement crucial projects and initiatives that will benefit our citizens and enhance the overall quality of life in our Municipality,” said Tuburan Mayor Kallahal. “We value the strong partnership we have built with LANDBANK over the years and look forward to work together towards our shared vision of a thriving and prosperous community,” he added. LANDBANK is the biggest development partner of LGUs in the country, with outstanding loans reaching P113.6 billion as of April 2024. These loans support local development projects nationwide, including the acquisition of heavy equipment, construction and maintenance of farm-to-market roads, railways and bridges, utility projects, school and hospital buildings, street lights, and computerization of LGU operations, among others. ABOUT LANDBANK LANDBANK is the largest development financial institution in the country promoting financial inclusion, digital transformation and sustainable development to benefit Filipinos. The Bank is present in all 82 provinces in the country, committed to providing accessible and affordable financial support to key players and industries as part of its broader thrust of serving the nation.

LEARN MORE