Be in the know of the latest news and updates about LANDBANK.

LANDBANK: No ‘ayuda’ in PhilSys registration centers

The Land Bank of the Philippines (LANDBANK) wishes to clarify that the LANDBANK cards being provided for free to unbanked national ID registrants, with no initial deposit required, are not pre-loaded with government subsidy or ‘ayuda’. The statement comes after crowds expecting for financial assistance turned up at various Philippine Identification System (PhilSys) registration centers due to false information circulating online. LANDBANK is co-locating with the Philippine Statistics Authority (PSA) in the PhilSys rollouts nationwide to provide unbanked registrants with their own transaction accounts to bring more Filipinos into the formal banking system in support of the National Government’s financial inclusion agenda. PhilSys registrants without a bank account are encouraged to open a LANDBANK transaction account. The LANDBANK card can be used to conveniently manage funds and make financial transactions such as withdraw and send money, shop and pay bills online, among others. As of 31 October 2021, LANDBANK has onboarded 6.14 million unbanked PhilSys registrants for their own transaction accounts from 1,296 registration sites in 62 provinces nationwide. # LANDBANK: Walang ‘ayuda’ sa PhilSys registration centers Nilinaw ngayon ng Land Bank of the Philippines (LANDBANK) na ang mga LANDBANK cards na ibinibigay nang libre at walang kinakailangang paunang deposito sa mga nag a-apply para sa national ID, ay walang kasamang tulong pinansyal mula sa pamahalaan o ‘ayuda’. Ipinahayag ito ng LANDBANK matapos na dagsain ng mga taong umaasang makakatangap ng ayuda ang iba't-ibang Philippine Identification System (PhilSys) registration centers dahil sa maling impormasyon na kumakalat online. Ang LANDBANK ay nakikipagtulungan sa Philippine Statistics Authority (PSA) para sa sa implementasyon ng PhilSys sa buong bansa upang bigyan ang mga nag-apply para sa national ID na wala pang bank account ng kanilang sariling transaction account. Ito ay upang mas maraming Pilipino ang magkaroon ng access sa iba’t-ibang produkto at serbisyong pampinansyal, at bilang pagsuporta sa layunin ng ating pamahalaan na mas palawakin pa ang financial inclusion sa bansa. Patuloy ding hinihikayat ang mga PhilSys registrants na wala pang bank account na magbukas ng LANDBANK transaction account. Ang LANDBANK card ay maaring gamitin para mas madali ang mag-ipon at gumawa ng pinansiyal na transakyon tulad ng mag-withdraw at magpadala ng pera, mag-shopping at magbayad ng mga babayarin online, at madami pang iba. Nitong ika-31 ng Oktubre 2021, nasa 6.14 milyong PhilSys registrants na ang na-onboard ng LANDBANK makatanggap ng kanilang sariling transaction account mula sa 1,296 registration sites sa 62 probinsya sa buong bansa.

LEARN MORE

LANDBANK bags innovation, sustainability honors in Asia CEO Awards

The Land Bank of the Philippines (LANDBANK) was recognized as a Circle of Excellence awardee for innovation and sustainable finance at the 12th Asia CEO Awards, garnering top points among the 514 entries from both government and private-sector organizations. LANDBANK bagged the Most Innovative Company of the Year award for its Agent Banking Program, which forms part of the Bank’s thrust of serving unbanked and underserved Filipinos, especially those living in areas with limited or no bank presence. As of September 2021, the Bank has certified 162 Full-Suite Agent Banking Partners (ABPs) and 660 POS-only ABPs composed of cooperatives, rural banks, local government units, and micro, small and medium enterprises (MSMEs), to provide basic financial services in 45 unbanked municipalities and 131 underserved municipalities. LANDBANK has also tapped over 150 ABPs to co-locate with the Philippine Statistics Authority (PSA) in over 500 registration centers nationwide for the Philippine Identification System (PhilSys), to help onboard unbanked registrants to the formal banking system in support of the National Government’s financial inclusion agenda. The state-run Bank also received the Most Sustainable Company of the Year award for promoting environmentally sustainable programs to address climate-related issues, and for integrating sustainable finance in all aspects of the Bank’s operations. Last year, LANDBANK also made a successful return to the capital markets by generating P5 billion through the maiden Sustainability Bonds offer, designed to finance various loan programs that support sustainable green and social projects. “There is still so much to do as we navigate, recover, and rise from this economic and health crisis. Yet, these recognitions strengthen our spirit to serve with passion and overcome the challenges before us,” said LANDBANK President and CEO Cecilia C. Borromeo. The 2021 Asia CEO Awards is on its 12th year of recognizing outstanding leadership achievements by individuals and organizations in the Philippines and across the Asia-Pacific region.

LEARN MORE

LANDBANK 9-month 2021 profit surges 21% to P16.72B

State-run Land Bank of the Philippines (LANDBANK) posted double-digit growth in net income, assets, deposits and capital year-on-year for the nine-month period ending 30 September 2021. The Bank’s net income grew by 21.2% to P16.72 billion from P13.8 billion in the same period last year, due to lower cost of funds and provision for losses. As a result, the Bank is on track to meet its net income target of P19.68 billion by year-end. Total assets went up 13.6% to P2.564 trillion from P2.257 trillion in September 2020. This was propelled by deposits amounting to P2.267 trillion, which expanded by 14.68%. Meanwhile, LANDBANK’s capital significantly rose by 25.77% year-on-year to P208.17 billion from P165.52 billion, attributed to the P27.5 billion equity infusion made by the National Government in February 2021 plus the net income for the year. “LANDBANK has shown remarkable resilience against the economic shocks of the pandemic. As we continue to exceed our year-end targets in total assets and deposits, we are optimistic that the Bank’s overall financial performance will keep in step with the country’s continuing recovery,” said LANDBANK President and CEO Cecilia C. Borromeo. In terms of financial ratios, LANDBANK’s return on equity reached 10.74%, which is well above the industry average of 6.48%. LANDBANK’s financial muscle is driving the fulfillment of its social mandate of providing financial and support services not only to the agriculture sector, but contributing at large to the country’s recovery and development efforts. As of 30 September 2021, LANDBANK’s total outstanding loans to the agriculture sector reached P228.21 billion. The total number of farmers and fishers assisted stood at 2.97 million, closer to reaching the year-end target of three million. LANDBANK strikes a balance in fulfilling its social mandate while remaining financially viable, making it unique among universal banks in the country.

LEARN MORE

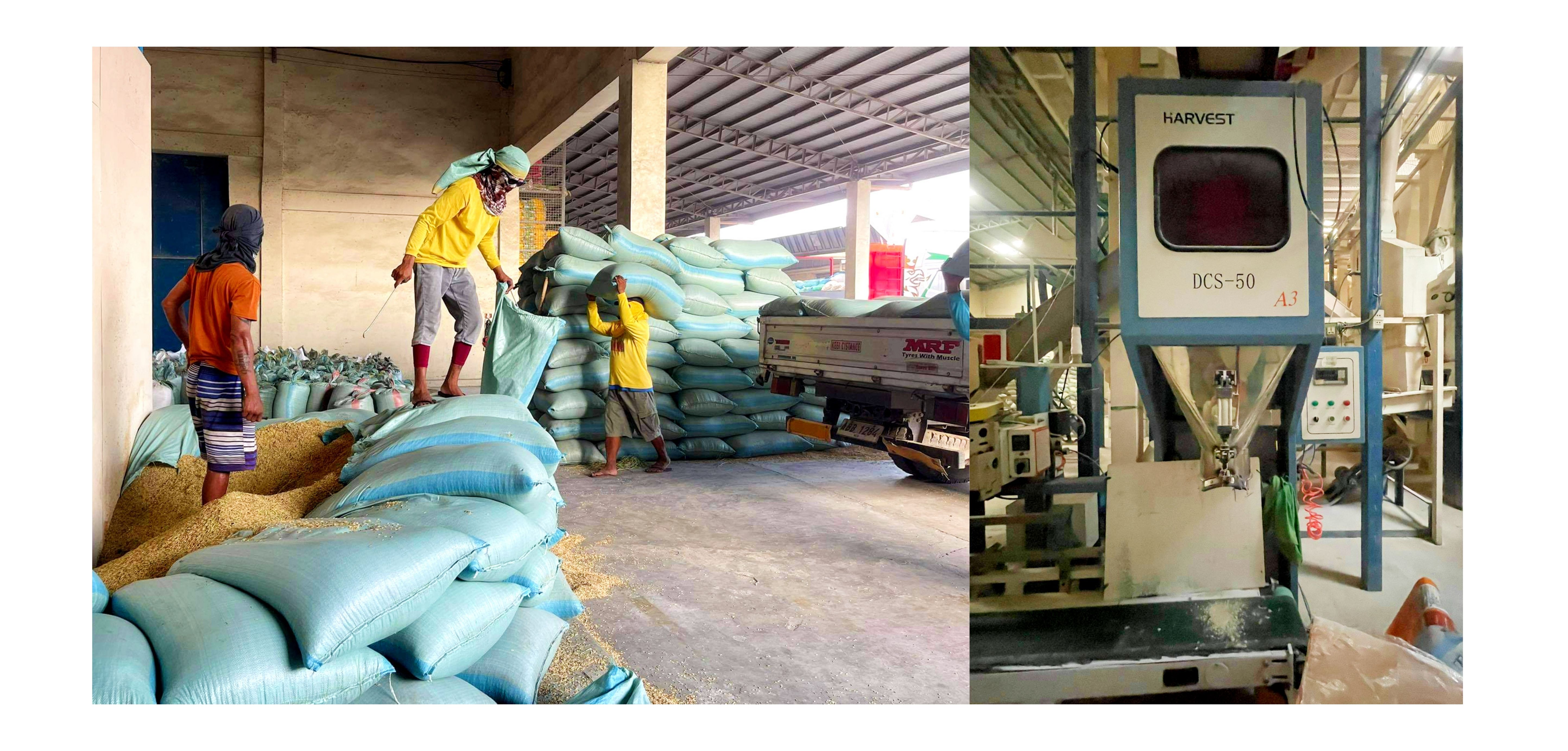

LANDBANK funds expansion of Nueva Ecija-based rice mill

With LANDBANK's support, RVR Ricemill is regularly supplying aromatic rice varieties to Metro Manila and various provinces, while providing stable employment to almost 100 employees and a market for 6,000 rice farmers to sell their palay produce at premium prices. LUPAO, Nueva Ecija – Spouses Glenda and Alex Rommel Romano have come a long way from initially trading only a few sacks of palay and milled rice two decades ago. Now, they run a thriving rice milling business which regularly supplies Metro Manila and various provinces with tons of aromatic rice varieties. The couple’s RVR Ricemill business also provides stable employment for about 100 residents of this third-class municipality, as well as a market for up to 6,000 small rice farmers to sell their palay produce at premium prices. The expansion of the Romanos’ business operations in the last five years was made possible through loans from the Land Bank of the Philippines (LANDBANK) in 2016 and 2017. Aside from boosting their working capital, the couple used the funds for the construction of a rice mill complex and warehouse, including modern machinery and drying facilities. “The agribusiness sector is a primary driver in the country’s road to recovery. LANDBANK will continue to service their requirements toward boosting food security and generating employment opportunities, especially in the countryside,” said LANDBANK President and CEO Cecilia C. Borromeo. Through the increased capital and improved operations, the RVR Rice Mill now buys more palay directly from small farmers and supplies milled rice to different markets every day—far from having only two deliveries per month before expanding their business. “Dito sa business namin, kapag malaki ang puhunan, mas malaki ang napapaikot na pera at mas maraming rice farmers ang natutulungan. Napakalaking tulong ng LANDBANK kasi kung hindi dahil sa tiwala at suportang ibinibigay nila, hindi po lalaki ang business namin,” said Mr. Romano. For the first nine months of 2021, LANDBANK’s outstanding loans to small, medium and large agribusiness enterprises have reached P145.75 billion. These involved loans to private enterprises in agri-processing, aqua-business, and other related industries engaged in the food and agriculture value chain. LANDBANK remains steadfast in helping agribusiness enterprises expand their operations as part of its main mandate to deliver intensified support to the agriculture sector.

LEARN MORE

LANDBANK app now allows direct payments to merchants via QR code

The Land Bank of the Philippines (LANDBANK) has enhanced its Mobile Banking App (MBA) to allow users to make quick, convenient, and secure payments using quick response (QR) code to over 20,000 participating merchants nationwide. The LANDBANK MBA has adopted the Bangko Sentral ng Pilipinas’ (BSP) QR Ph Person-to-Merchant (P2M) feature to benefit both customers and merchants with a convenient and secure digital payment option, in line with the Government’s thrust of promoting digital transactions in the country. With this new QR feature, clients can pay for goods and services directly to merchants such as department stores, pharmacies, supermarkets, and restaurants. “LANDBANK is one with the BSP in making and receiving payments a more convenient, reliable, and seamless experience through the national QR code standard or QR Ph. This contactless payment feature builds on our timely and relevant digital initiatives to keep clients safe, as we continue to follow strict health protocols in the new normal,” said LANDBANK President and CEO Cecilia C Borromeo. Apart from having a wide set of merchants that accept QR payments, LANDBANK clients who will use the QR payment feature will also benefit from having cost-effective transactions, minimized encoding errors, and encrypted payment information and data transfers. “QR Ph empowers consumers by giving them the freedom to choose their digital payment service through its interoperable feature, and this is aligned with the United Nations principle on responsible use of digital payments,” said BSP Governor Benjamin E. Diokno during the virtual launch of the QR Ph P2M on 12 October 2021. The LANDBANK MBA continues to record a surge in usage in the first three quarters of 2021, as transactions grew 50% to 73.26 million with a significant 124% rise in amount facilitated to P119.65 billion, year-on-year. LANDBANK’s digital banking platforms power the delivery of responsive and innovative financial products and services towards greater financial inclusion.

LEARN MORE

LANDBANK backs Misamis Occidental co-op’s agri initiatives amid pandemic

TANGUB, Misamis Occidental – As the COVID-19 pandemic continues to affect livelihoods and employment throughout the country, the Lorenzo Tan Multi-Purpose Cooperative (LTMPC) has remained responsive to the financial needs of its members, with help from the Land Bank of the Philippines (LANDBANK). The P300-million rediscounting loan line from the state-run Bank in 2020 allowed LTMPC to sustain its lending operations and finance the needs of its nearly 80,000 members, of whom 31,000 are farmers, fishers, and agrarian reform beneficiaries (ARBs). The loan helped LTMPC support farmers and fishers in purchasing production requirements, such as farm inputs and seedlings. It also provided for the needs of micro and small entrepreneurs, Overseas Filipino Workers (OFWs), and pensioner-members amid the economic challenges brought about by the pandemic. “LANDBANK recognizes the essential role of cooperatives in promoting economic recovery and resiliency in their local communities. We stand ready to bolster their support interventions as we continue to rise together in the new normal,” said LANDBANK President and CEO Cecilia C. Borromeo. With an assured source of funds, LTMPC has also provided its members with essential goods, such as groceries and rice, including free medical check-ups at the LTMPC Community Hospital in Zamboanga del Sur, which is owned by the cooperative. A LANBANK partner since 1991, LTMPC has expanded its operations from its lone branch in Tangub City, Misamis Occidental to 22 branches across the provinces of Zamboanga del Norte, Zamboanga del Sur, Zamboanga Sibugay, Misamis Oriental, and Lanao del Norte. “Taos-puso akong nagpapasalamat sa tulong, walang-sawang pagsuporta, at tiwalang ipinagkaloob ng LANDBANK sa aming kooperatiba. Ang pampinansyal at teknikal na tulong, at abot-kayang interes ay malaking tulong sa kooperatiba lalo na sa aming mga miyembrong magsasaka,” said General Manager Lusminda S. Cubero. As of end-September 2021, LANDBANK’s outstanding loans to the agriculture sector have reached P228.21 billion, of which P21.53 billion directly benefited small farmers and fishers channeled through cooperatives and farmers’ associations. LANDBANK continues its intensified support to partner cooperatives towards ramping-up the implementation of recovery and resiliency strategies under the new normal.

LEARN MORE

LANDBANK certified anew to ISO standards amid pandemic

State-run Land Bank of the Philippines (LANDBANK) has secured continuous certification for ISO 9001:2015 Quality Management System (QMS) and ISO 14001:2015 Environmental Management System (EMS) standards until December 2022, underscoring the Bank’s steadfast commitment to delivering quality financial and support services towards promoting sustainable and inclusive development. Certification International Philippines, Inc. (CIP)—a local consulting company that specializes in ISO recognition—completed the remote second surveillance audit of the Bank’s Head Office, 13 branches, and four field units from July to September 2021. “This recognition is in line with our thrust to promote excellent customer service as part of serving the nation. Next year, we will raise the bar even higher by expanding our performance commitments to include the continued certification to the EMS standards to fully comply with the Sustainable Finance Framework of the Bangko Sentral ng Pilipinas (BSP),” said LANDBANK President and CEO Cecilia C. Borromeo. During the closing meeting on 29 September 2021, CIP commended LANDBANK’s Management System and personnel for its adaptability to the changing demographics, risks, market demands, and innovations in the industry while navigating the challenges of the COVID-19 crisis. “The commitment of the competent LANDBANK personnel is a key driver in its successful maintenance of the Integrated Management System (IMS). LANDBANK remains very strong and is even stronger during the pandemic,” CIP said. CIP also gave positive feedback to the Bank’s regular conduct of Management Review and Field Unit staff meetings, which was classified as an excellent way of constantly reviewing the Bank’s performance. The Bank was also commended for its consistency in upholding internal policies and procedures from the head office to the field units, as sampled units continued to achieve high targets despite the challenging task of physically reporting for work at the height of the pandemic. ISO 9001:2015 is an international standard dedicated to Quality Management Systems (QMS). It outlines a framework for improving quality and a vocabulary of understanding for any organization looking to provide products and services that consistently meet the requirements and expectations of customers and other relevant interested parties in the most efficient manner possible. LANDBANK’s continued certification to the QMS standards is part of its 2021 performance commitments to the Governance Commission for GOCCs (GCG), while the EMS standards signifies the Bank’s continued commitment to the preservation of the environment and the efficient management of its resources.

LEARN MORE

LANDBANK retail dollar bond sales top US$205-M

The Land Bank of the Philippines (LANDBANK) contributed US$205.27 million or close to 13% of the US$1.593 billion generated from the maiden Retail Dollar Bond (RDB) offering of the Bureau of the Treasury (BTr). The proceeds will fund infrastructure projects and boost health services to fast-track the country’s ongoing economic resurgence, after suffering from debilitating effects of the COVID-19 pandemic. From 15 September to 1 October 2021, the state-run Bank sold the RDB offer through various investment channels, which allowed Filipino retail investors worldwide to participate in the said offering safely and conveniently. Of LANDBANK’s total RDB sales, US$95 million was raised during the rate-setting auction at the launch event held on September 15. The remaining US$109.94 million and US$329,700 were facilitated via over-the-counter placements at LANDBANK branches and online channels, respectively. About US$203,500 of LANDBANK’s RDB sales online was facilitated through the mobile banking application (MBA) of the Overseas Filipino Bank (OFBank)—the official digital bank of the Philippine government and a subsidiary of LANDBANK. Likewise, US$107,800 was transacted using the LANDBANK MBA, while the remaining US$18,400 was processed through the BTr’s Online Ordering Facility via LANDBANK’s Link.BizPortal. “A significant draw to the RDB offering was the availability of various investment channels that provided greater convenience and accessibility to retail investors worldwide. The wide participation in this offering also demonstrates the increasing appreciation for the government’s affordable and higher-yielding investment instruments that spur economic recovery and development,” said LANDBANK President and CEO Cecilia C. Borromeo. The RDBs are United States (US) dollar-denominated bonds offered at a minimum investment of US$300 and increments of US$100 thereafter, with annual interest rates of 1.375% and 2.25% for the five- and 10-year bonds, respectively. Interest payments will be paid quarterly during the term of the bond. LANDBANK is Joint Lead Issue Manager for the RDB issuance, as part of its continued support to advance greater financial inclusion and raise state resources for timely and responsive recovery and development initiatives.

LEARN MORE

LANDBANK’s P50-M loan ‘links’ La Union town to a promising future

ARINGAY, La Union – The Land Bank of the Philippines (LANDBANK) has approved a P50-million term loan of the Municipal Government of Aringay for the construction of a three-span bridge which is expected to boost growth and progress for the town’s underdeveloped areas. The new bridge will be built between Barangay San Juan East and Barangay San Juan West to connect seven isolated barangays of Aringay to the town proper, thereby making the transport of agricultural goods and access to essential services safer, easier, and more efficient. Upon completion of the bridge, farmers from the seven barangays can conveniently transport their harvests directly to Aringay’s public market instead of bringing these to Baguio City in Benguet. They will also no longer need to cross a river using a raft or pass through other perilous routes during heavy rains that often add to costs. The more than 14,800 residents from the seven barangays can also safely reach the town proper to access essential services, such as medical assistance, without the risk that comes with crossing the river. The P50-million term loan of the Municipal Government of Aringay was approved under the LANDBANK RISE UP LGUs (Restoration and Invigoration Package for a Self-sufficient Economy towards UPgrowth for LGUs) Lending Program, designed to support local government units (LGUs) in the implementation of their respective economic recovery plans. “LANDBANK is fully committed to servicing the infrastructure requirements of our LGU partners to fast-track the recovery of local communities. These projects are crucial to spur economic activities towards inclusive and sustainable development,” said LANDBANK President and CEO Cecilia C. Borromeo. As of 31 August 2021, LANDBANK has approved loans for 322 LGUs under the RISE UP LGUs Program totaling P88.42 billion. “Napakalaking tulong ang maibibigay ng tulay para sa pagpapaunlad ng produktong agrikultura at sa ikabubuti ng mga residente ng Aringay. Tatlumpung taong hinanapan ng pondo ang proyektong ito para ito’y maisakatuparan. Nagpapasalamat kami sa programa ng LANDBANK at sa kanilang matiyagang paggabay at pagsubaybay dahil nabigyan kami ng pagkakataong matupad ang adhikaing matagal naming minimithi,” said Aringay Mayor Eric O. Sibuma. LANDBANK is one with LGUs nationwide in implementing various development projects and in serving the nation as it threads the path to recovery and resiliency amid the ongoing pandemic.

LEARN MORE

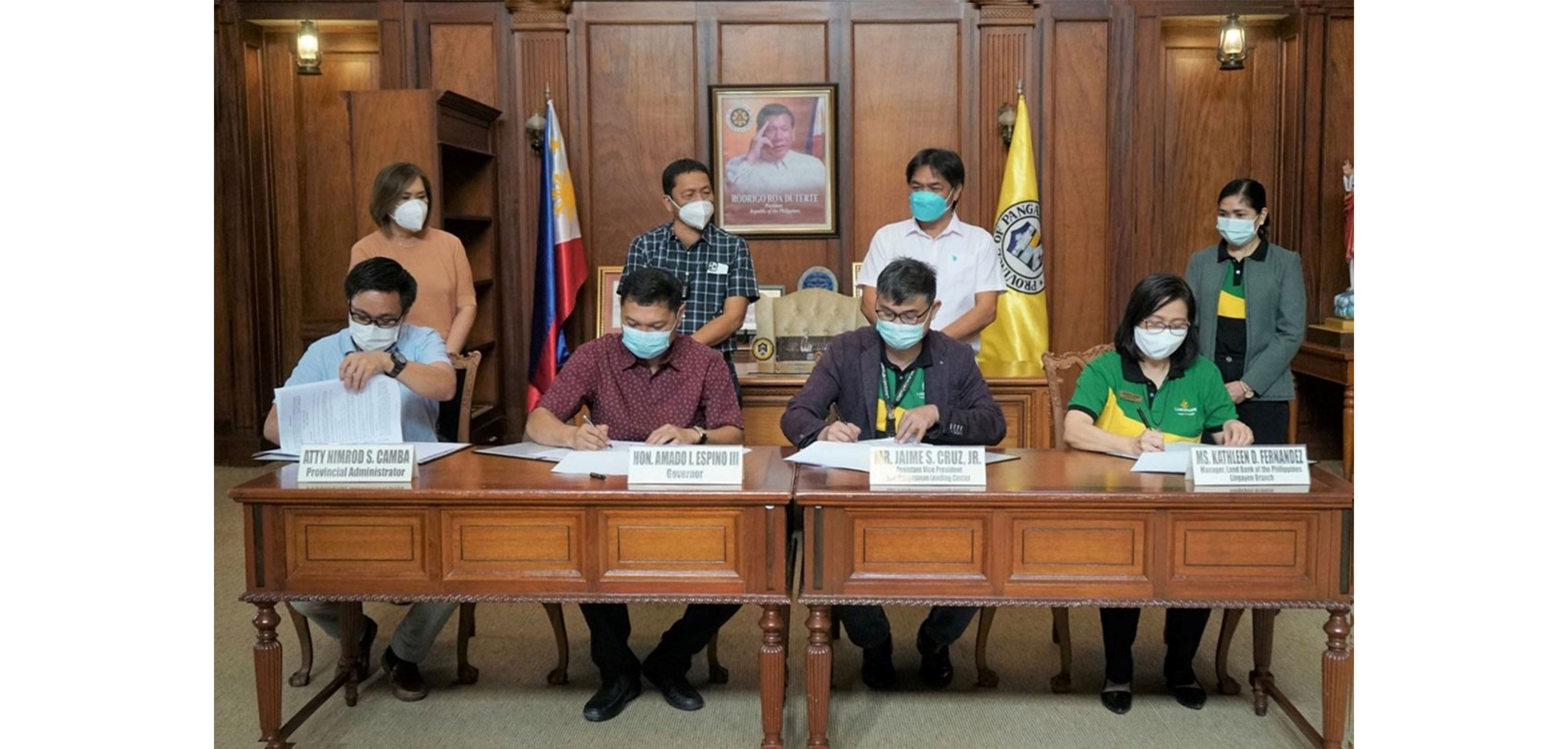

LANDBANK, Pangasinan LGU sign P500-million loan to boost income of rice farmers

Pangasinan Governor Amado I. Espino III (2nd from left) and LANDBANK Pangasinan Lending Center Head, Assistant Vice President Jaime S. Cruz (3rd from left), sign a P500-million loan agreement on 24 September 2021 at the Provincial Capitol in Lingayen, Pangasinan to help boost the income of rice farmers in the province. They are joined by Provincial Administrator Atty. Nimrod S. Camba (leftmost) and LANDBANK Lingayen Branch Head, Assistant Vice President Kathleen D. Fernandez (rightmost). LINGAYEN, Pangasinan – State-run Land Bank of the Philippines (LANDBANK) and the Provincial Government of Pangasinan have signed a P500-million loan to finance agricultural projects aimed at boosting the productivity and income of local rice farmers in the Province of Pangasinan. Under the LANDBANK Palay at Mais ng Lalawigan Lending Program, P400 million of the total loan will be used by the Local Government Unit (LGU) to purchase palay produced by small farmers with less than two (2) hectares of land each. Around 20,000,000 kilos of palay will be purchased by the Provincial LGU at higher prices than the prevailing market in the Province benefitting around 16,000 farmers in Pangasinan. The Provincial Government shall process the milling of the purchased palay and sell them to 14 provincial government-owned hospitals, the Pangasinan Provincial Jail, as well as other LGUs as part of relief operations and other related social services. The rice may also be distributed to Bigasan ng Bayan centers owned by Overseas Filipino Workers (OFWs) to be sold to local communities. The remaining P100 million will be used for the construction of a second Rice Processing Complex (RPC) in Pangasinan, together with the purchase of a rice mill, dryer, and industrial vehicles to transport agriculture products. “LANDBANK continues to answer the call of small farmers for an assured market and reasonable prices for their produce. We stand together with our LGU partners towards helping farmers increase their productivity and income, especially during this ongoing pandemic,” said LANDBANK President and CEO Cecilia C. Borromeo. Through the Palay at Mais ng Lalawigan Program, LANDBANK has approved loans amounting to P3.78 billion to eight (8) LGU-borrowers intended for palay procurement and acquisition of farm machineries and equipment (post-harvest facilities). Of this amount, P115 million has been availed by two (2) LGUs as working capital loan for palay procurement, benefitting more than 1,800 small farmers as of August 2021. From January to August 2021, LANDBANK has extended a total of P21.27 billion in outstanding loans in support of agri- and aquaculture projects of LGUs nationwide. LANDBANK remains committed to providing intensified support to the agriculture sector to fast-track its growth and recovery from the impact of the pandemic.

LEARN MORE

LANDBANK paves the way for 1.5K Payatas families to become landowners

More than 1,500 families struggling to get decent housing in Payatas, Quezon City will now have the opportunity to own the land they have been living in for over four decades after the Land Bank of the Philippines (LANDBANK) agreed to sell its property at a lower price. The state-owned Bank recently sold to the Quezon City Government its 96,169-square-meter property covering 157 parcels of land in Barangay Payatas in the amount of P209 million or P48 million less than the original offer of P257 million, paving the way for the urban dwellers to acquire land security tenure. “LANDBANK is proud to be instrumental in fulfilling the dreams of 1,500 families in Payatas to finally own the land they have been occupying for the past forty years. As a universal bank with a social mandate, we are committed to supporting our local government partners in providing affordable housing and other basic necessities to their constituents,” said LANDBANK President and CEO Cecilia C. Borromeo. The City Government will implement a direct sale program to award the land, wherein families will pay for the area they are occupying at P3,000 per square meter. “Malaki po ang pasasalamat namin sa LANDBANK dahil you agreed to enter into negotiations with the City Government para maibigay po sa tao ang matagal na nilang tinitirahang mga lupa,” said Quezon City Mayor Ma. Josefina “Joy” G. Belmonte during a ceremonial awarding of the Deed of Conditional Sale by LANDBANK to the Quezon City Government last 25 September 2021. Alongside extending loans to the agriculture sector, LANDBANK’s efforts toward national development involve extending support to the socioeconomic programs of local government partners, aimed at enhancing the quality of life of their constituents and promoting sustainable and inclusive growth.

LEARN MORE

LANDBANK lends financial muscle to DA-Go Negosyo agri program

The Land Bank of the Philippines (LANDBANK) has partnered with the Department of Agriculture (DA) and Go Negosyo to support their existing coaching program and service the financial requirements of eligible farmers, fishers, and micro, small, and medium enterprises (MSMEs) nationwide. Under the Kapatid Agri Mentor Me Program (KAMMP), LANDBANK will facilitate loan applications and provide credit assistance to graduate-mentees coached and trained by Go Negosyo and DA. The Bank will also assist in the development of new training and mentorship modules for startup and expanding agribusiness ventures. During the virtual Memorandum of Agreement (MOA) signing ceremony on 20 September 2021, LANDBANK welcomed the opportunity to match its loan programs with the specific requirements of eligible KAMMP graduates and provide accessible and affordable credit assistance to support their livelihood. “We are proud to be part of this meaningful and timely undertaking tailored to the needs of the agriculture sector. This is aligned with our ongoing efforts in widening credit access to farmers, fishers, and MSMEs nationwide,” said LANDBANK President and CEO Cecilia C. Borromeo. Presidential Adviser for Entrepreneurship and Go Negosyo founder Secretary Joey A. Concepcion highlighted the impact of LANDBANK’s involvement in KAMMP towards achieving its goal under the Mentorship, Market, and Money (3Ms) Principle. “These efforts from LANDBANK to provide financing to entrepreneurs under KAMMP are definitely a welcome development. I would like to thank Secretary Dar and President Borromeo for joining forces with Go Negosyo to really try and improve the lives of the Filipino people,” said Presidential Adviser Concepcion. For his part, DA Secretary William D. Dar noted the importance of adapting digital innovations to transform agriculture in the country. “Mahalaga po ang technology and innovation as part of this mentorship program para sa gano’n ay madagdagan ang kaalaman ng mga nagnenegosyo sa agrikultura at mapadali ang kanilang paghahanap-buhay,” said Secretary Dar. LANDBANK is looking to launch within the year its Digital Lending System (DLS), which will facilitate online loan applications for the safety and convenience of farmers and fishers. This move is in line with the National Government’s health and safety protocols due to the COVID-19 pandemic and its Ease of Doing Business campaign. From January to July 2021, LANDBANK has conducted 20 virtual trainings for 168 cooperatives nationwide facilitated by the LANDBANK Countryside Development Foundation, Inc. (LCDFI), while 85 MSMEs have attended the Bank’s new webinars from July to August 2021 to strengthen their recovery strategy under the new normal. LANDBANK’s partnership with DA and Go Negosyo builds on the Bank’s ongoing efforts to provide accessible and timely agricultural credit as part of serving the nation.

LEARN MORE